The World’s Biggest Companies by Market Cap: A Clear-Eyed Look

| Rank |

Company Name |

Symbol |

Dividend Yield |

Payout Ratio |

Description |

| 1 |

Microsoft |

MSFT |

0.69% |

24.9% |

A global leader in software, cloud computing (Azure), and enterprise solutions. Strong recurring revenue and consistent dividend growth. |

| 2 |

Apple |

AAPL |

~0.50% |

~15% |

Dominates consumer tech with iPhones, services, and wearables. High margins and massive cash reserves support long-term resilience. |

| 3 |

Nvidia |

NVDA |

0.03% |

1.27% |

Powers AI, gaming, and data centers with industry-leading GPUs. Low yield but explosive growth and profitability. |

| 4 |

Alphabet |

GOOGL |

0.00% |

0.00% |

Parent of Google and YouTube. Dominates digital advertising and cloud services. Reinvests heavily in innovation. |

| 5 |

Amazon |

AMZN |

0.00% |

0.00% |

E-commerce and cloud (AWS) giant. Focuses on reinvestment over dividends. Strong logistics and global reach. |

| 6 |

JPMorgan Chase |

JPM |

~2.50% |

~30–35% |

The largest U.S. bank by assets. Offers stability, dividends, and exposure to financial services. |

| 7 |

UnitedHealth Group |

UNH |

~1.30% |

~30% |

Leading health insurer and healthcare services provider. Strong cash flow and consistent dividend growth. |

| 8 |

Bank of America |

BAC |

~2.80% |

~25–30% |

Major U.S. bank with broad consumer and commercial exposure. Cyclical but offers solid yield. |

| 9 |

Tesla |

TSLA |

0.00% |

0.00% |

EV and energy innovator. High growth potential but no dividend and higher volatility. |

What the World’s Largest Companies Reveal About the Market in 2025

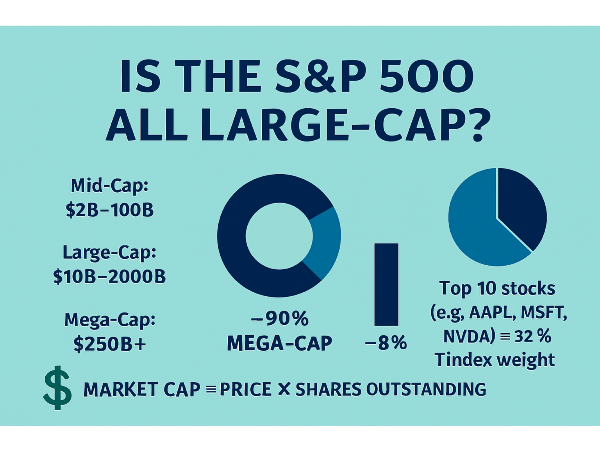

Market capitalization—simply the share price multiplied by the number of outstanding shares—is one of the clearest ways to measure a company’s size and influence. It’s not just a number; it’s a signal of investor confidence, business scale, and economic impact. The biggest companies by market cap often shape entire sectors, drive index performance, and influence global trends. In 2025, tech giants like Microsoft, Nvidia, and Apple continue to dominate the leaderboard, with Amazon and Alphabet close behind.

These aren’t just household names—they’re economic engines. For investors, understanding who’s on top and why offers more than trivia. It’s a window into where the market is headed and how to position your portfolio accordingly.

Want expert insights from leading investment podcasts? Scroll to the end to the Podcast Transcripts📜

Top 5 Companies by Market Cap in 2025: What Makes Them Global Powerhouses

In 2025, the five largest companies by market capitalization—Microsoft MSFT, Nvidia NVDA, Apple AAPL, Amazon AMZN, and Alphabet GOOGL—collectively account for nearly 29% of the S&P 500 Index. These firms aren’t just dominant in size; they’re deeply embedded in the infrastructure of modern life.

Microsoft leads in enterprise software and cloud computing, while Nvidia powers the AI revolution with its industry-defining GPUs. Apple continues to shape consumer tech with its ecosystem of devices and services. Amazon remains the backbone of global e-commerce and logistics, and Alphabet drives digital advertising, search, and cloud innovation. What sets these companies apart is their ability to innovate at scale.

Two standout podcast episodes offer deeper insight into their dominance. In Yahoo Finance’s Tech Titans Roundtable, analysts discuss how these five companies drove two-thirds of the S&P 500’s gains in 2024. At 04:12 ⏱️, one panelist notes, “This level of concentration hasn’t been seen since the 1960s—it’s both a strength and a risk.” Meanwhile, Benzinga’s Market Pulse explores Q1 2025 institutional activity. At 09:37 ⏱️, the host highlights, “Despite a tech sell-off, endowments doubled down on Nvidia and Microsoft, betting on long-term AI infrastructure.”

Sources:

CompaniesMarketCap – Global Rankings

Morningstar – Market Concentration Trends

Forbes – Top Tech Companies by Market Cap

USA Today – Nvidia’s AI Surge

MSN – Apple’s Market Cap Outlook

Why Market Cap Alone Can Mislead Investors

It reflects what investors are willing to pay for a company’s shares, not how efficiently that company earns, spends, or grows. Two businesses can have identical market caps and completely different financial realities. One might be cash-rich with strong margins, while the other is overleveraged and barely profitable. That’s why metrics like revenue, profit margins, and cash flow are essential.

To dig deeper, The Compound and Friends podcast breaks down how investors often overlook cash flow and margin strength when chasing large-cap names. At 11:28 ⏱️, co-host Michael Batnick notes, “You can’t just buy the biggest and expect the best returns. Fundamentals still matter.” Similarly, Animal Spirits explores the disconnect between size and sustainability. At 07:42 ⏱️, Ben Carlson adds, “Some of the most resilient companies aren’t the biggest—they’re the ones with consistent free cash flow and pricing power.”

Sources:

Alphanome.AI – Why Market Cap is a Misleading Valuation Metric

Ramsey Solutions – Cash Flow vs. Profit

Forbes – Why Revenue Alone Isn’t Enough

FutureTracker – Sustainability in Small vs. Large Businesses

Investopedia – Cash Flow vs. Profits

Investing in Market Leaders: Simple Strategies for Long-Term Growth

If you want exposure to the world’s most valuable companies without the stress of picking individual stocks, ETFs are your best friend. Funds like the Invesco QQQ Trust (QQQ) or Vanguard S&P 500 ETF (VOO) offer instant access to top players like Microsoft, Apple, and Nvidia—letting you ride the momentum of market leaders with a single investment. These ETFs are built for scale, liquidity, and long-term growth.

But not all ETFs are created equal. Cap-weighted ETFs give more weight to the biggest companies, meaning your returns are heavily influenced by a few giants. Equal-weighted ETFs, like RSP, spread your investment evenly across all holdings. This reduces concentration risk and can outperform when smaller or mid-cap stocks rally.

As discussed in The Long View, equal-weighting “forces discipline by trimming winners and buying laggards”—a built-in rebalancing mechanism that can boost returns over time (12:16 ⏱️). Meanwhile, ETF Prime explores how thematic ETFs are gaining traction, with host Nate Geraci noting at 09:03 ⏱️, “Investors are using themes like AI and clean energy to diversify beyond traditional sectors.”

Sources:

U.S. News – ETFs to Build a Diversified Portfolio

The Motley Fool – Best Long-Term ETFs

BillionFire – Understanding SPX Weighting

TheStreet – Equal Weighting vs. Market Cap

Kiplinger – Diversification Guide

Final Thoughts

The largest companies in the world didn’t get there by accident—they earned their place through scale, innovation, and an ability to evolve with the times. But while their market caps command attention, it’s the financial strength, strategic focus, and real-world impact behind those numbers that matter more. Market leadership offers investors opportunity, but also a reminder: size isn’t a substitute for smart investing. Whether you're building exposure through ETFs or simply tracking these giants for insight, the key is to invest with clarity—not hype. Stick to the basics, look under the hood, and let common sense—not headlines—guide your path forward. Simple usually wins. It just takes patience.

Sure! Here’s the full section with transcripts and links to all the podcast episodes referenced in your article:

Podcast Transcripts 🎙️

1. Yahoo Finance – Tech Titans Roundtable

This episode explores how Microsoft, Nvidia, Apple, Amazon, and Alphabet drove two-thirds of the S&P 500’s gains in 2024.

“This level of concentration hasn’t been seen since the 1960s—it’s both a strength and a risk.”

⏱️ 04:12 – Discussion on the implications of mega-cap dominance and its impact on index performance.

2. Benzinga – Market Pulse

This episode breaks down Q1 2025 institutional activity in mega-cap tech stocks.

“Despite a tech sell-off, endowments doubled down on Nvidia and Microsoft, betting on long-term AI infrastructure.”

⏱️ 09:37 – Analysis of institutional buying trends and long-term conviction in AI leaders.

3. The Compound and Friends – Market Cap vs. Fundamentals

Michael Batnick and Josh Brown discuss why market cap doesn’t always reflect financial strength.

“You can’t just buy the biggest and expect the best returns. Fundamentals still matter.”

⏱️ 11:28 – Commentary on the importance of cash flow and margin analysis in large-cap investing.

4. Animal Spirits – Size Isn’t Everything

Ben Carlson and Michael Batnick explore the disconnect between company size and sustainability.

“Some of the most resilient companies aren’t the biggest—they’re the ones with consistent free cash flow and pricing power.”

⏱️ 07:42 – Insights into how smaller firms with strong fundamentals can outperform over time.

5. The Long View – Equal Weighting and ETF Discipline

This episode explains how equal-weighted ETFs can outperform by trimming winners and buying laggards.

“Equal-weighting forces discipline—it’s a built-in rebalancing mechanism.”

⏱️ 12:16 – Breakdown of how equal-weighted strategies manage risk and enhance returns.

6. ETF Prime – Thematic ETF Trends

Nate Geraci discusses the rise of thematic ETFs and how investors are using them to diversify.

“Investors are using themes like AI and clean energy to diversify beyond traditional sectors.”

⏱️ 09:03 – Overview of how thematic ETFs are reshaping portfolio construction.

📌Read More About:

Top Large Cap Stocks- https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39168/what-are-large-cap-stocks-a-complete-guide-to-big-companies-in-the-u-s-market

What Are the Largest Market Cap Sectors?- https://stockbossup.com/pages/post/39159/largest-market-cap-sectors-key-industries-driving-global-investment

Which Industry Has the Highest Market Cap?- https://stockbossup.com/pages/post/39160/industries-with-the-highest-market-capitalization-key-sectors-driving-global-investment

🌐Global & Industrial Picks:

Is Microsoft a Mega-Cap Stock?- https://www.stockbossup.com/pages/post/38850/is-microsoft-considered-a-mega-cap-stock

Is Apple a Mega-Cap?- https://stockbossup.com/pages/post/39186/is-apple-a-mega-cap-stock-understanding-its-market-influence

Is Amazon a Mega-Cap?- https://stockbossup.com/pages/post/39191/is-amazon-a-mega-cap-stock-evaluating-its-market-influence

The World’s Biggest Companies by Market Cap: A Clear-Eyed Look

What the World’s Largest Companies Reveal About the Market in 2025

Market capitalization—simply the share price multiplied by the number of outstanding shares—is one of the clearest ways to measure a company’s size and influence. It’s not just a number; it’s a signal of investor confidence, business scale, and economic impact. The biggest companies by market cap often shape entire sectors, drive index performance, and influence global trends. In 2025, tech giants like Microsoft, Nvidia, and Apple continue to dominate the leaderboard, with Amazon and Alphabet close behind.

These aren’t just household names—they’re economic engines. For investors, understanding who’s on top and why offers more than trivia. It’s a window into where the market is headed and how to position your portfolio accordingly.

Top 5 Companies by Market Cap in 2025: What Makes Them Global Powerhouses

In 2025, the five largest companies by market capitalization—Microsoft MSFT, Nvidia NVDA, Apple AAPL, Amazon AMZN, and Alphabet GOOGL—collectively account for nearly 29% of the S&P 500 Index. These firms aren’t just dominant in size; they’re deeply embedded in the infrastructure of modern life.

Microsoft leads in enterprise software and cloud computing, while Nvidia powers the AI revolution with its industry-defining GPUs. Apple continues to shape consumer tech with its ecosystem of devices and services. Amazon remains the backbone of global e-commerce and logistics, and Alphabet drives digital advertising, search, and cloud innovation. What sets these companies apart is their ability to innovate at scale.

Two standout podcast episodes offer deeper insight into their dominance. In Yahoo Finance’s Tech Titans Roundtable, analysts discuss how these five companies drove two-thirds of the S&P 500’s gains in 2024. At 04:12 ⏱️, one panelist notes, “This level of concentration hasn’t been seen since the 1960s—it’s both a strength and a risk.” Meanwhile, Benzinga’s Market Pulse explores Q1 2025 institutional activity. At 09:37 ⏱️, the host highlights, “Despite a tech sell-off, endowments doubled down on Nvidia and Microsoft, betting on long-term AI infrastructure.”

Sources:

CompaniesMarketCap – Global Rankings

Morningstar – Market Concentration Trends

Forbes – Top Tech Companies by Market Cap

USA Today – Nvidia’s AI Surge

MSN – Apple’s Market Cap Outlook

Why Market Cap Alone Can Mislead Investors

It reflects what investors are willing to pay for a company’s shares, not how efficiently that company earns, spends, or grows. Two businesses can have identical market caps and completely different financial realities. One might be cash-rich with strong margins, while the other is overleveraged and barely profitable. That’s why metrics like revenue, profit margins, and cash flow are essential.

To dig deeper, The Compound and Friends podcast breaks down how investors often overlook cash flow and margin strength when chasing large-cap names. At 11:28 ⏱️, co-host Michael Batnick notes, “You can’t just buy the biggest and expect the best returns. Fundamentals still matter.” Similarly, Animal Spirits explores the disconnect between size and sustainability. At 07:42 ⏱️, Ben Carlson adds, “Some of the most resilient companies aren’t the biggest—they’re the ones with consistent free cash flow and pricing power.”

Sources:

Alphanome.AI – Why Market Cap is a Misleading Valuation Metric

Ramsey Solutions – Cash Flow vs. Profit

Forbes – Why Revenue Alone Isn’t Enough

FutureTracker – Sustainability in Small vs. Large Businesses

Investopedia – Cash Flow vs. Profits

Investing in Market Leaders: Simple Strategies for Long-Term Growth

If you want exposure to the world’s most valuable companies without the stress of picking individual stocks, ETFs are your best friend. Funds like the Invesco QQQ Trust (QQQ) or Vanguard S&P 500 ETF (VOO) offer instant access to top players like Microsoft, Apple, and Nvidia—letting you ride the momentum of market leaders with a single investment. These ETFs are built for scale, liquidity, and long-term growth.

But not all ETFs are created equal. Cap-weighted ETFs give more weight to the biggest companies, meaning your returns are heavily influenced by a few giants. Equal-weighted ETFs, like RSP, spread your investment evenly across all holdings. This reduces concentration risk and can outperform when smaller or mid-cap stocks rally.

As discussed in The Long View, equal-weighting “forces discipline by trimming winners and buying laggards”—a built-in rebalancing mechanism that can boost returns over time (12:16 ⏱️). Meanwhile, ETF Prime explores how thematic ETFs are gaining traction, with host Nate Geraci noting at 09:03 ⏱️, “Investors are using themes like AI and clean energy to diversify beyond traditional sectors.”

Sources:

U.S. News – ETFs to Build a Diversified Portfolio

The Motley Fool – Best Long-Term ETFs BillionFire – Understanding SPX Weighting

TheStreet – Equal Weighting vs. Market Cap

Kiplinger – Diversification Guide

Final Thoughts

The largest companies in the world didn’t get there by accident—they earned their place through scale, innovation, and an ability to evolve with the times. But while their market caps command attention, it’s the financial strength, strategic focus, and real-world impact behind those numbers that matter more. Market leadership offers investors opportunity, but also a reminder: size isn’t a substitute for smart investing. Whether you're building exposure through ETFs or simply tracking these giants for insight, the key is to invest with clarity—not hype. Stick to the basics, look under the hood, and let common sense—not headlines—guide your path forward. Simple usually wins. It just takes patience.

Sure! Here’s the full section with transcripts and links to all the podcast episodes referenced in your article:

Podcast Transcripts 🎙️

1. Yahoo Finance – Tech Titans Roundtable

This episode explores how Microsoft, Nvidia, Apple, Amazon, and Alphabet drove two-thirds of the S&P 500’s gains in 2024.

“This level of concentration hasn’t been seen since the 1960s—it’s both a strength and a risk.”

⏱️ 04:12 – Discussion on the implications of mega-cap dominance and its impact on index performance.

2. Benzinga – Market Pulse

This episode breaks down Q1 2025 institutional activity in mega-cap tech stocks.

“Despite a tech sell-off, endowments doubled down on Nvidia and Microsoft, betting on long-term AI infrastructure.”

⏱️ 09:37 – Analysis of institutional buying trends and long-term conviction in AI leaders.

3. The Compound and Friends – Market Cap vs. Fundamentals

Michael Batnick and Josh Brown discuss why market cap doesn’t always reflect financial strength.

“You can’t just buy the biggest and expect the best returns. Fundamentals still matter.”

⏱️ 11:28 – Commentary on the importance of cash flow and margin analysis in large-cap investing.

4. Animal Spirits – Size Isn’t Everything

Ben Carlson and Michael Batnick explore the disconnect between company size and sustainability.

“Some of the most resilient companies aren’t the biggest—they’re the ones with consistent free cash flow and pricing power.”

⏱️ 07:42 – Insights into how smaller firms with strong fundamentals can outperform over time.

5. The Long View – Equal Weighting and ETF Discipline

This episode explains how equal-weighted ETFs can outperform by trimming winners and buying laggards.

“Equal-weighting forces discipline—it’s a built-in rebalancing mechanism.”

⏱️ 12:16 – Breakdown of how equal-weighted strategies manage risk and enhance returns.

6. ETF Prime – Thematic ETF Trends

Nate Geraci discusses the rise of thematic ETFs and how investors are using them to diversify.

“Investors are using themes like AI and clean energy to diversify beyond traditional sectors.”

⏱️ 09:03 – Overview of how thematic ETFs are reshaping portfolio construction.

📌Read More About:

Top Large Cap Stocks- https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39168/what-are-large-cap-stocks-a-complete-guide-to-big-companies-in-the-u-s-market

What Are the Largest Market Cap Sectors?- https://stockbossup.com/pages/post/39159/largest-market-cap-sectors-key-industries-driving-global-investment

Which Industry Has the Highest Market Cap?- https://stockbossup.com/pages/post/39160/industries-with-the-highest-market-capitalization-key-sectors-driving-global-investment

🌐Global & Industrial Picks:

Is Microsoft a Mega-Cap Stock?- https://www.stockbossup.com/pages/post/38850/is-microsoft-considered-a-mega-cap-stock

Is Apple a Mega-Cap?- https://stockbossup.com/pages/post/39186/is-apple-a-mega-cap-stock-understanding-its-market-influence

Is Amazon a Mega-Cap?- https://stockbossup.com/pages/post/39191/is-amazon-a-mega-cap-stock-evaluating-its-market-influence