Markets are moving fast, and with all the noise around Nvidia’s GTC conference and the Fed’s rate decisions, it's easy to get caught up in macro trends. But let's take a step back and talk about individual stocks that look attractive right now.

While big names like Amazon, Meta, Nvidia, Taiwan Semiconductor, and Google remain solid picks, sometimes, it’s worth analyzing a company outside your portfolio. That’s exactly what we’re doing today—diving into Twilio, a stock I’ve been watching for a while.

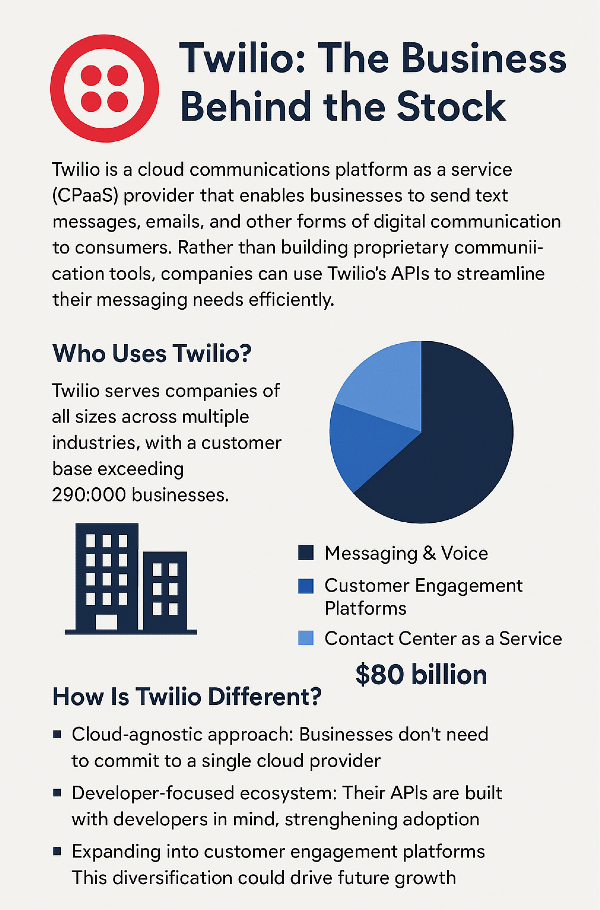

Twilio: The Business Behind the Stock

Twilio is a cloud communications platform as a service (CPaaS) provider that enables businesses to send text messages, emails, and other forms of digital communication to consumers. Rather than building proprietary communication tools, companies can use Twilio’s APIs to streamline their messaging needs efficiently.

Who Uses Twilio?

Twilio serves companies of all sizes across multiple industries, with a customer base exceeding 290,000 businesses. Their total addressable market sits at approximately $80 billion, spread across three key segments:

- Messaging & Voice

- Customer Engagement Platforms

- Contact Center as a Service

How Is Twilio Different?

Twilio stands out for a few reasons:

- Cloud-agnostic approach: Businesses don’t need to commit to a single cloud provider.

- Developer-focused ecosystem: Their APIs are built with developers in mind, strengthening adoption.

- Expanding into customer engagement platforms: This diversification could drive future growth.

Twilio’s Growth: Strong History but Slowing Momentum?

Looking at Twilio’s revenue, the company has grown steadily over the past five years, with 39% annualized revenue growth during that time. However, year-over-year revenue growth has dropped to just 7%, signaling a slowdown.

Another encouraging metric is their free cash flow per share, which sits at 18%—showing solid financial health even as revenue growth slows. More importantly, Twilio turned operating income positive for the first time last quarter, marking a significant step toward long-term profitability.

| Year |

Revenue (Billions USD) |

Revenue Growth (%) |

| 2024 |

4.46 |

7.32 |

| 2023 |

4.15 |

8.56 |

| 2022 |

3.83 |

34.64 |

| 2021 |

2.84 |

61.31 |

| 2020 |

1.76 |

55.30 |

Twilio’s Core Business vs. Expansion Efforts

Twilio’s revenue primarily comes from communications, the core business powering emails, texts, and voice messaging. That segment grew 12% year-over-year.

On the other hand, Twilio’s customer engagement platform (Segment) is struggling, posting negative growth. This segment is crucial for Twilio’s broader strategy because expanding beyond low-margin transactional messaging would help improve profitability.

Twilio’s geographic breakdown reveals that two-thirds of its revenue comes from U.S. customers, growing at just 5%, while international sales expanded by 11.7%.

Twilio’s Competitive Landscape

Twilio operates in a competitive space. Traditional telecom-based companies like Vonage, Bandwidth, and Cinch offer similar services. Meanwhile, Microsoft, Amazon, and Google have integrated messaging tools within their cloud platforms.

A key differentiation for Twilio is its cloud-agnostic model, which allows companies to use its platform regardless of their cloud provider. Additionally, while large cloud providers offer similar messaging capabilities, Twilio’s regional flexibility and developer-first approach give it an edge.

Key Risks: What Could Challenge Twilio’s Growth?

Commoditization of Software

As AI-driven coding tools advance, software development is becoming more accessible and scalable than ever. This could lead to pressure on pricing and margins, as businesses find it easier to develop their own communication tools instead of relying on third-party services like Twilio.

Margin Pressures in Messaging

Messaging, Twilio’s core business, relies on legacy telecom infrastructure. Since telecom providers control pricing, Twilio must navigate inherent cost pressures—limiting how much profitability they can extract from their transactional communications business.

Strong Competition

Twilio faces competition from both telecom-based API providers and cloud giants like Amazon, Microsoft, and Google. While Twilio’s cloud-agnostic model offers flexibility, these larger firms bundle similar services into their existing cloud ecosystems—potentially making them more attractive to customers already invested in their platforms.

Key Opportunities: What Could Drive Twilio’s Growth?

Developer Ecosystem

Twilio pioneered the API-first approach to communications, making it easy for startups and enterprises to integrate messaging into their applications without building infrastructure from scratch. Developer adoption remains a major strength, reinforcing Twilio’s brand leadership.

Expansion into Customer Engagement Platforms

Beyond transactional messaging, Twilio is investing in higher-margin customer analytics tools. Its Segment platform aims to help businesses understand and segment their users more effectively, improving engagement and enhancing Twilio’s revenue mix.

Enterprise Growth Potential

Twilio already serves large-scale enterprises, but continued wins in this space could drive stronger revenue predictability. Winning more enterprise customers will solidify its market position and help offset the pressures of commoditization in messaging services.

The Big Questions for Twilio’s Future

- Can Twilio transition from a transactional service to a higher-margin engagement platform?

- Will its cloud-agnostic model be enough to compete with hyperscalers like Amazon, Microsoft, and Google?

- How will the commoditization of software impact growth in this sector?

Twilio’s Financials: Operational Trends and Valuation

Twilio’s most recent quarter reflected solid execution, but long-term sustainability remains the key focus.

Recent Earnings Performance

- Revenue: $1.19 billion (above guidance)

- Operating income: $197 million (also beat expectations)

- Next quarter guidance:

- Revenue: $1.13–$1.14 billion

- Operating income: $180–$190 million

Twilio has a track record of beating its guidance, likely due to its conservative forecasting approach. This trend suggests potential upside surprises, but also means investors should assess long-term revenue stability rather than just short-term guidance beats.

Capital Allocation and Shareholder Returns

- ROIC: -1.5%, though improving over time

- Shareholder yield: 15.3%, driven by large-scale buybacks

- Stock-based compensation: Historically high, but trending downward

- Buybacks: $2.3 billion in the past 12 months, with $2 billion still available

- Debt: Virtually zero net debt, improving financial flexibility

Despite negative ROIC, Twilio’s fundamentals are trending in the right direction, particularly as it focuses on profitability and reduces stock-based compensation.

Twilio’s Valuation and Commoditization Risks

Twilio has undergone significant shifts over the past year, with revenue growth starting to accelerate after a period of stagnation. The growth trajectory for the company will be a defining factor in whether its stock remains an attractive investment.

Revenue Growth: An Improving Trend?

Twilio’s revenue growth was in single digits for the first half of the year, but started accelerating in Q3 and Q4—reaching 11% in the latest quarter. Investors will want to monitor whether this upward trend continues or stalls again.

Another key valuation metric discussed is price-to-cash-flow-to-growth, where some argue that operational cash flow alone doesn’t paint a full picture, especially when stock-based compensation isn’t factored in. While it's a judgment call, understanding that Twilio is actively working to reduce stock-based compensation is important for assessing long-term financial health.

Twilio’s Three-Tier Rating

Business: Just Okay

Twilio is the market leader in CPaaS, with a strong developer ecosystem and an expanding presence in customer engagement platforms. However, the commoditization of software introduces uncertainty, making its business model just okay for now.

Operations: Trending Up, But Still Just Okay

Twilio maintains zero net debt and has decent—but not exceptional—margins due to messaging costs. Despite improving profitability and ROIC, it still falls short of becoming an unquestionably strong operation.

Valuation: Surprisingly Good

Twilio’s price-to-cash-flow-to-growth rating falls below 0.5, and projected price-to-cash-flow sits under 18. For a company with potential for double-digit growth, this valuation looks attractive.

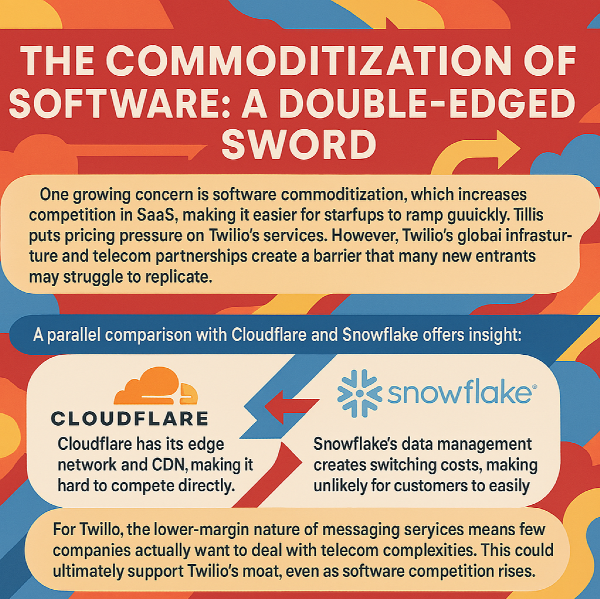

The Commoditization of Twilio Software: A Double-Edged Sword

One growing concern is software commoditization, which increases competition in SaaS, making it easier for startups to ramp up quickly. This puts pricing pressure on Twilio’s services. However, Twilio’s global infrastructure and telecom partnerships create a barrier that many new entrants may struggle to replicate.

A parallel comparison with Cloudflare and Snowflake offers insight:

- Cloudflare has its edge network and CDN, making it hard to compete directly.

- Snowflake’s data management creates switching costs, making it unlikely for customers to easily migrate.

For Twilio, the lower-margin nature of messaging services means few companies actually want to deal with telecom complexities. This could ultimately support Twilio’s moat, even as software competition rises.

Monitoring Key Trends Going Forward

Investors should track:

- Revenue Growth: Will Twilio continue trending upward?

- Communications vs. Segment Growth: Can customer engagement reverse its negative growth?

- Profitability and Stock-Based Compensation: Twilio must keep improving efficiency for sustainable earnings.

- Market Positioning: Is Twilio defending itself against hyperscaler competition?

Final Thoughts: Is Twilio Worth Watching?

Twilio is transitioning from a growth-at-all-costs mindset to a profit-focused model, which is promising. While strong competition and software commoditization create challenges, Twilio’s unique telecom relationships may prevent it from suffering the worst effects.

For now, Twilio remains on the watchlist, but its attractive valuation and early signs of improving profitability make it a stock worth tracking. If customer engagement platforms gain traction, Twilio could become a much stronger buy.

https://youtu.be/Qb6Iv0F7ZA4?si=s9-u1YqGgsHoCTN-

Markets are moving fast, and with all the noise around Nvidia’s GTC conference and the Fed’s rate decisions, it's easy to get caught up in macro trends. But let's take a step back and talk about individual stocks that look attractive right now.

While big names like Amazon, Meta, Nvidia, Taiwan Semiconductor, and Google remain solid picks, sometimes, it’s worth analyzing a company outside your portfolio. That’s exactly what we’re doing today—diving into Twilio, a stock I’ve been watching for a while.

Twilio: The Business Behind the Stock

Twilio is a cloud communications platform as a service (CPaaS) provider that enables businesses to send text messages, emails, and other forms of digital communication to consumers. Rather than building proprietary communication tools, companies can use Twilio’s APIs to streamline their messaging needs efficiently.

Who Uses Twilio?

Twilio serves companies of all sizes across multiple industries, with a customer base exceeding 290,000 businesses. Their total addressable market sits at approximately $80 billion, spread across three key segments:

How Is Twilio Different?

Twilio stands out for a few reasons:

Twilio’s Growth: Strong History but Slowing Momentum?

Looking at Twilio’s revenue, the company has grown steadily over the past five years, with 39% annualized revenue growth during that time. However, year-over-year revenue growth has dropped to just 7%, signaling a slowdown.

Another encouraging metric is their free cash flow per share, which sits at 18%—showing solid financial health even as revenue growth slows. More importantly, Twilio turned operating income positive for the first time last quarter, marking a significant step toward long-term profitability.

Twilio’s Core Business vs. Expansion Efforts

Twilio’s revenue primarily comes from communications, the core business powering emails, texts, and voice messaging. That segment grew 12% year-over-year.

On the other hand, Twilio’s customer engagement platform (Segment) is struggling, posting negative growth. This segment is crucial for Twilio’s broader strategy because expanding beyond low-margin transactional messaging would help improve profitability.

Twilio’s geographic breakdown reveals that two-thirds of its revenue comes from U.S. customers, growing at just 5%, while international sales expanded by 11.7%.

Twilio’s Competitive Landscape

Twilio operates in a competitive space. Traditional telecom-based companies like Vonage, Bandwidth, and Cinch offer similar services. Meanwhile, Microsoft, Amazon, and Google have integrated messaging tools within their cloud platforms.

A key differentiation for Twilio is its cloud-agnostic model, which allows companies to use its platform regardless of their cloud provider. Additionally, while large cloud providers offer similar messaging capabilities, Twilio’s regional flexibility and developer-first approach give it an edge.

Key Risks: What Could Challenge Twilio’s Growth?

Commoditization of Software

As AI-driven coding tools advance, software development is becoming more accessible and scalable than ever. This could lead to pressure on pricing and margins, as businesses find it easier to develop their own communication tools instead of relying on third-party services like Twilio.

Margin Pressures in Messaging

Messaging, Twilio’s core business, relies on legacy telecom infrastructure. Since telecom providers control pricing, Twilio must navigate inherent cost pressures—limiting how much profitability they can extract from their transactional communications business.

Strong Competition

Twilio faces competition from both telecom-based API providers and cloud giants like Amazon, Microsoft, and Google. While Twilio’s cloud-agnostic model offers flexibility, these larger firms bundle similar services into their existing cloud ecosystems—potentially making them more attractive to customers already invested in their platforms.

Key Opportunities: What Could Drive Twilio’s Growth?

Developer Ecosystem

Twilio pioneered the API-first approach to communications, making it easy for startups and enterprises to integrate messaging into their applications without building infrastructure from scratch. Developer adoption remains a major strength, reinforcing Twilio’s brand leadership.

Expansion into Customer Engagement Platforms

Beyond transactional messaging, Twilio is investing in higher-margin customer analytics tools. Its Segment platform aims to help businesses understand and segment their users more effectively, improving engagement and enhancing Twilio’s revenue mix.

Enterprise Growth Potential

Twilio already serves large-scale enterprises, but continued wins in this space could drive stronger revenue predictability. Winning more enterprise customers will solidify its market position and help offset the pressures of commoditization in messaging services.

The Big Questions for Twilio’s Future

Twilio’s Financials: Operational Trends and Valuation

Twilio’s most recent quarter reflected solid execution, but long-term sustainability remains the key focus.

Recent Earnings Performance

Twilio has a track record of beating its guidance, likely due to its conservative forecasting approach. This trend suggests potential upside surprises, but also means investors should assess long-term revenue stability rather than just short-term guidance beats.

Capital Allocation and Shareholder Returns

Despite negative ROIC, Twilio’s fundamentals are trending in the right direction, particularly as it focuses on profitability and reduces stock-based compensation.

Twilio’s Valuation and Commoditization Risks

Twilio has undergone significant shifts over the past year, with revenue growth starting to accelerate after a period of stagnation. The growth trajectory for the company will be a defining factor in whether its stock remains an attractive investment.

Revenue Growth: An Improving Trend?

Twilio’s revenue growth was in single digits for the first half of the year, but started accelerating in Q3 and Q4—reaching 11% in the latest quarter. Investors will want to monitor whether this upward trend continues or stalls again.

Another key valuation metric discussed is price-to-cash-flow-to-growth, where some argue that operational cash flow alone doesn’t paint a full picture, especially when stock-based compensation isn’t factored in. While it's a judgment call, understanding that Twilio is actively working to reduce stock-based compensation is important for assessing long-term financial health.

Twilio’s Three-Tier Rating

Business: Just Okay

Twilio is the market leader in CPaaS, with a strong developer ecosystem and an expanding presence in customer engagement platforms. However, the commoditization of software introduces uncertainty, making its business model just okay for now.

Operations: Trending Up, But Still Just Okay

Twilio maintains zero net debt and has decent—but not exceptional—margins due to messaging costs. Despite improving profitability and ROIC, it still falls short of becoming an unquestionably strong operation.

Valuation: Surprisingly Good

Twilio’s price-to-cash-flow-to-growth rating falls below 0.5, and projected price-to-cash-flow sits under 18. For a company with potential for double-digit growth, this valuation looks attractive.

The Commoditization of Twilio Software: A Double-Edged Sword

One growing concern is software commoditization, which increases competition in SaaS, making it easier for startups to ramp up quickly. This puts pricing pressure on Twilio’s services. However, Twilio’s global infrastructure and telecom partnerships create a barrier that many new entrants may struggle to replicate.

A parallel comparison with Cloudflare and Snowflake offers insight:

For Twilio, the lower-margin nature of messaging services means few companies actually want to deal with telecom complexities. This could ultimately support Twilio’s moat, even as software competition rises.

Monitoring Key Trends Going Forward

Investors should track:

Final Thoughts: Is Twilio Worth Watching?

Twilio is transitioning from a growth-at-all-costs mindset to a profit-focused model, which is promising. While strong competition and software commoditization create challenges, Twilio’s unique telecom relationships may prevent it from suffering the worst effects.

For now, Twilio remains on the watchlist, but its attractive valuation and early signs of improving profitability make it a stock worth tracking. If customer engagement platforms gain traction, Twilio could become a much stronger buy.

https://youtu.be/Qb6Iv0F7ZA4?si=s9-u1YqGgsHoCTN-