Utility stocks are often associated with long histories of paying dividends to shareholders. Their relatively predictable earnings and recession resistance combine to make increasing dividends somewhat easier over the long term than a business that is highly cyclical.

However, not all utility stocks are created equal in this sense.

There are six utility stocks on the prestigious list of Dividend Kings, a group of stocks with at least 50 consecutive years of dividend increases. You can see all 45 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Click here to instantly download your free spreadsheet of all Dividend Kings now, along with important investing metrics.

Northwest Natural Holdings (NWN) is among the six utility stocks on the list of Dividend Kings.

It has increased its dividend for 66 consecutive years, giving it one of the longest streaks anywhere in the market.

Below, we’ll assess Northwest’s business, growth prospects, and whether to buy, sell, or hold.

Business Overview

Northwest was founded more than 160 years ago as a natural gas utility in Portland, Oregon.

It has grown from a very small, local utility that provided gas service to a handful of customers to a very successful regional utility with interests that now include water and wastewater, which were purchased in recent acquisitions.

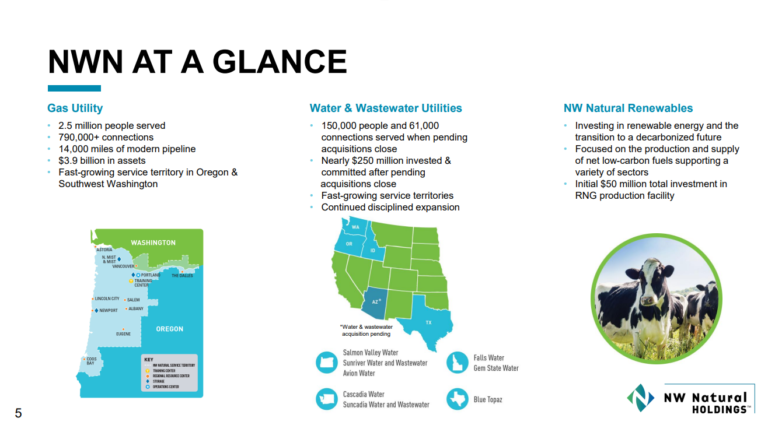

The company’s locations served are shown in the image below.

Northwest provides gas service to 2.5 million customers in ~140 communities in Oregon and Washington, serving more than 785,000 connections. It also owns and operates ~35 billion cubic feet of underground gas storage capacity.

Finally, its fairly recent move into water has grown to over 33,000 connections serving more than 80,000 people. Once the company’s pending acquisitions close, the company’s water connections will grow to 60,000 connections, ready to serve roughly 145,000 people.

Northwest reported Q2 results on Aug. 4th, 2022. Revenue grew by 30.9% year–over–year to about $145 million. Net income grew $0.05 per share compared to a loss of $0.02 in the prior-year period as well.

The company also reported that it added 10,159 natural gas meters over the past 12 months, equating to a 1.3% growth rate.

Northwest also invested, in the first six months of 2022, nearly $170 million in their utility systems for greater reliability and resiliency.

Meanwhile, the management team reaffirmed its guidance for 2022, with earnings–per–share expected to come in at between $2.45 and $2.65.

Next, we’ll assess Northwest’s future growth prospects.

Growth Prospects

Northwest has had a difficult time growing earnings-per-share in the past decade, despite the fact that the company managed to acquire customers fairly steadily during that time frame.

The company has struggled with rate cases in some of its localities, although it experienced more recent success in Oregon with raising prices. Since Northwest is a regulated utility, it must ask for pricing increases from local authorities.

Northwest’s customer growth has been quite strong over the past decade. It has a combination of conversions and new construction, both of which have helped move the needle over time by low-single digits.

We believe the demographics of Northwest’s served communities support continued customer growth, so this should be a tailwind for revenue and earnings.

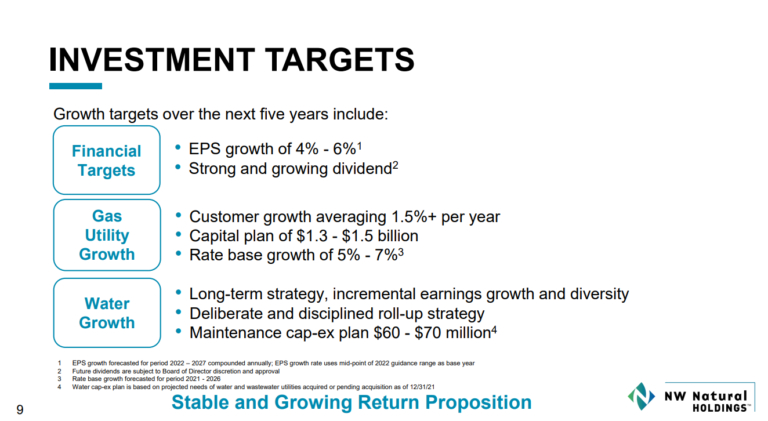

Below, Northwest has laid out what it sees as growth targets for the next five years.

The company believes it can grow earnings-per-share at 4% to 6% annually while increasing its dividend.

It plans to get there by growing its customer count by at least 1.5% annually — which is consistent with historical performance — as well as rate base growth of 5% to 7%.

We believe customer growth will be steady, but Northwest’s history on rate cases has us a bit more cautious on rate growth.

Accordingly, we assess long-term growth potential at 1.9% annually for Northwest in the coming years.

Competitive Advantages & Recession Performance

Northwest’s competitive advantage is much like any other utility; it has a virtual monopoly in its service area.

The utility business model is vastly different from just about any other type of business as it requires regulatory approval for things like CAPEX and pricing increases.

In return, the company generates a highly predictable and consistent stream of profits from year to year, even during recessions. Approximately 88% of the company’s net income last year was derived from the natural gas utility business.

Additionally, almost two-thirds of Northwest’s customers are residential. We believe that Northwest’s fairly heavy concentration on residential customers will continue to serve it well during any future recessions.

Below, we have Northwest’s earning-per-share before, during, and after the Great Recession:

- 2007 earnings-per-share: $1.44

- 2008 earnings-per-share: $1.52 (5.6% increase)

- 2009 earnings-per-share: $1.60 (5.3% decrease)

- 2010 earnings-per-share: $1.68 (5.0% increase)

Northwest was able to not only maintain its earnings during a deep and long recession, but it produced at least 5% earnings-per-share growth each year before, during, and following the Great Recession.

The company performed nicely in 2020 during the coronavirus pandemic as well. The move by employers to allow people to work from home created a situation where residential customers consume more water and natural gas at home.

That’s an extremely impressive track record, and for a dividend stock, nothing could be more attractive. Performance like this is why Northwest has been able to produce dividend increases for 66 consecutive years.

The one note of caution on the dividend is that years of lackluster earnings-per-share growth has led to a situation where the dividend payout ratio is rising. Indeed, the payout ratio is now in excess of 75% of earnings.

While utilities can afford to distribute a high level of profits in the form of dividends, given their predictable earnings base, investors should note that increases are likely to be small. The most recent increase was just 0.5%, illustrating this point.

We believe the current dividend is safe for the foreseeable future, but we note that dividend growth will likely be difficult to achieve.

Valuation & Expected Returns

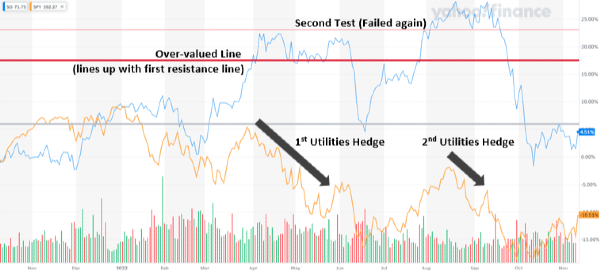

Northwest stock has declined significantly from its 52-week high, bringing the stock back to an appealing valuation and dividend yield.

At today’s price, Northwest trades for 18 times this year’s earnings, which is below our fair value estimate of 20 times earnings. We, therefore, expect a 2.2% annual boost to total returns from the rising P/E multiple.

The current dividend yield is 4.3%, which is very high by Northwest’s own historical standards. Combining it with the valuation and expected EPS growth, we forecast total annual returns of 7.7% moving forward.

A mid-to-high single-digit total return potential earns Northwest a hold rating.

Final Thoughts

While Northwest has some challenges to face, we believe its strategic direction of focusing on building out its residential business will lead to positive growth. Steady customer growth is attractive and should help at least buoy earnings at current levels, if not produce a small amount of EPS growth each year.

With the share price decline in the past year, Northwest offers an improved value proposition. With total returns projected roughly at 7.7% annually, Northwest can be proven a fruitful investment for conservative income-oriented investors.

Image by David Mark from Pixabay

Utility stocks are often associated with long histories of paying dividends to shareholders. Their relatively predictable earnings and recession resistance combine to make increasing dividends somewhat easier over the long term than a business that is highly cyclical.

However, not all utility stocks are created equal in this sense.

There are six utility stocks on the prestigious list of Dividend Kings, a group of stocks with at least 50 consecutive years of dividend increases. You can see all 45 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Click here to instantly download your free spreadsheet of all Dividend Kings now, along with important investing metrics.

Northwest Natural Holdings (NWN) is among the six utility stocks on the list of Dividend Kings.

It has increased its dividend for 66 consecutive years, giving it one of the longest streaks anywhere in the market.

Below, we’ll assess Northwest’s business, growth prospects, and whether to buy, sell, or hold.

Business Overview

Northwest was founded more than 160 years ago as a natural gas utility in Portland, Oregon.

It has grown from a very small, local utility that provided gas service to a handful of customers to a very successful regional utility with interests that now include water and wastewater, which were purchased in recent acquisitions.

The company’s locations served are shown in the image below.

Source: Investor Presentation

Northwest provides gas service to 2.5 million customers in ~140 communities in Oregon and Washington, serving more than 785,000 connections. It also owns and operates ~35 billion cubic feet of underground gas storage capacity.

Finally, its fairly recent move into water has grown to over 33,000 connections serving more than 80,000 people. Once the company’s pending acquisitions close, the company’s water connections will grow to 60,000 connections, ready to serve roughly 145,000 people.

Northwest reported Q2 results on Aug. 4th, 2022. Revenue grew by 30.9% year–over–year to about $145 million. Net income grew $0.05 per share compared to a loss of $0.02 in the prior-year period as well.

The company also reported that it added 10,159 natural gas meters over the past 12 months, equating to a 1.3% growth rate.

Northwest also invested, in the first six months of 2022, nearly $170 million in their utility systems for greater reliability and resiliency.

Meanwhile, the management team reaffirmed its guidance for 2022, with earnings–per–share expected to come in at between $2.45 and $2.65.

Next, we’ll assess Northwest’s future growth prospects.

Growth Prospects

Northwest has had a difficult time growing earnings-per-share in the past decade, despite the fact that the company managed to acquire customers fairly steadily during that time frame.

The company has struggled with rate cases in some of its localities, although it experienced more recent success in Oregon with raising prices. Since Northwest is a regulated utility, it must ask for pricing increases from local authorities.

Northwest’s customer growth has been quite strong over the past decade. It has a combination of conversions and new construction, both of which have helped move the needle over time by low-single digits.

We believe the demographics of Northwest’s served communities support continued customer growth, so this should be a tailwind for revenue and earnings.

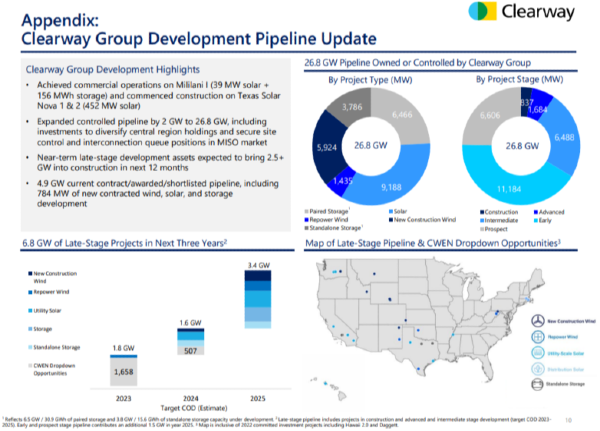

Below, Northwest has laid out what it sees as growth targets for the next five years.

Source: Investor Presentation

The company believes it can grow earnings-per-share at 4% to 6% annually while increasing its dividend.

It plans to get there by growing its customer count by at least 1.5% annually — which is consistent with historical performance — as well as rate base growth of 5% to 7%.

We believe customer growth will be steady, but Northwest’s history on rate cases has us a bit more cautious on rate growth.

Accordingly, we assess long-term growth potential at 1.9% annually for Northwest in the coming years.

Competitive Advantages & Recession Performance

Northwest’s competitive advantage is much like any other utility; it has a virtual monopoly in its service area.

The utility business model is vastly different from just about any other type of business as it requires regulatory approval for things like CAPEX and pricing increases.

In return, the company generates a highly predictable and consistent stream of profits from year to year, even during recessions. Approximately 88% of the company’s net income last year was derived from the natural gas utility business.

Additionally, almost two-thirds of Northwest’s customers are residential. We believe that Northwest’s fairly heavy concentration on residential customers will continue to serve it well during any future recessions.

Below, we have Northwest’s earning-per-share before, during, and after the Great Recession:

Northwest was able to not only maintain its earnings during a deep and long recession, but it produced at least 5% earnings-per-share growth each year before, during, and following the Great Recession.

The company performed nicely in 2020 during the coronavirus pandemic as well. The move by employers to allow people to work from home created a situation where residential customers consume more water and natural gas at home.

That’s an extremely impressive track record, and for a dividend stock, nothing could be more attractive. Performance like this is why Northwest has been able to produce dividend increases for 66 consecutive years.

The one note of caution on the dividend is that years of lackluster earnings-per-share growth has led to a situation where the dividend payout ratio is rising. Indeed, the payout ratio is now in excess of 75% of earnings.

While utilities can afford to distribute a high level of profits in the form of dividends, given their predictable earnings base, investors should note that increases are likely to be small. The most recent increase was just 0.5%, illustrating this point.

We believe the current dividend is safe for the foreseeable future, but we note that dividend growth will likely be difficult to achieve.

Valuation & Expected Returns

Northwest stock has declined significantly from its 52-week high, bringing the stock back to an appealing valuation and dividend yield.

At today’s price, Northwest trades for 18 times this year’s earnings, which is below our fair value estimate of 20 times earnings. We, therefore, expect a 2.2% annual boost to total returns from the rising P/E multiple.

The current dividend yield is 4.3%, which is very high by Northwest’s own historical standards. Combining it with the valuation and expected EPS growth, we forecast total annual returns of 7.7% moving forward.

A mid-to-high single-digit total return potential earns Northwest a hold rating.

Final Thoughts

While Northwest has some challenges to face, we believe its strategic direction of focusing on building out its residential business will lead to positive growth. Steady customer growth is attractive and should help at least buoy earnings at current levels, if not produce a small amount of EPS growth each year.

With the share price decline in the past year, Northwest offers an improved value proposition. With total returns projected roughly at 7.7% annually, Northwest can be proven a fruitful investment for conservative income-oriented investors.