Compare the risk, return, and diversification potential of small, mid, and large-cap stocks to build a portfolio that aligns with your financial goals.

Introduction

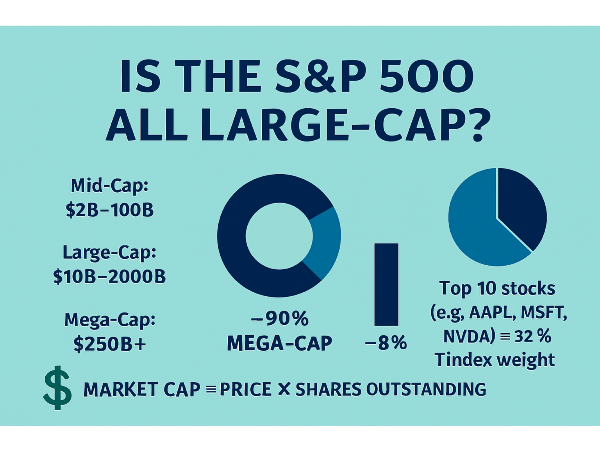

Market capitalization, or market cap, is a foundational concept in investing that helps categorize companies based on their total market value. It’s calculated by multiplying a company’s share price by the number of outstanding shares, offering a quick snapshot of a company’s size and market presence. Investors often use market cap to assess risk, growth potential, and portfolio diversification. Stocks are typically grouped into three main categories: small-cap (roughly $250 million to $2 billion), mid-cap ($2 billion to $10 billion), and large-cap (over $10 billion).

Each tier carries distinct characteristics—small-caps are known for high growth and volatility, mid-caps offer a balance of risk and return, and large-caps provide stability and consistent performance. Choosing the right mix depends on your financial goals, risk tolerance, and investment horizon. In this article, we’ll break down the defining traits of each cap tier, weigh their pros and cons, compare historical performance, and explore how to align them with your portfolio strategy. Whether you’re a cautious investor or a growth-seeker, understanding market cap is key to building a resilient and goal-driven investment plan.

What Is Market Capitalization and Why It Matters for Investors

Market capitalization, or market cap, is a key metric used to assess a company’s size and investment profile. Market cap categories include small-cap ($250 million–$2 billion), mid-cap ($2 billion–$10 billion), and large-cap ($10 billion–$200 billion). Companies exceeding $200 billion are considered mega-cap, while those below $250 million fall into the micro-cap range.

In The Investor’s Podcast Network, analysts explain how market cap influences portfolio construction and index inclusion. “Market cap is the foundation of most index strategies—it determines weight, not price” (🎧 07:45). Meanwhile, Morningstar’s Investing Insights highlights how investors often misjudge value by focusing on share price alone. “A $50 stock isn’t necessarily cheaper than a $500 stock—it’s about what you’re getting for that price” (🎧 09:10). These insights underscore why understanding market cap is essential for evaluating risk, growth potential, and diversification.

Mega-cap companies like Apple AAPL and Microsoft MSFT dominate major indices due to their massive valuations. In contrast, small-cap firms—often early-stage or niche players—offer higher growth potential but come with greater volatility. Mid-cap stocks strike a balance between the two, making them attractive for investors seeking moderate risk and return. Knowing where a company falls on the market cap spectrum helps investors align their choices with long-term financial goals.

Sources:

MarketBeat – What Is Market Capitalization?

Investopedia – Market Capitalization vs. Shares Outstanding

OneSDR – How to Calculate Market Capitalization

Rows – Market Capitalization Calculator

The Investor’s Podcast Network

Morningstar’s Investing Insights

StockBossUp – Market Cap Breakdown and ETF Tools

ETF.com – Cap-Based ETF Strategies

Money Under 30 – Small Cap vs. Mid Cap vs. Large Cap

VanEck – Understanding Market Capitalization

Morningstar – Market Cap and Portfolio Allocation

Why Small-Cap Stocks Offer Big Potential—and Big Risks

These companies tend to operate in niche markets or emerging industries, giving them the potential to deliver outsized returns. However, this growth potential comes with higher volatility. Small-caps are more sensitive to economic shifts, interest rate changes, and investor sentiment, which can lead to sharp price swings. Because small-cap stocks receive less analyst coverage and institutional attention, they often trade at prices that don’t fully reflect their fundamentals. ETFs like the iShares Russell 2000 ETF (IWM) and Vanguard Small-Cap ETF (VB) offer diversified exposure to this segment.

In The Investor’s Podcast Network, analysts noted, “Small-caps are where inefficiencies live—if you’re willing to dig, you can find value others miss” (🎧 08:55). Meanwhile, Morningstar’s Investing Insights emphasized, “Volatility in small-caps isn’t a bug—it’s a feature that rewards patience” (🎧 10:40).

Sources:

Value Research – Types of Stocks Explained

Brown Advisory – Why US Small-Cap Stocks Deserve More Attention

TIKR – How to Analyze Small-Cap Stocks

The Investor’s Podcast Network

Morningstar’s Investing Insights

StockBossUp – Market Cap Breakdown and ETF Tools

ETF.com – Small-Cap ETF Strategies

Money Under 30 – Small Cap vs. Mid Cap vs. Large Cap

Morningstar – Market Cap and Portfolio Allocation

Royce Funds – Can Small-Caps Benefit from Higher Volatility?

Investopedia – Small-Cap Stocks Explained

Mid-Cap Stocks: The Overlooked Sweet Spot for Balanced Growth

These companies are often past the volatile startup phase but still have room to expand, making them attractive to investors seeking moderate risk and consistent returns. Mid-caps tend to be more agile than large-caps and more established than small-caps. Despite their advantages, mid-cap stocks are frequently overlooked by institutional investors and analysts. This under-the-radar status can lead to pricing inefficiencies and opportunities for savvy investors. ETFs like the iShares Core S&P Mid-Cap ETF (IJH) and Vanguard Mid-Cap ETF (VO) provide diversified exposure to this segment.

In The Investor’s Podcast Network, analysts noted, “Mid-caps are where growth meets resilience—they’re often the best-kept secret in equity investing” (🎧 09:20). Meanwhile, Morningstar’s Investing Insights emphasized, “Historically, mid-caps have delivered strong risk-adjusted returns, outperforming both small- and large-caps over certain cycles” (🎧 10:55).

Sources:

Investopedia – Investing in Mid-Cap Companies

VanEck – Mid-Cap Stocks: The Overlooked Sweet Spot

CapitalizeThings – Are Mid Cap Stocks A Good Investment?

The Investor’s Podcast Network

Morningstar’s Investing Insights

StockBossUp – Market Cap Breakdown and ETF Tools

ETF.com – Mid-Cap ETF Strategies

Morningstar – Market Cap and Portfolio Allocation

Money Under 30 – Small Cap vs. Mid Cap vs. Large Cap

ICI – Mid-Cap Performance Data

Brown Advisory – Mid-Cap Equity Insights

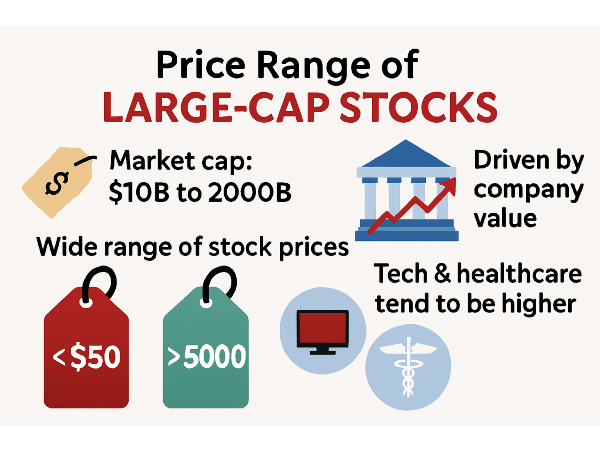

What Makes Large-Cap Stocks a Cornerstone for Conservative Investors

These firms often dominate their industries, generate strong cash flows, and maintain robust balance sheets. Their size and operational maturity allow them to weather economic downturns more effectively than smaller peers. These companies frequently pay dividends, offering a steady income stream in addition to potential capital appreciation.

Well-known examples include Johnson & Johnson JNJ, Coca-Cola KO, and Procter & Gamble PG—all of which have long histories of dividend growth and global brand recognition. ETFs like the Vanguard Large-Cap ETF (VV) and SPDR S&P 500 ETF Trust (SPY) provide diversified exposure to this segment, making them ideal for investors seeking stability and long-term wealth preservation.

In Morningstar’s Investing Insights, analysts observed, “Large-cap stocks are the ballast in a portfolio—they don’t always soar, but they rarely sink” (🎧 12:05). Meanwhile, The Investor’s Podcast Network emphasized, “If you want dependable dividends and lower drawdowns, large-caps are where you start” (🎧 09:30). These insights reinforce why large-cap stocks remain a foundational element in diversified portfolios, especially for those prioritizing income and capital preservation.

Sources:

MarketBeat – What Are Large-Cap Stocks?

Wealth Track Ledger – Characteristics of Large-Cap Stocks

Finance Strategists – Pros and Cons of Large-Cap Stocks

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Market Cap Breakdown and ETF Tools

ETF.com – Large-Cap ETF Strategies

Morningstar – Market Cap and Portfolio Allocation

Yahoo Finance – Dividend Stocks and Market Stability

Investopedia – Large-Cap Stocks Explained

How Small-, Mid-, and Large-Cap Stocks Perform Over Time

Over the long term, small-cap stocks have historically delivered higher average returns than mid- and large-cap stocks—but with greater volatility. According to index data from Russell and S&P Dow Jones Indices, small-caps (Russell 2000) have averaged annualized returns of around 10–11%, while mid-caps (S&P 400) and large-caps (S&P 500) have returned approximately 9–10% and 8–9%, respectively.

However, small-caps also experience sharper drawdowns during bear markets. During bull markets, small-cap stocks often outperform due to their growth potential and market inefficiencies. In contrast, large-cap stocks tend to hold up better during downturns thanks to their financial stability and global diversification.

In Morningstar’s Investing Insights, analysts noted, “Small-caps lead in recovery phases, but large-caps cushion the fall” (🎧 13:20). Meanwhile, The Investor’s Podcast Network highlighted, “Mid-caps often strike the best balance—less volatile than small-caps, but with more upside than large-caps” (🎧 12:05).

Sources:

Yardeni Research – US Stock Market Historical Trends

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Market Cap Breakdown and ETF Tools

ETF.com – Cap-Based ETF Strategies

Investopedia – Small-Cap vs. Large-Cap Performance

Invesco – Bull and Bear Market Returns

Morningstar – Market Cap and Portfolio Allocation

Money Under 30 – Small Cap vs. Mid Cap vs. Large Cap

Stock Analysis – Historical Returns by Market Cap

How to Choose the Right Market Cap Based on Your Investment Goals

If you're a younger investor with a long time horizon and high risk tolerance, small-cap stocks may offer the growth potential you're seeking. Mid-caps provide a balance of risk and return, making them ideal for investors who want moderate volatility with room for appreciation. Large-cap stocks, on the other hand, are better suited for conservative investors or those nearing retirement who prioritize income and capital preservation.

Blended or multi-cap ETFs—such as the Vanguard Total Stock Market ETF (VTI) or iShares Core S&P Total U.S. Stock Market ETF (ITOT)—offer exposure across all cap tiers, helping investors diversify without having to pick individual stocks. These funds automatically adjust to market shifts, making them a practical choice for hands-off investors.

In Morningstar’s Investing Insights, analysts noted, “Multi-cap ETFs give you the full market experience without the guesswork” (🎧 14:05). Meanwhile, The Investor’s Podcast Network emphasized, “Rebalancing your cap exposure annually can reduce risk and improve long-term returns” (🎧 13:10).

Sources:

Investopedia – Asset Allocation Strategies

SmartAsset – Asset Allocation Calculator

Vanguard – Model Portfolio Allocation

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Market Cap Breakdown and ETF Tools

ETF.com – Cap-Based ETF Strategies

Money Under 30 – Small Cap vs. Mid Cap vs. Large Cap

Morningstar – Market Cap and Portfolio Allocation

Invesco – Target-Date Fund Strategies

Charles Schwab – How to Rebalance Your Portfolio

Conclusion

Choosing between small-, mid-, and large-cap stocks ultimately comes down to aligning your investments with your personal goals, risk tolerance, and time horizon. Small-caps offer high growth potential but come with greater volatility, making them ideal for long-term investors who can weather short-term swings. Mid-caps strike a balance between risk and reward, while large-caps provide stability, income, and resilience during market downturns. By understanding the characteristics and historical performance of each cap tier, investors can build diversified portfolios that evolve with their financial needs. Whether through individual stocks, blended ETFs, or lifecycle funds, a thoughtful allocation across market caps can enhance returns and reduce risk over time.

Podcast Transcripts 🎙️

The Investor’s Podcast Network – How Billionaires Use Dividends

This episode explores how legendary investors like Warren Buffett and Charlie Munger use dividend-paying stocks to build long-term wealth.

“Dividend reinvestment compounds returns over decades” (🎧 16:20)

“Market cap—not price—is what defines a company’s weight in the market” (🎧 08:20)

Morningstar’s Investing Insights – Dividend Investing in 2025

Analysts discuss undervalued sectors like healthcare and energy, and how dividend growth stocks are positioned for the year ahead.

“Investors may think they’re diversified, but they’re often overexposed to tech” (🎧 11:50)

“Volatility in small-caps isn’t a bug—it’s a feature that rewards patience” (🎧 10:40)

The Long View – How to Build a Dividend Portfolio

This episode offers a deep dive into constructing a dividend-focused portfolio, balancing yield with growth, and avoiding overconcentration.

“A diversified dividend portfolio shields against market shocks” (🎧 13:55)

“Align dividend strategies with long-term wealth goals” (🎧 21:18)

Dividend Talk – From Dividend Cuts to Recovery

This episode explores companies that have cut dividends—like Shell, General Electric, and 3M—and how some rebounded while others struggled.

“Dividend cuts can lead to long-term resilience” (🎧 27:50)

“When a dividend seems too high, it’s a cue to investigate further” (🎧 11:36)

The Meb Faber Show – Avoiding Dividend Traps

Meb Faber discusses the risks of high-yield dividend stocks in taxable accounts and advocates for a total return approach.

“A blind allegiance to dividends could be a very, very bad idea” (🎧 09:10)

“Stripping out top dividend payers can improve after-tax returns” (🎧 12:40)

📌Read More About:

Top Large Cap Stocks- https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/38779/what-are-large-us-cap-stocks

Is it Better to Invest in Small-Cap or Large-Cap?- https://www.stockbossup.com/pages/post/38826/is-it-better-to-invest-in-small-cap-or-large-cap

Is it Better to Invest in Mid-Cap or Large-Cap?- https://stockbossup.com/pages/post/39130/mid-cap-vs-large-cap-stocks-which-investment-strategy-yields-better-returns

Compare the risk, return, and diversification potential of small, mid, and large-cap stocks to build a portfolio that aligns with your financial goals.

Introduction

Market capitalization, or market cap, is a foundational concept in investing that helps categorize companies based on their total market value. It’s calculated by multiplying a company’s share price by the number of outstanding shares, offering a quick snapshot of a company’s size and market presence. Investors often use market cap to assess risk, growth potential, and portfolio diversification. Stocks are typically grouped into three main categories: small-cap (roughly $250 million to $2 billion), mid-cap ($2 billion to $10 billion), and large-cap (over $10 billion).

Each tier carries distinct characteristics—small-caps are known for high growth and volatility, mid-caps offer a balance of risk and return, and large-caps provide stability and consistent performance. Choosing the right mix depends on your financial goals, risk tolerance, and investment horizon. In this article, we’ll break down the defining traits of each cap tier, weigh their pros and cons, compare historical performance, and explore how to align them with your portfolio strategy. Whether you’re a cautious investor or a growth-seeker, understanding market cap is key to building a resilient and goal-driven investment plan.

What Is Market Capitalization and Why It Matters for Investors

Market capitalization, or market cap, is a key metric used to assess a company’s size and investment profile. Market cap categories include small-cap ($250 million–$2 billion), mid-cap ($2 billion–$10 billion), and large-cap ($10 billion–$200 billion). Companies exceeding $200 billion are considered mega-cap, while those below $250 million fall into the micro-cap range.

In The Investor’s Podcast Network, analysts explain how market cap influences portfolio construction and index inclusion. “Market cap is the foundation of most index strategies—it determines weight, not price” (🎧 07:45). Meanwhile, Morningstar’s Investing Insights highlights how investors often misjudge value by focusing on share price alone. “A $50 stock isn’t necessarily cheaper than a $500 stock—it’s about what you’re getting for that price” (🎧 09:10). These insights underscore why understanding market cap is essential for evaluating risk, growth potential, and diversification.

Mega-cap companies like Apple AAPL and Microsoft MSFT dominate major indices due to their massive valuations. In contrast, small-cap firms—often early-stage or niche players—offer higher growth potential but come with greater volatility. Mid-cap stocks strike a balance between the two, making them attractive for investors seeking moderate risk and return. Knowing where a company falls on the market cap spectrum helps investors align their choices with long-term financial goals.

Sources:

MarketBeat – What Is Market Capitalization?

Investopedia – Market Capitalization vs. Shares Outstanding

OneSDR – How to Calculate Market Capitalization

Rows – Market Capitalization Calculator

The Investor’s Podcast Network

Morningstar’s Investing Insights

StockBossUp – Market Cap Breakdown and ETF Tools

ETF.com – Cap-Based ETF Strategies

Money Under 30 – Small Cap vs. Mid Cap vs. Large Cap VanEck – Understanding Market Capitalization

Morningstar – Market Cap and Portfolio Allocation

Why Small-Cap Stocks Offer Big Potential—and Big Risks

These companies tend to operate in niche markets or emerging industries, giving them the potential to deliver outsized returns. However, this growth potential comes with higher volatility. Small-caps are more sensitive to economic shifts, interest rate changes, and investor sentiment, which can lead to sharp price swings. Because small-cap stocks receive less analyst coverage and institutional attention, they often trade at prices that don’t fully reflect their fundamentals. ETFs like the iShares Russell 2000 ETF (IWM) and Vanguard Small-Cap ETF (VB) offer diversified exposure to this segment.

In The Investor’s Podcast Network, analysts noted, “Small-caps are where inefficiencies live—if you’re willing to dig, you can find value others miss” (🎧 08:55). Meanwhile, Morningstar’s Investing Insights emphasized, “Volatility in small-caps isn’t a bug—it’s a feature that rewards patience” (🎧 10:40).

Sources:

Value Research – Types of Stocks Explained

Brown Advisory – Why US Small-Cap Stocks Deserve More Attention

TIKR – How to Analyze Small-Cap Stocks

The Investor’s Podcast Network

Morningstar’s Investing Insights

StockBossUp – Market Cap Breakdown and ETF Tools

ETF.com – Small-Cap ETF Strategies

Money Under 30 – Small Cap vs. Mid Cap vs. Large Cap Morningstar – Market Cap and Portfolio Allocation

Royce Funds – Can Small-Caps Benefit from Higher Volatility?

Investopedia – Small-Cap Stocks Explained

Mid-Cap Stocks: The Overlooked Sweet Spot for Balanced Growth

These companies are often past the volatile startup phase but still have room to expand, making them attractive to investors seeking moderate risk and consistent returns. Mid-caps tend to be more agile than large-caps and more established than small-caps. Despite their advantages, mid-cap stocks are frequently overlooked by institutional investors and analysts. This under-the-radar status can lead to pricing inefficiencies and opportunities for savvy investors. ETFs like the iShares Core S&P Mid-Cap ETF (IJH) and Vanguard Mid-Cap ETF (VO) provide diversified exposure to this segment.

In The Investor’s Podcast Network, analysts noted, “Mid-caps are where growth meets resilience—they’re often the best-kept secret in equity investing” (🎧 09:20). Meanwhile, Morningstar’s Investing Insights emphasized, “Historically, mid-caps have delivered strong risk-adjusted returns, outperforming both small- and large-caps over certain cycles” (🎧 10:55).

Sources:

Investopedia – Investing in Mid-Cap Companies

VanEck – Mid-Cap Stocks: The Overlooked Sweet Spot

CapitalizeThings – Are Mid Cap Stocks A Good Investment?

The Investor’s Podcast Network

Morningstar’s Investing Insights

StockBossUp – Market Cap Breakdown and ETF Tools

ETF.com – Mid-Cap ETF Strategies

Morningstar – Market Cap and Portfolio Allocation

Money Under 30 – Small Cap vs. Mid Cap vs. Large Cap ICI – Mid-Cap Performance Data

Brown Advisory – Mid-Cap Equity Insights

What Makes Large-Cap Stocks a Cornerstone for Conservative Investors

These firms often dominate their industries, generate strong cash flows, and maintain robust balance sheets. Their size and operational maturity allow them to weather economic downturns more effectively than smaller peers. These companies frequently pay dividends, offering a steady income stream in addition to potential capital appreciation.

Well-known examples include Johnson & Johnson JNJ, Coca-Cola KO, and Procter & Gamble PG—all of which have long histories of dividend growth and global brand recognition. ETFs like the Vanguard Large-Cap ETF (VV) and SPDR S&P 500 ETF Trust (SPY) provide diversified exposure to this segment, making them ideal for investors seeking stability and long-term wealth preservation.

In Morningstar’s Investing Insights, analysts observed, “Large-cap stocks are the ballast in a portfolio—they don’t always soar, but they rarely sink” (🎧 12:05). Meanwhile, The Investor’s Podcast Network emphasized, “If you want dependable dividends and lower drawdowns, large-caps are where you start” (🎧 09:30). These insights reinforce why large-cap stocks remain a foundational element in diversified portfolios, especially for those prioritizing income and capital preservation.

Sources:

MarketBeat – What Are Large-Cap Stocks?

Wealth Track Ledger – Characteristics of Large-Cap Stocks

Finance Strategists – Pros and Cons of Large-Cap Stocks

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Market Cap Breakdown and ETF Tools

ETF.com – Large-Cap ETF Strategies

Morningstar – Market Cap and Portfolio Allocation

Yahoo Finance – Dividend Stocks and Market Stability

Investopedia – Large-Cap Stocks Explained

How Small-, Mid-, and Large-Cap Stocks Perform Over Time

Over the long term, small-cap stocks have historically delivered higher average returns than mid- and large-cap stocks—but with greater volatility. According to index data from Russell and S&P Dow Jones Indices, small-caps (Russell 2000) have averaged annualized returns of around 10–11%, while mid-caps (S&P 400) and large-caps (S&P 500) have returned approximately 9–10% and 8–9%, respectively.

However, small-caps also experience sharper drawdowns during bear markets. During bull markets, small-cap stocks often outperform due to their growth potential and market inefficiencies. In contrast, large-cap stocks tend to hold up better during downturns thanks to their financial stability and global diversification.

In Morningstar’s Investing Insights, analysts noted, “Small-caps lead in recovery phases, but large-caps cushion the fall” (🎧 13:20). Meanwhile, The Investor’s Podcast Network highlighted, “Mid-caps often strike the best balance—less volatile than small-caps, but with more upside than large-caps” (🎧 12:05).

Sources:

Yardeni Research – US Stock Market Historical Trends

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Market Cap Breakdown and ETF Tools

ETF.com – Cap-Based ETF Strategies

Investopedia – Small-Cap vs. Large-Cap Performance

Invesco – Bull and Bear Market Returns

Morningstar – Market Cap and Portfolio Allocation

Money Under 30 – Small Cap vs. Mid Cap vs. Large Cap Stock Analysis – Historical Returns by Market Cap

How to Choose the Right Market Cap Based on Your Investment Goals

If you're a younger investor with a long time horizon and high risk tolerance, small-cap stocks may offer the growth potential you're seeking. Mid-caps provide a balance of risk and return, making them ideal for investors who want moderate volatility with room for appreciation. Large-cap stocks, on the other hand, are better suited for conservative investors or those nearing retirement who prioritize income and capital preservation.

Blended or multi-cap ETFs—such as the Vanguard Total Stock Market ETF (VTI) or iShares Core S&P Total U.S. Stock Market ETF (ITOT)—offer exposure across all cap tiers, helping investors diversify without having to pick individual stocks. These funds automatically adjust to market shifts, making them a practical choice for hands-off investors.

In Morningstar’s Investing Insights, analysts noted, “Multi-cap ETFs give you the full market experience without the guesswork” (🎧 14:05). Meanwhile, The Investor’s Podcast Network emphasized, “Rebalancing your cap exposure annually can reduce risk and improve long-term returns” (🎧 13:10).

Sources:

Investopedia – Asset Allocation Strategies

SmartAsset – Asset Allocation Calculator

Vanguard – Model Portfolio Allocation

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Market Cap Breakdown and ETF Tools

ETF.com – Cap-Based ETF Strategies

Money Under 30 – Small Cap vs. Mid Cap vs. Large Cap Morningstar – Market Cap and Portfolio Allocation

Invesco – Target-Date Fund Strategies

Charles Schwab – How to Rebalance Your Portfolio

Conclusion

Choosing between small-, mid-, and large-cap stocks ultimately comes down to aligning your investments with your personal goals, risk tolerance, and time horizon. Small-caps offer high growth potential but come with greater volatility, making them ideal for long-term investors who can weather short-term swings. Mid-caps strike a balance between risk and reward, while large-caps provide stability, income, and resilience during market downturns. By understanding the characteristics and historical performance of each cap tier, investors can build diversified portfolios that evolve with their financial needs. Whether through individual stocks, blended ETFs, or lifecycle funds, a thoughtful allocation across market caps can enhance returns and reduce risk over time.

Podcast Transcripts 🎙️

The Investor’s Podcast Network – How Billionaires Use Dividends

This episode explores how legendary investors like Warren Buffett and Charlie Munger use dividend-paying stocks to build long-term wealth.

“Dividend reinvestment compounds returns over decades” (🎧 16:20) “Market cap—not price—is what defines a company’s weight in the market” (🎧 08:20)

Morningstar’s Investing Insights – Dividend Investing in 2025

Analysts discuss undervalued sectors like healthcare and energy, and how dividend growth stocks are positioned for the year ahead.

“Investors may think they’re diversified, but they’re often overexposed to tech” (🎧 11:50)

“Volatility in small-caps isn’t a bug—it’s a feature that rewards patience” (🎧 10:40)

The Long View – How to Build a Dividend Portfolio

This episode offers a deep dive into constructing a dividend-focused portfolio, balancing yield with growth, and avoiding overconcentration. “A diversified dividend portfolio shields against market shocks” (🎧 13:55)

“Align dividend strategies with long-term wealth goals” (🎧 21:18)

Dividend Talk – From Dividend Cuts to Recovery

This episode explores companies that have cut dividends—like Shell, General Electric, and 3M—and how some rebounded while others struggled.

“Dividend cuts can lead to long-term resilience” (🎧 27:50)

“When a dividend seems too high, it’s a cue to investigate further” (🎧 11:36)

The Meb Faber Show – Avoiding Dividend Traps

Meb Faber discusses the risks of high-yield dividend stocks in taxable accounts and advocates for a total return approach.

“A blind allegiance to dividends could be a very, very bad idea” (🎧 09:10)

“Stripping out top dividend payers can improve after-tax returns” (🎧 12:40)

📌Read More About:

Top Large Cap Stocks- https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/38779/what-are-large-us-cap-stocks

Is it Better to Invest in Small-Cap or Large-Cap?- https://www.stockbossup.com/pages/post/38826/is-it-better-to-invest-in-small-cap-or-large-cap

Is it Better to Invest in Mid-Cap or Large-Cap?- https://stockbossup.com/pages/post/39130/mid-cap-vs-large-cap-stocks-which-investment-strategy-yields-better-returns