A practical guide to understanding the world’s corporate giants, why they matter, and how to invest with clarity—not complexity.

| Company Name |

Symbol |

Dividend Yield |

P/E Ratio |

Market Cap (USD) |

Revenue (TTM) |

| Microsoft |

MSFT |

0.69% |

37.57 |

$3.52T |

$260.2B |

| Nvidia |

NVDA |

0.03% |

45.72 |

$3.50T |

$148.5B |

| Apple |

AAPL |

~0.50% |

27.98 |

$3.11T |

$383.3B |

| Amazon |

AMZN |

0.00% |

61.46 |

$2.32T |

$575.0B |

| Alphabet |

GOOGL |

0.00% |

23.81 |

$2.12T |

$324.0B |

| Meta Platforms |

META |

0.00% |

33.71 |

$1.79T |

$134.9B |

| Tesla |

TSLA |

0.00% |

47.02 |

$1.00T+ |

$97.0B |

| JPMorgan Chase |

JPM |

~2.50% |

~11.5 |

$580B+ |

$160.0B+ |

| Bank of America |

BAC |

~2.80% |

~10.2 |

$300B+ |

$100.0B+ |

| UnitedHealth Group |

UNH |

~1.30% |

~20.0 |

$450B+ |

$370.0B+ |

| Eli Lilly |

LLY |

~0.80% |

~95.0 |

$800B+ |

$42.0B |

| Berkshire Hathaway |

BRK-B |

0.00% |

~9.0 |

$870B+ |

$364.0B |

| TSMC |

TSMC |

~1.60% |

~22.0 |

$872B |

$69.2B |

| Saudi Aramco |

2222.SR |

~3.80% |

~13.0 |

$2.00T+ |

$500.0B+ |

What the World’s Most Valuable Companies Reveal About the Economy in 2025

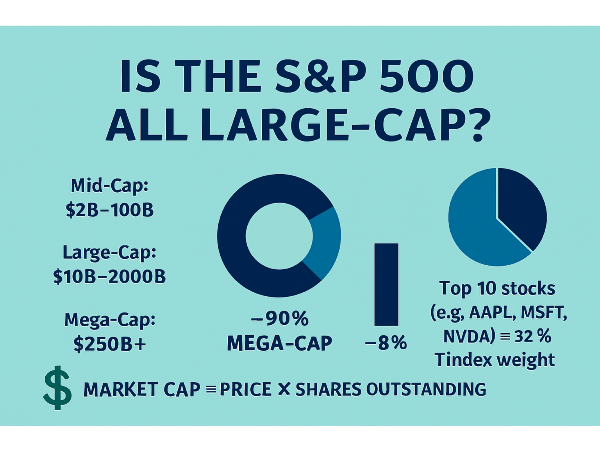

When we talk about the “most valuable” companies in the world, we’re really talking about market capitalization—the total value of a company’s outstanding shares. It’s a quick way to measure size, but also a signal of influence. These corporate giants shape global supply chains, drive innovation, and often anchor major stock indexes. For investors, they’re more than just headlines—they’re indicators of where capital is flowing and which sectors are leading the charge.

In 2025, the leaderboard includes familiar names like Microsoft, Nvidia, Apple, Amazon, and Alphabet. These firms aren’t just big—they’re foundational to how the modern economy runs. Understanding their role helps investors make smarter, more grounded decisions.

Want expert insights from leading investment podcasts? Scroll to the end to the Podcast Transcripts📜

Top 10 Most Valuable Companies in 2025: What They Do and Why They Matter

In 2025, the global leaderboard of corporate value is led by a familiar cast of giants—each with a unique role in shaping the modern economy. Microsoft MSFT continues to dominate enterprise software and cloud infrastructure, while Nvidia NVDA has become the backbone of AI computing. Apple AAPL remains a consumer tech powerhouse, and Amazon AMZN leads in e-commerce and logistics. Alphabet GOOGL, the parent of Google, drives digital advertising and cloud innovation. Meta META continues its push into virtual and augmented reality, while Saudi Aramco anchors the energy sector with unmatched oil production. Taiwan’s TSMC TSMC is the world’s most advanced chipmaker, Berkshire Hathaway BRK-B offers diversified exposure across industries, and Eli Lilly LLY leads in pharmaceutical innovation. What unites these companies isn’t just size—it’s their ability to adapt and lead.

Two insightful podcast episodes help unpack how these companies reached the top. In The Journal by WSJ, the hosts explore Nvidia’s meteoric rise. “They didn’t just ride the AI wave—they built the surfboard,” says a guest analyst at 06:58 ⏱️, highlighting how Nvidia’s early bets on GPU architecture paid off. Meanwhile, Bloomberg’s Odd Lots dives into Apple’s services strategy. At 10:21 ⏱️, the host notes, “Apple’s pivot from hardware to recurring revenue is what’s keeping it at the top.” These episodes reveal how scale, innovation, and global demand converge to create trillion-dollar valuations.

Sources:

CompaniesMarketCap – Global Rankings

Forbes – Top 10 Most Valuable Companies in 2025

Morningstar – Market Cap Trends

Investopedia – Market Capitalization Explained

U.S. News – Most Valuable Companies

Where the World’s Most Valuable Companies Are Born: Sector Signals from 2025

In 2025, tech remains the undisputed heavyweight, with companies like Microsoft, Nvidia, Apple, and Alphabet dominating the top of the market cap rankings. Much of this strength is powered by semiconductors—now the backbone of AI, cloud computing, and automation. According to Techovedas, the U.S. semiconductor ecosystem has surged thanks to public-private partnerships and relentless innovation, positioning chipmakers like Nvidia and TSMC at the center of global transformation. This sector mix tells a broader story: the global economy is diversifying.

But the story doesn’t end with tech. Energy, healthcare, and financials are holding their ground. Saudi Aramco continues to anchor the energy sector with unmatched oil production. Eli Lilly LLY leads in healthcare innovation, while Berkshire Hathaway BRK-B and JPMorgan Chase JPM represent financial resilience. In The Macro Trading Floor, analysts discuss how energy and financials are benefiting from inflation hedging and capital rotation. At 08:19 ⏱️, one guest notes, “We’re seeing a rebalancing—tech leads, but old-economy sectors are quietly catching up.” Meanwhile, The Tape by Bloomberg explores healthcare’s defensive strength. At 06:44 ⏱️, the host says, “In a volatile world, healthcare is where capital hides with confidence.”

Sources:

Techovedas – Rise of Semiconductors

PwC – State of the Semiconductor Industry

Investing.com – Sector ETF Trends

World Economic Forum – Chief Economists Outlook 2025

IMF – Global Economy Enters a New Era

Why Market Cap Isn’t the Whole Story in 2025

It tells you what the market thinks a company is worth—based on share price and outstanding shares—but it ignores debt, cash flow, and profitability. Two companies can have the same market cap and wildly different financial health. That’s why investors look beyond size. Revenue shows how much a company brings in, but margins and cash flow reveal how efficiently it turns that into profit. Revenue keeps you in business, profit helps you grow, and cash flow keeps you running.

In Animal Spirits, Ben Carlson puts it plainly at 07:42 ⏱️: “Some of the most resilient companies aren’t the biggest—they’re the ones with consistent free cash flow and pricing power.” Meanwhile, The Compound and Friends dives into why fundamentals still matter. At 11:28 ⏱️, Michael Batnick says, “You can’t just buy the biggest and expect the best returns.” In short, market cap tells you who’s winning the popularity contest. But if you want to know who’s built to last, follow the cash.

Sources:

Alphanome.AI – Why Market Cap is Misleading

Ramsey Solutions – Cash Flow vs. Profit

Forbes – Why Revenue Alone Isn’t Enough

Investopedia – Cash Flow vs. Profits

FutureTracker – Size vs. Sustainability

How to Invest in the World’s Most Valuable Companies Without Picking Stocks

ETFs and index funds make it easy to invest in the world’s most valuable companies with just a few clicks. Funds like the Vanguard S&P 500 ETF (VOO) or Invesco QQQ Trust (QQQ) offer exposure to top names like Apple, Amazon, and Alphabet—all bundled into one diversified investment. These funds are low-cost, tax-efficient, and ideal for long-term investors who want to keep things simple.

Cap-weighted funds give more weight to the biggest companies, meaning your returns are heavily influenced by a few mega caps. Equal-weighted ETFs, like RSP, spread your investment evenly across all holdings. This reduces concentration risk and can outperform when smaller or mid-cap stocks rally. To balance growth with diversification, consider blending both strategies.

In The Long View, Morningstar’s analysts explain at 12:16 ⏱️, “Equal-weighting forces discipline—it trims winners and buys laggards automatically.” Meanwhile, ETF Prime explores how thematic ETFs are gaining traction. At 09:03 ⏱️, host Nate Geraci notes, “Investors are using themes like AI and clean energy to diversify beyond traditional sectors.”

Sources:

U.S. News – ETFs to Build a Diversified Portfolio

The Motley Fool – Best Long-Term ETFs

BillionFire – Understanding SPX Weighting

TheStreet – Equal Weighting vs. Market Cap

Kiplinger – Diversification Guide

Conclusion

The most valuable companies in the world didn’t earn their titles with flash—they built them with scale, staying power, and relentless innovation. But as we’ve seen, market cap is just the surface. It tells us who’s big, not who’s best prepared for what’s next. Whether it’s chips powering AI, healthcare breakthroughs, or digital platforms running the global economy, these giants shape how we live and invest. That said, investors don’t need to chase every name—just understand the forces driving them. Focus on fundamentals, spread your bets, and use simple tools like ETFs to stay in the game without losing sleep. Wealth building isn’t magic—it’s patience wrapped in common sense. Just keep going. That’s the path.

Podcast Transcripts 🎧

1. The Journal by WSJ – How Nvidia Became the Most Valuable Chipmaker

This episode explores Nvidia’s rise from gaming GPUs to AI infrastructure dominance.

“They didn’t just ride the AI wave—they built the surfboard.”

⏱️ 06:58 – Discussion on Nvidia’s early investment in parallel processing and its payoff in the AI boom.

2. Bloomberg’s Odd Lots – Apple’s Services Strategy

This episode breaks down how Apple transitioned from hardware to recurring revenue.

“Apple’s pivot from hardware to recurring revenue is what’s keeping it at the top.”

⏱️ 10:21 – Analysis of Apple’s services growth and its impact on long-term valuation.

3. The Macro Trading Floor – Sector Rotation and Inflation Hedges

A deep dive into how energy and financials are benefiting from macroeconomic shifts.

“We’re seeing a rebalancing—tech leads, but old-economy sectors are quietly catching up.”

⏱️ 08:19 – Insight into capital flows into energy and financials amid inflation concerns.

4. The Tape by Bloomberg – Healthcare as a Defensive Play

This episode highlights how healthcare stocks like Eli Lilly are attracting long-term capital.

“In a volatile world, healthcare is where capital hides with confidence.”

⏱️ 06:44 – Commentary on healthcare’s role in portfolio stability.

5. Animal Spirits – Size Isn’t Everything

Ben Carlson and Michael Batnick explore why smaller companies with strong fundamentals often outperform.

“Some of the most resilient companies aren’t the biggest—they’re the ones with consistent free cash flow and pricing power.”

⏱️ 07:42 – Discussion on the importance of cash flow over market cap.

6. The Compound and Friends – Market Cap vs. Fundamentals

Michael Batnick and Josh Brown explain why market cap can be misleading.

“You can’t just buy the biggest and expect the best returns. Fundamentals still matter.”

⏱️ 11:28 – Breakdown of why revenue, margins, and cash flow are critical.

7. The Long View – Equal Weighting and ETF Discipline

This episode explains how equal-weighted ETFs can outperform by trimming winners and buying laggards.

“Equal-weighting forces discipline—it’s a built-in rebalancing mechanism.”

⏱️ 12:16 – Overview of how equal-weighted strategies manage risk and enhance returns.

8. ETF Prime – Thematic ETF Trends

Nate Geraci discusses how investors are using thematic ETFs to diversify beyond traditional sectors.

“Investors are using themes like AI and clean energy to diversify beyond traditional sectors.”

⏱️ 09:03 – Exploration of how themes are reshaping portfolio construction.

📌Read More About:

Top Large Cap Stocks- https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39168/what-are-large-cap-stocks-a-complete-guide-to-big-companies-in-the-u-s-market

Large Cap Sector Breakdown: How Each Industry Shapes the Market- https://stockbossup.com/pages/post/39242/large-cap-sector-breakdown-how-each-industry-shapes-the-market

Top Companies by Market Cap in 2025: Who’s Leading and Why It Matters- https://stockbossup.com/pages/post/39259/top-companies-by-market-cap-in-2025-who-s-leading-and-why-it-matters

🌐Global & Industrial Picks:

Is Microsoft a Mega-Cap Stock?- https://www.stockbossup.com/pages/post/38850/is-microsoft-considered-a-mega-cap-stock

Is Apple a Mega-Cap?- https://stockbossup.com/pages/post/39186/is-apple-a-mega-cap-stock-understanding-its-market-influence

Is Amazon a Mega-Cap?- https://stockbossup.com/pages/post/39191/is-amazon-a-mega-cap-stock-evaluating-its-market-influence

A practical guide to understanding the world’s corporate giants, why they matter, and how to invest with clarity—not complexity.

What the World’s Most Valuable Companies Reveal About the Economy in 2025

When we talk about the “most valuable” companies in the world, we’re really talking about market capitalization—the total value of a company’s outstanding shares. It’s a quick way to measure size, but also a signal of influence. These corporate giants shape global supply chains, drive innovation, and often anchor major stock indexes. For investors, they’re more than just headlines—they’re indicators of where capital is flowing and which sectors are leading the charge.

In 2025, the leaderboard includes familiar names like Microsoft, Nvidia, Apple, Amazon, and Alphabet. These firms aren’t just big—they’re foundational to how the modern economy runs. Understanding their role helps investors make smarter, more grounded decisions.

Want expert insights from leading investment podcasts? Scroll to the end to the Podcast Transcripts📜

Top 10 Most Valuable Companies in 2025: What They Do and Why They Matter

In 2025, the global leaderboard of corporate value is led by a familiar cast of giants—each with a unique role in shaping the modern economy. Microsoft MSFT continues to dominate enterprise software and cloud infrastructure, while Nvidia NVDA has become the backbone of AI computing. Apple AAPL remains a consumer tech powerhouse, and Amazon AMZN leads in e-commerce and logistics. Alphabet GOOGL, the parent of Google, drives digital advertising and cloud innovation. Meta META continues its push into virtual and augmented reality, while Saudi Aramco anchors the energy sector with unmatched oil production. Taiwan’s TSMC TSMC is the world’s most advanced chipmaker, Berkshire Hathaway BRK-B offers diversified exposure across industries, and Eli Lilly LLY leads in pharmaceutical innovation. What unites these companies isn’t just size—it’s their ability to adapt and lead.

Two insightful podcast episodes help unpack how these companies reached the top. In The Journal by WSJ, the hosts explore Nvidia’s meteoric rise. “They didn’t just ride the AI wave—they built the surfboard,” says a guest analyst at 06:58 ⏱️, highlighting how Nvidia’s early bets on GPU architecture paid off. Meanwhile, Bloomberg’s Odd Lots dives into Apple’s services strategy. At 10:21 ⏱️, the host notes, “Apple’s pivot from hardware to recurring revenue is what’s keeping it at the top.” These episodes reveal how scale, innovation, and global demand converge to create trillion-dollar valuations.

Sources: CompaniesMarketCap – Global Rankings

Forbes – Top 10 Most Valuable Companies in 2025

Morningstar – Market Cap Trends

Investopedia – Market Capitalization Explained

U.S. News – Most Valuable Companies

Where the World’s Most Valuable Companies Are Born: Sector Signals from 2025

In 2025, tech remains the undisputed heavyweight, with companies like Microsoft, Nvidia, Apple, and Alphabet dominating the top of the market cap rankings. Much of this strength is powered by semiconductors—now the backbone of AI, cloud computing, and automation. According to Techovedas, the U.S. semiconductor ecosystem has surged thanks to public-private partnerships and relentless innovation, positioning chipmakers like Nvidia and TSMC at the center of global transformation. This sector mix tells a broader story: the global economy is diversifying.

But the story doesn’t end with tech. Energy, healthcare, and financials are holding their ground. Saudi Aramco continues to anchor the energy sector with unmatched oil production. Eli Lilly LLY leads in healthcare innovation, while Berkshire Hathaway BRK-B and JPMorgan Chase JPM represent financial resilience. In The Macro Trading Floor, analysts discuss how energy and financials are benefiting from inflation hedging and capital rotation. At 08:19 ⏱️, one guest notes, “We’re seeing a rebalancing—tech leads, but old-economy sectors are quietly catching up.” Meanwhile, The Tape by Bloomberg explores healthcare’s defensive strength. At 06:44 ⏱️, the host says, “In a volatile world, healthcare is where capital hides with confidence.”

Sources:

Techovedas – Rise of Semiconductors

PwC – State of the Semiconductor Industry

Investing.com – Sector ETF Trends

World Economic Forum – Chief Economists Outlook 2025

IMF – Global Economy Enters a New Era

Why Market Cap Isn’t the Whole Story in 2025

It tells you what the market thinks a company is worth—based on share price and outstanding shares—but it ignores debt, cash flow, and profitability. Two companies can have the same market cap and wildly different financial health. That’s why investors look beyond size. Revenue shows how much a company brings in, but margins and cash flow reveal how efficiently it turns that into profit. Revenue keeps you in business, profit helps you grow, and cash flow keeps you running.

In Animal Spirits, Ben Carlson puts it plainly at 07:42 ⏱️: “Some of the most resilient companies aren’t the biggest—they’re the ones with consistent free cash flow and pricing power.” Meanwhile, The Compound and Friends dives into why fundamentals still matter. At 11:28 ⏱️, Michael Batnick says, “You can’t just buy the biggest and expect the best returns.” In short, market cap tells you who’s winning the popularity contest. But if you want to know who’s built to last, follow the cash.

Sources:

Alphanome.AI – Why Market Cap is Misleading

Ramsey Solutions – Cash Flow vs. Profit

Forbes – Why Revenue Alone Isn’t Enough

Investopedia – Cash Flow vs. Profits

FutureTracker – Size vs. Sustainability

How to Invest in the World’s Most Valuable Companies Without Picking Stocks

ETFs and index funds make it easy to invest in the world’s most valuable companies with just a few clicks. Funds like the Vanguard S&P 500 ETF (VOO) or Invesco QQQ Trust (QQQ) offer exposure to top names like Apple, Amazon, and Alphabet—all bundled into one diversified investment. These funds are low-cost, tax-efficient, and ideal for long-term investors who want to keep things simple.

Cap-weighted funds give more weight to the biggest companies, meaning your returns are heavily influenced by a few mega caps. Equal-weighted ETFs, like RSP, spread your investment evenly across all holdings. This reduces concentration risk and can outperform when smaller or mid-cap stocks rally. To balance growth with diversification, consider blending both strategies.

In The Long View, Morningstar’s analysts explain at 12:16 ⏱️, “Equal-weighting forces discipline—it trims winners and buys laggards automatically.” Meanwhile, ETF Prime explores how thematic ETFs are gaining traction. At 09:03 ⏱️, host Nate Geraci notes, “Investors are using themes like AI and clean energy to diversify beyond traditional sectors.”

Sources:

U.S. News – ETFs to Build a Diversified Portfolio

The Motley Fool – Best Long-Term ETFs BillionFire – Understanding SPX Weighting

TheStreet – Equal Weighting vs. Market Cap

Kiplinger – Diversification Guide

Conclusion

The most valuable companies in the world didn’t earn their titles with flash—they built them with scale, staying power, and relentless innovation. But as we’ve seen, market cap is just the surface. It tells us who’s big, not who’s best prepared for what’s next. Whether it’s chips powering AI, healthcare breakthroughs, or digital platforms running the global economy, these giants shape how we live and invest. That said, investors don’t need to chase every name—just understand the forces driving them. Focus on fundamentals, spread your bets, and use simple tools like ETFs to stay in the game without losing sleep. Wealth building isn’t magic—it’s patience wrapped in common sense. Just keep going. That’s the path.

Podcast Transcripts 🎧

1. The Journal by WSJ – How Nvidia Became the Most Valuable Chipmaker

This episode explores Nvidia’s rise from gaming GPUs to AI infrastructure dominance.

“They didn’t just ride the AI wave—they built the surfboard.”

⏱️ 06:58 – Discussion on Nvidia’s early investment in parallel processing and its payoff in the AI boom.

2. Bloomberg’s Odd Lots – Apple’s Services Strategy

This episode breaks down how Apple transitioned from hardware to recurring revenue.

“Apple’s pivot from hardware to recurring revenue is what’s keeping it at the top.”

⏱️ 10:21 – Analysis of Apple’s services growth and its impact on long-term valuation.

3. The Macro Trading Floor – Sector Rotation and Inflation Hedges

A deep dive into how energy and financials are benefiting from macroeconomic shifts.

“We’re seeing a rebalancing—tech leads, but old-economy sectors are quietly catching up.”

⏱️ 08:19 – Insight into capital flows into energy and financials amid inflation concerns.

4. The Tape by Bloomberg – Healthcare as a Defensive Play

This episode highlights how healthcare stocks like Eli Lilly are attracting long-term capital.

“In a volatile world, healthcare is where capital hides with confidence.” ⏱️ 06:44 – Commentary on healthcare’s role in portfolio stability.

5. Animal Spirits – Size Isn’t Everything

Ben Carlson and Michael Batnick explore why smaller companies with strong fundamentals often outperform.

“Some of the most resilient companies aren’t the biggest—they’re the ones with consistent free cash flow and pricing power.”

⏱️ 07:42 – Discussion on the importance of cash flow over market cap.

6. The Compound and Friends – Market Cap vs. Fundamentals

Michael Batnick and Josh Brown explain why market cap can be misleading.

“You can’t just buy the biggest and expect the best returns. Fundamentals still matter.”

⏱️ 11:28 – Breakdown of why revenue, margins, and cash flow are critical.

7. The Long View – Equal Weighting and ETF Discipline

This episode explains how equal-weighted ETFs can outperform by trimming winners and buying laggards.

“Equal-weighting forces discipline—it’s a built-in rebalancing mechanism.”

⏱️ 12:16 – Overview of how equal-weighted strategies manage risk and enhance returns.

8. ETF Prime – Thematic ETF Trends

Nate Geraci discusses how investors are using thematic ETFs to diversify beyond traditional sectors.

“Investors are using themes like AI and clean energy to diversify beyond traditional sectors.”

⏱️ 09:03 – Exploration of how themes are reshaping portfolio construction.

📌Read More About:

Top Large Cap Stocks- https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39168/what-are-large-cap-stocks-a-complete-guide-to-big-companies-in-the-u-s-market

Large Cap Sector Breakdown: How Each Industry Shapes the Market- https://stockbossup.com/pages/post/39242/large-cap-sector-breakdown-how-each-industry-shapes-the-market

Top Companies by Market Cap in 2025: Who’s Leading and Why It Matters- https://stockbossup.com/pages/post/39259/top-companies-by-market-cap-in-2025-who-s-leading-and-why-it-matters

🌐Global & Industrial Picks:

Is Microsoft a Mega-Cap Stock?- https://www.stockbossup.com/pages/post/38850/is-microsoft-considered-a-mega-cap-stock

Is Apple a Mega-Cap?- https://stockbossup.com/pages/post/39186/is-apple-a-mega-cap-stock-understanding-its-market-influence

Is Amazon a Mega-Cap?- https://stockbossup.com/pages/post/39191/is-amazon-a-mega-cap-stock-evaluating-its-market-influence