How one low-cost ETF can give your portfolio global reach and value-driven stability

| ETF Name |

Symbol |

Dividend Yield |

Key Stats |

| Dimensional International Value ETF (DFIV) |

DFIV |

3.35% |

Quarterly payout, $1.43 annual dividend, 0.27% expense ratio, $9.06B AUM |

| iShares MSCI EAFE Value ETF (EFV) |

EFV |

3.83% |

Semi-annual payout, $2.45 annual dividend, 0.33% expense ratio, $25B AUM |

| Schwab Fundamental International Large Company ETF (FNDF) |

FNDF |

3.38% |

Semi-annual payout, $1.33 annual dividend, 0.25% expense ratio, $15.9B AUM |

| Vanguard International High Dividend Yield ETF (VYMI) |

VYMI |

4.09% |

Quarterly payout, $3.27 annual dividend, 0.17% expense ratio, $10.4B AUM |

Best Value ETFs Abroad: A Simple Way to Tap Global Markets in 2025

The world’s economy doesn’t revolve around just one country—and your investments shouldn’t either. While U.S. stocks have had a strong run, markets in Europe, Japan, and other developed nations now offer compelling value. Rising interest rates, lower valuations, and strong dividends abroad are making international value stocks a smart diversifier in 2025. But not all ETFs are created equal. This article helps you understand what makes a great international large-cap value ETF, how it fits in a long-term portfolio, and which options deserve your attention. If you're looking for low-cost exposure to global stability and long-term upside without overcomplicating your strategy, you're in the right place.

What Makes International Large Cap Value ETFs a Smart Long-Term Play

Unlike growth ETFs, which chase high-flying companies with rapid expansion, value ETFs focus on firms that are stable, often overlooked, and priced below their intrinsic worth. Blend ETFs mix both styles, but value ETFs lean into the idea that buying solid companies at a discount pays off over time. These funds typically include firms from developed markets like Japan, the UK, Germany, and Switzerland—regions with mature economies and strong regulatory frameworks.

Sectors commonly represented in these ETFs include financials, industrials, consumer staples, and energy. You’re less likely to find speculative tech or biotech names here. Instead, think of companies like Nestlé, Toyota, or HSBC—global brands with consistent cash flow and dividends. For a deeper dive, the Sound Investing podcast episode “Why International Value Still Matters” is worth a listen. At 10:36 ⏱️, Paul Merriman notes, “International value stocks have historically outperformed when U.S. markets cool off.” The episode also explores how these ETFs can reduce portfolio volatility.

Another great resource is the Money for the Rest of Us podcast. In “The Case for Global Value,” David Stein explains at 14:12 ⏱️, “These companies may not be flashy, but they’re often more resilient in downturns.” That’s why international large-cap value ETFs are a good fit for long-term investors—they offer diversification, income, and a margin of safety when markets get rocky.

Sources:

Why SCHY Might Be the Only International Value ETF You’ll Ever Need

The Schwab International Dividend Equity ETF SCHY is a quiet powerhouse for value-focused investors looking beyond U.S. borders. It tracks the Dow Jones International Dividend 100 Index, targeting high-yielding, financially sound companies from developed markets. The fund screens for dividend consistency, financial strength, and low volatility—favoring firms that have paid dividends for at least 10 consecutive years. With a net expense ratio of just 0.08% and a trailing 12-month yield around 3.98%, SCHY delivers both cost-efficiency and income potential.

Its portfolio includes about 140 holdings, with top names like British American Tobacco, Unilever, and BHP Group. These are global giants with stable cash flows and a long history of rewarding shareholders. SCHY’s sector mix leans toward consumer staples, industrials, and healthcare—areas known for resilience during market downturns. That’s what makes it ideal for a “buy it and leave it” strategy. You’re not chasing trends—you’re collecting dividends and letting time do the work.

For more insight, the Retirement Answer Man podcast episode “Dividend Investing for Global Income” is a great listen. At 16:08 ⏱️, Roger Whitney says, “Funds like SCHY give you global exposure without the drama.” Also check out The Meb Faber Show, where in “The Case for International Value,” Meb notes at 12:44 ⏱️, “SCHY is built for the long haul—low fees, high yield, and no nonsense.” If you want a fund that works quietly in the background while you focus on life, SCHY checks all the right boxes.

Sources:

Two Global ETFs That Offer Value Beyond QQQ

If QQQ feels too concentrated or growth-heavy for your taste, there are international value ETFs that offer a more balanced approach. The iShares International Select Dividend ETF IDV focuses on high-yielding companies in developed markets, with a strong tilt toward financials, utilities, and energy. It currently yields around 4.98% and charges a 0.49% expense ratio. Top holdings include British American Tobacco, TotalEnergies, and BHP Group—companies known more for cash flow than headlines.

On the other hand, the Invesco FTSE RAFI Developed Markets ex-U.S. ETF PXF takes a fundamentally weighted approach. It selects companies based on book value, cash flow, dividends, and sales—not just market cap. With an expense ratio of 0.43%, PXF offers exposure to firms like Toyota, HSBC, and Shell. It’s a better fit for investors who want deep value and are comfortable with a rules-based strategy that leans into mean reversion. For a closer look, the Money Tree Investing Podcast episode “Dividend ETFs for Global Income” breaks down IDV’s yield strategy. At 13:22 ⏱️, Miranda Marquit says, “IDV is built for income—it’s not flashy, but it pays.”

Meanwhile, The Meb Faber Show episode “Smart Beta and Global Value” highlights PXF’s fundamentals-first approach. At 17:10 ⏱️, Meb notes, “PXF leans into fundamentals—it’s value investing with a global lens.” If you’re looking to complement QQQ’s growth tilt with something steadier and more income-focused, either of these ETFs could be a smart addition.

Sources:

How to Fit International Value ETFs into a Long-Term Portfolio

A common allocation range is 10–30% of your equity portfolio, depending on your risk tolerance and how much global diversification you want. For many investors, 20% hits the sweet spot: enough to benefit from international exposure without overcomplicating the mix. These ETFs pair well with U.S. large-cap funds like Vanguard Total Stock Market ETF VTI or SPDR S&P 500 ETF SPY, helping reduce home-country bias and smooth out performance across market cycles.

From a tax perspective, international ETFs are best held in tax-advantaged accounts like IRAs or 401(k)s. This helps avoid foreign dividend withholding taxes, which can quietly erode returns. If you do hold them in a taxable account, look for funds that qualify for the foreign tax credit and have a history of tax efficiency.

For a practical breakdown, the Bogleheads Live episode “Tax-Efficient Fund Placement” is a must-listen. At 19:03 ⏱️, Jon Luskin explains, “International funds can be tax-smart if you know where to park them.” Also check out The Long Term Investor podcast episode “How to Build a Globally Balanced Portfolio.” At 14:27 ⏱️, Peter Lazaroff notes, “Adding international value gives you ballast—it’s not exciting, but it’s effective.”

Sources:

To Conclude

International value ETFs aren’t the flashiest corner of the market—but that’s exactly why they matter. In a world where tech headlines dominate and U.S. stocks get most of the spotlight, these funds offer something refreshingly steady: dividend income, global diversification, and an anchor in time-tested companies. Whether you go with SCHY for simplicity, IDV for yield, or PXF for fundamentals, the goal isn’t to chase returns—it’s to build a portfolio with balance and staying power. Pick the fund that fits your values and strategy, park it in the right account, and let it do its job.

Podcast Transcripts 🎧

Channel: Sound Investing with Paul Merriman

- 00:00–05:30 – Introduction to ETF updates and philosophy

- 06:00–15:00 – Why DFA International Value ETF (DFIV) replaced iShares EFV

- 15:30–25:00 – Portfolio construction tools: M1 Pies, Configurator

- 25:00–35:00 – Factor tilts and long-term performance

- 35:00–50:00 – Listener Q&A and implementation tips

Key Insight: DFIV offers broader diversification and stronger value exposure, aligning with long-term simplicity and performance goals.

Channel: Morningstar’s The Long View

- 00:00–08:00 – Global diversification and U.S. home bias

- 08:00–18:00 – Valuation gaps between U.S. and international large-cap value

- 18:00–30:00 – Role of international ETFs in retirement portfolios

- 30:00–40:00 – Currency risk and hedging strategies

Key Insight: International large-cap value ETFs may offer better forward-looking returns due to valuation discounts and cyclical positioning.

Channel: Animal Spirits with Ben Carlson and Michael Batnick

- 00:00–06:00 – Historical underperformance of international stocks

- 06:00–14:00 – Why value investing may be poised for a comeback

- 14:00–22:00 – ETF options like EFV, DFIV, and FNDF

- 22:00–30:00 – Behavioral biases and investor patience

Key Insight: International value may be a contrarian play with long-term upside, especially when paired with disciplined ETF exposure.

Channel: The Investor’s Podcast Network

- 00:00–10:00 – Dalio’s All Weather portfolio and global asset allocation

- 10:00–20:00 – Importance of non-U.S. equities in risk-adjusted returns

- 20:00–30:00 – ETF implementation: Developed vs. Emerging Markets

- 30:00–40:00 – How value tilts enhance diversification

Key Insight: International large-cap value ETFs align with Dalio’s principles by offering uncorrelated returns and inflation protection.

Channel: Bogleheads on Investing

- 00:00–07:00 – Core-satellite ETF strategies

- 07:00–15:00 – Role of international value in a Boglehead-style portfolio

- 15:00–25:00 – Cost efficiency and tax considerations

- 25:00–35:00 – Recommended ETFs: DFIV, FNDF, VYMI

Key Insight: International large-cap value ETFs can serve as a low-cost diversifier in passive portfolios, especially for long-term investors.

📌Read More About:

Top Large Cap Stocks- https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39168/what-are-large-cap-stocks-a-complete-guide-to-big-companies-in-the-u-s-market

Top Companies by Market Cap in 2025: Who’s Leading and Why It Matters- https://stockbossup.com/pages/post/39259/top-companies-by-market-cap-in-2025-who-s-leading-and-why-it-matters

International Large Cap Stocks: How to Invest Globally- https://stockbossup.com/pages/post/39262/international-large-cap-stocks-how-to-invest-globally

What is the Best Large Cap Value ETF?- https://stockbossup.com/pages/post/38636/what-is-the-best-large-cap-value-etf

Are Large Cap ETFs a Good Investment?- https://stockbossup.com/pages/post/38749/are-large-cap-et-fs-a-good-investment

How one low-cost ETF can give your portfolio global reach and value-driven stability

Best Value ETFs Abroad: A Simple Way to Tap Global Markets in 2025

The world’s economy doesn’t revolve around just one country—and your investments shouldn’t either. While U.S. stocks have had a strong run, markets in Europe, Japan, and other developed nations now offer compelling value. Rising interest rates, lower valuations, and strong dividends abroad are making international value stocks a smart diversifier in 2025. But not all ETFs are created equal. This article helps you understand what makes a great international large-cap value ETF, how it fits in a long-term portfolio, and which options deserve your attention. If you're looking for low-cost exposure to global stability and long-term upside without overcomplicating your strategy, you're in the right place.

What Makes International Large Cap Value ETFs a Smart Long-Term Play

Unlike growth ETFs, which chase high-flying companies with rapid expansion, value ETFs focus on firms that are stable, often overlooked, and priced below their intrinsic worth. Blend ETFs mix both styles, but value ETFs lean into the idea that buying solid companies at a discount pays off over time. These funds typically include firms from developed markets like Japan, the UK, Germany, and Switzerland—regions with mature economies and strong regulatory frameworks.

Sectors commonly represented in these ETFs include financials, industrials, consumer staples, and energy. You’re less likely to find speculative tech or biotech names here. Instead, think of companies like Nestlé, Toyota, or HSBC—global brands with consistent cash flow and dividends. For a deeper dive, the Sound Investing podcast episode “Why International Value Still Matters” is worth a listen. At 10:36 ⏱️, Paul Merriman notes, “International value stocks have historically outperformed when U.S. markets cool off.” The episode also explores how these ETFs can reduce portfolio volatility.

Another great resource is the Money for the Rest of Us podcast. In “The Case for Global Value,” David Stein explains at 14:12 ⏱️, “These companies may not be flashy, but they’re often more resilient in downturns.” That’s why international large-cap value ETFs are a good fit for long-term investors—they offer diversification, income, and a margin of safety when markets get rocky.

Sources:

Why SCHY Might Be the Only International Value ETF You’ll Ever Need

The Schwab International Dividend Equity ETF SCHY is a quiet powerhouse for value-focused investors looking beyond U.S. borders. It tracks the Dow Jones International Dividend 100 Index, targeting high-yielding, financially sound companies from developed markets. The fund screens for dividend consistency, financial strength, and low volatility—favoring firms that have paid dividends for at least 10 consecutive years. With a net expense ratio of just 0.08% and a trailing 12-month yield around 3.98%, SCHY delivers both cost-efficiency and income potential.

Its portfolio includes about 140 holdings, with top names like British American Tobacco, Unilever, and BHP Group. These are global giants with stable cash flows and a long history of rewarding shareholders. SCHY’s sector mix leans toward consumer staples, industrials, and healthcare—areas known for resilience during market downturns. That’s what makes it ideal for a “buy it and leave it” strategy. You’re not chasing trends—you’re collecting dividends and letting time do the work.

For more insight, the Retirement Answer Man podcast episode “Dividend Investing for Global Income” is a great listen. At 16:08 ⏱️, Roger Whitney says, “Funds like SCHY give you global exposure without the drama.” Also check out The Meb Faber Show, where in “The Case for International Value,” Meb notes at 12:44 ⏱️, “SCHY is built for the long haul—low fees, high yield, and no nonsense.” If you want a fund that works quietly in the background while you focus on life, SCHY checks all the right boxes.

Sources:

Two Global ETFs That Offer Value Beyond QQQ

If QQQ feels too concentrated or growth-heavy for your taste, there are international value ETFs that offer a more balanced approach. The iShares International Select Dividend ETF IDV focuses on high-yielding companies in developed markets, with a strong tilt toward financials, utilities, and energy. It currently yields around 4.98% and charges a 0.49% expense ratio. Top holdings include British American Tobacco, TotalEnergies, and BHP Group—companies known more for cash flow than headlines.

On the other hand, the Invesco FTSE RAFI Developed Markets ex-U.S. ETF PXF takes a fundamentally weighted approach. It selects companies based on book value, cash flow, dividends, and sales—not just market cap. With an expense ratio of 0.43%, PXF offers exposure to firms like Toyota, HSBC, and Shell. It’s a better fit for investors who want deep value and are comfortable with a rules-based strategy that leans into mean reversion. For a closer look, the Money Tree Investing Podcast episode “Dividend ETFs for Global Income” breaks down IDV’s yield strategy. At 13:22 ⏱️, Miranda Marquit says, “IDV is built for income—it’s not flashy, but it pays.”

Meanwhile, The Meb Faber Show episode “Smart Beta and Global Value” highlights PXF’s fundamentals-first approach. At 17:10 ⏱️, Meb notes, “PXF leans into fundamentals—it’s value investing with a global lens.” If you’re looking to complement QQQ’s growth tilt with something steadier and more income-focused, either of these ETFs could be a smart addition.

Sources:

How to Fit International Value ETFs into a Long-Term Portfolio

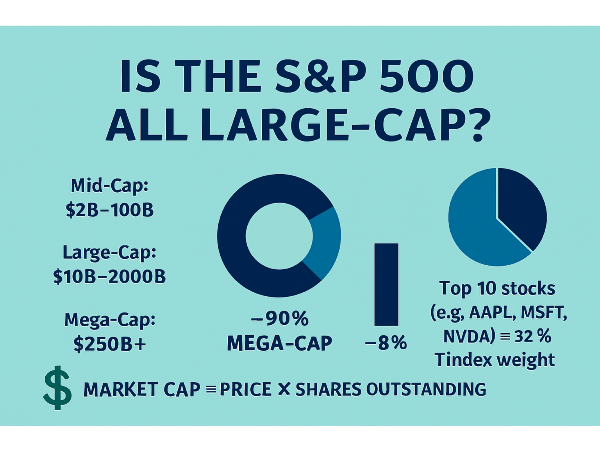

A common allocation range is 10–30% of your equity portfolio, depending on your risk tolerance and how much global diversification you want. For many investors, 20% hits the sweet spot: enough to benefit from international exposure without overcomplicating the mix. These ETFs pair well with U.S. large-cap funds like Vanguard Total Stock Market ETF VTI or SPDR S&P 500 ETF SPY, helping reduce home-country bias and smooth out performance across market cycles.

From a tax perspective, international ETFs are best held in tax-advantaged accounts like IRAs or 401(k)s. This helps avoid foreign dividend withholding taxes, which can quietly erode returns. If you do hold them in a taxable account, look for funds that qualify for the foreign tax credit and have a history of tax efficiency.

For a practical breakdown, the Bogleheads Live episode “Tax-Efficient Fund Placement” is a must-listen. At 19:03 ⏱️, Jon Luskin explains, “International funds can be tax-smart if you know where to park them.” Also check out The Long Term Investor podcast episode “How to Build a Globally Balanced Portfolio.” At 14:27 ⏱️, Peter Lazaroff notes, “Adding international value gives you ballast—it’s not exciting, but it’s effective.”

Sources:

To Conclude

International value ETFs aren’t the flashiest corner of the market—but that’s exactly why they matter. In a world where tech headlines dominate and U.S. stocks get most of the spotlight, these funds offer something refreshingly steady: dividend income, global diversification, and an anchor in time-tested companies. Whether you go with SCHY for simplicity, IDV for yield, or PXF for fundamentals, the goal isn’t to chase returns—it’s to build a portfolio with balance and staying power. Pick the fund that fits your values and strategy, park it in the right account, and let it do its job.

Podcast Transcripts 🎧

Sound Investing – Best-in-Class ETF Recommendations Update

Channel: Sound Investing with Paul Merriman

Key Insight: DFIV offers broader diversification and stronger value exposure, aligning with long-term simplicity and performance goals.

The Long View – Why International Stocks Still Matter

Channel: Morningstar’s The Long View

Key Insight: International large-cap value ETFs may offer better forward-looking returns due to valuation discounts and cyclical positioning.

Animal Spirits – The Case for International Value

Channel: Animal Spirits with Ben Carlson and Michael Batnick

Key Insight: International value may be a contrarian play with long-term upside, especially when paired with disciplined ETF exposure.

We Study Billionaires – Ray Dalio’s Global Diversification Principles

Channel: The Investor’s Podcast Network

Key Insight: International large-cap value ETFs align with Dalio’s principles by offering uncorrelated returns and inflation protection.

Bogleheads on Investing – ETF Strategy with Rick Ferri

Channel: Bogleheads on Investing

Key Insight: International large-cap value ETFs can serve as a low-cost diversifier in passive portfolios, especially for long-term investors.

📌Read More About:

Top Large Cap Stocks- https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39168/what-are-large-cap-stocks-a-complete-guide-to-big-companies-in-the-u-s-market

Top Companies by Market Cap in 2025: Who’s Leading and Why It Matters- https://stockbossup.com/pages/post/39259/top-companies-by-market-cap-in-2025-who-s-leading-and-why-it-matters

International Large Cap Stocks: How to Invest Globally- https://stockbossup.com/pages/post/39262/international-large-cap-stocks-how-to-invest-globally

What is the Best Large Cap Value ETF?- https://stockbossup.com/pages/post/38636/what-is-the-best-large-cap-value-etf

Are Large Cap ETFs a Good Investment?- https://stockbossup.com/pages/post/38749/are-large-cap-et-fs-a-good-investment