Introduction

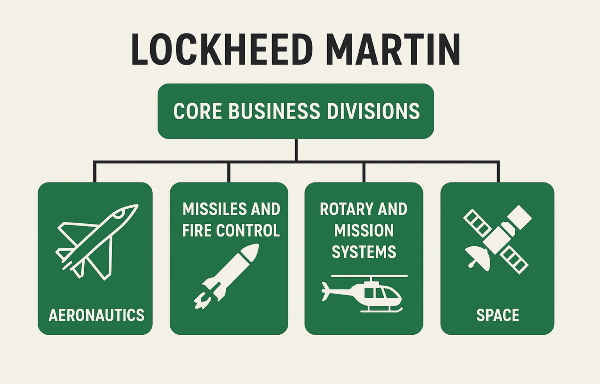

Lockheed Martin Corporation (NYSE: LMT) is one of the leading defense technology companies in the world, primarily serving the United States government. Even if you don’t own LMT in your personal portfolio, this stock is still worth paying attention to—especially for dividend investors. Notably, Lockheed Martin is a significant holding in Schwab’s U.S. Dividend Equity ETF (SCHD), where it currently comprises 4.08% of the fund’s allocation.

With LMT trading near the lower end of its 52-week range, this presents a potential opportunity for investors looking for a mix of defensive characteristics, dividend income, and share repurchase-driven appreciation.

Lockheed Martin as a Dividend Stock

LMT Dividend Yield for the past 5 years and dividend growth rate

| Year |

Dividend Yield |

Dividend Growth Rate |

| 2024 |

2.74% |

6.99% |

| 2023 |

2.46% |

8.20% |

| 2022 |

2.50% |

7.40% |

| 2021 |

2.60% |

5.00% |

| 2020 |

2.55% |

9.70% |

Lockheed Martin is not just a dividend stock—it is what investors call a "true shareholder yield stock." Shareholder yield considers both dividend payouts and share buybacks, giving investors a more comprehensive picture of how the company returns value.

Dividend Yield & Growth

Currently, Lockheed Martin offers a starting dividend yield of 2.72%, which is solid for a mature defense contractor. Over the past decade, the company has demonstrated a commitment to dividend growth, boasting a 10-year dividend CAGR of 7.7% and a 5-year CAGR of 5.6%.

This steady increase in dividend payouts is supported by Lockheed Martin’s cash flow generation, making it a reliable dividend-paying stock.

Here’s a markdown table comparing five stocks similar to Lockheed Martin (LMT) that might offer better dividend potential:

5 companies like Lockheed Martin that my be better dividend investments!

| Company Name |

Stock Symbol |

Dividend Advantage |

| General Dynamics |

GD |

Higher dividend yield and consistent payout growth. |

| Northrop Grumman |

NOC |

Strong dividend growth rate and lower payout ratio. |

| Raytheon Technologies |

RTX |

Diversified revenue streams supporting stable dividends. |

| Boeing |

BA |

Potential for dividend reinstatement as financials improve. |

| Honeywell International |

HON |

Steady dividend growth with strong cash flow generation. |

Buyback Yield & Shareholder Returns

While dividends are important, share buybacks add another layer of returns for investors. Over the past few years, Lockheed Martin has been aggressively repurchasing shares, reducing total shares outstanding from 280 million in 2020 to just 238 million in 2024. This represents significant buybacks, increasing the ownership stake of existing shareholders.

Analyzing the buyback yield, we see Lockheed Martin has retired 4.5% to 5% of outstanding shares annually in recent years, with a 5-year average buyback yield of approximately 3.3%. Combining the dividend yield with the buyback yield gives a total shareholder yield of 6.02%, making LMT attractive for investors focused on total capital returns.

Cash Flow Trends & Stability

Free cash flow is one of the most critical metrics for dividend investors because it supports dividend payouts and buybacks.

- 2021: $7.7 billion (highest ever)

- 2024: Declined to ~$5.3 billion

- 2025 outlook: Expected to recover to 6.6–6.8 billion

Management’s guidance suggests free cash flow is rebounding, an important sign for dividend sustainability. This trend indicates that the payout ratio could decline in 2025, further reinforcing Lockheed Martin’s stability.

Predictable Revenue Streams

One of the biggest appeals of Lockheed Martin is its predictable cash flows, primarily due to long-term defense contracts.

U.S. Defense Budget & Lockheed Martin's Sales

In 2024, 73% of Lockheed Martin’s total net sales came from the U.S. government. While some view this reliance on government contracts as a risk, others consider it an advantage due to long-term commitments.

Looking at global military expenditures, Lockheed Martin benefits from the U.S. government’s significant defense spending:

- U.S. Defense Budget (2024): $895 billion

- China: $266 billion

- Russia: $126 billion

Historically, U.S. military spending has grown faster than inflation, reinforcing Lockheed Martin’s position as a top defense contractor.

Additionally, Lockheed Martin's $173 billion backlog provides more than two years of guaranteed revenue, making cash flow highly predictable.

Profitability & Earnings Growth

Despite stable cash flows, Lockheed Martin's gross profit ratio is somewhat volatile, largely due to the timing of government contracts. However, this does not significantly impact its long-term cash flow outlook.

Future Growth Estimates

Growth projections for Lockheed Martin vary:

- Seeking Alpha: 3–5 year EPS CAGR estimate at 12.78% (high estimate)

- Consensus estimates: High-single-digit growth (more realistic)

With historical revenue per share growing predictably, the company is likely to maintain stable returns even if growth remains moderate.

Valuation Analysis

Given the company’s expected free cash flow recovery, let’s analyze Lockheed Martin's valuation using two key models:

Discounted Cash Flow (DCF) Model

Using management’s 6.6 billion free cash flow guidance for 2025, applying 6% growth, and discounting future cash flows, we arrive at a DCF price per share of $526.46, which is 11.25% above the current price.

Dividend Discount Model (DDM)

Using a 5.5% dividend growth rate, we arrive at a DDM valuation of $544.38 per share, indicating 15% upside.

Average of DCF & DDM: $535.42 (suggesting Lockheed Martin is undervalued)

With a 10% margin of safety, LMT’s acceptable buy range is $481.88, triggering a buy signal.

Should You Buy Lockheed Martin?

While Lockheed Martin has many attractive qualities, including predictable cash flows, strong shareholder returns, and a defensive market position, it’s not a high-growth company. The stock appeals to investors who prioritize stability over volatility, making it ideal for dividend and defensive investors.

As always, investors should consider their personal portfolio objectives and risk tolerance before making investment decisions.

https://youtu.be/wPmFMy_m6Ms?si=32y3KFJvWmq0HvwM

Introduction

Lockheed Martin Corporation (NYSE: LMT) is one of the leading defense technology companies in the world, primarily serving the United States government. Even if you don’t own LMT in your personal portfolio, this stock is still worth paying attention to—especially for dividend investors. Notably, Lockheed Martin is a significant holding in Schwab’s U.S. Dividend Equity ETF (SCHD), where it currently comprises 4.08% of the fund’s allocation.

With LMT trading near the lower end of its 52-week range, this presents a potential opportunity for investors looking for a mix of defensive characteristics, dividend income, and share repurchase-driven appreciation.

Lockheed Martin as a Dividend Stock

Lockheed Martin is not just a dividend stock—it is what investors call a "true shareholder yield stock." Shareholder yield considers both dividend payouts and share buybacks, giving investors a more comprehensive picture of how the company returns value.

Dividend Yield & Growth

Currently, Lockheed Martin offers a starting dividend yield of 2.72%, which is solid for a mature defense contractor. Over the past decade, the company has demonstrated a commitment to dividend growth, boasting a 10-year dividend CAGR of 7.7% and a 5-year CAGR of 5.6%.

This steady increase in dividend payouts is supported by Lockheed Martin’s cash flow generation, making it a reliable dividend-paying stock.

Here’s a markdown table comparing five stocks similar to Lockheed Martin (LMT) that might offer better dividend potential:

Buyback Yield & Shareholder Returns

While dividends are important, share buybacks add another layer of returns for investors. Over the past few years, Lockheed Martin has been aggressively repurchasing shares, reducing total shares outstanding from 280 million in 2020 to just 238 million in 2024. This represents significant buybacks, increasing the ownership stake of existing shareholders.

Analyzing the buyback yield, we see Lockheed Martin has retired 4.5% to 5% of outstanding shares annually in recent years, with a 5-year average buyback yield of approximately 3.3%. Combining the dividend yield with the buyback yield gives a total shareholder yield of 6.02%, making LMT attractive for investors focused on total capital returns.

Cash Flow Trends & Stability

Free cash flow is one of the most critical metrics for dividend investors because it supports dividend payouts and buybacks.

Management’s guidance suggests free cash flow is rebounding, an important sign for dividend sustainability. This trend indicates that the payout ratio could decline in 2025, further reinforcing Lockheed Martin’s stability.

Predictable Revenue Streams

One of the biggest appeals of Lockheed Martin is its predictable cash flows, primarily due to long-term defense contracts.

U.S. Defense Budget & Lockheed Martin's Sales

In 2024, 73% of Lockheed Martin’s total net sales came from the U.S. government. While some view this reliance on government contracts as a risk, others consider it an advantage due to long-term commitments.

Looking at global military expenditures, Lockheed Martin benefits from the U.S. government’s significant defense spending:

Historically, U.S. military spending has grown faster than inflation, reinforcing Lockheed Martin’s position as a top defense contractor.

Additionally, Lockheed Martin's $173 billion backlog provides more than two years of guaranteed revenue, making cash flow highly predictable.

Profitability & Earnings Growth

Despite stable cash flows, Lockheed Martin's gross profit ratio is somewhat volatile, largely due to the timing of government contracts. However, this does not significantly impact its long-term cash flow outlook.

Future Growth Estimates

Growth projections for Lockheed Martin vary:

With historical revenue per share growing predictably, the company is likely to maintain stable returns even if growth remains moderate.

Valuation Analysis

Given the company’s expected free cash flow recovery, let’s analyze Lockheed Martin's valuation using two key models:

Discounted Cash Flow (DCF) Model

Using management’s 6.6 billion free cash flow guidance for 2025, applying 6% growth, and discounting future cash flows, we arrive at a DCF price per share of $526.46, which is 11.25% above the current price.

Dividend Discount Model (DDM)

Using a 5.5% dividend growth rate, we arrive at a DDM valuation of $544.38 per share, indicating 15% upside.

Average of DCF & DDM: $535.42 (suggesting Lockheed Martin is undervalued)

With a 10% margin of safety, LMT’s acceptable buy range is $481.88, triggering a buy signal.

Should You Buy Lockheed Martin?

While Lockheed Martin has many attractive qualities, including predictable cash flows, strong shareholder returns, and a defensive market position, it’s not a high-growth company. The stock appeals to investors who prioritize stability over volatility, making it ideal for dividend and defensive investors.

As always, investors should consider their personal portfolio objectives and risk tolerance before making investment decisions.

https://youtu.be/wPmFMy_m6Ms?si=32y3KFJvWmq0HvwM