Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

Image by Alfonso Charles from Pixabay

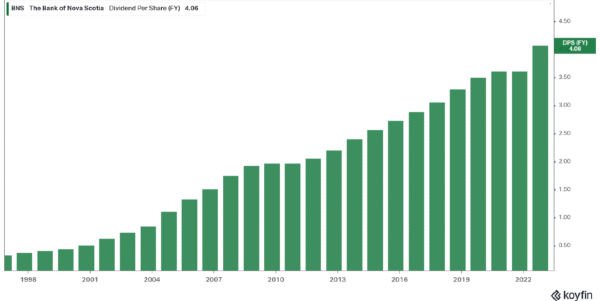

The beginning of every month is exciting for all dividend income investors as we look back at the previous month and see how much passive dividend income our portfolios generated. No doubt, these are the best posts to write and read online as it only provides further proof that dividend investing can work over time and that anyone can create an ever growing passive income stream. Looking back at my December totals I see that my year over year progress is moving at a nice clip. With that being said, let’s take a look back at my December 2022 dividend income.

Grand total for [2022] dividends: $14,496.97. You just have to love the very real results of dividend growth investing even if we experience some harsh dividend cuts and suspensions.

I hope everyone had a great 2022 with a renewed sense of what can be accomplished with patience, not panicking, common sense and general investing consistency and discipline as we were all put through the test last year. These traits enable consistent dividend income results you see above as well as the knowledge that with high, moderate or even low income levels from active work, passive income growth can still be achieved. Are any of these dividend stocks in your portfolio too? How was your December dividend income? Please let me know below.

Disclosure: Long all above

Related Posts:

Originally Posted in Dividend Investing Blog