Is Constellation Energy a Good Stock to Buy?

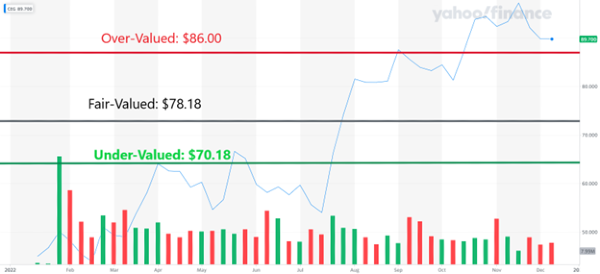

I’m giving a sell rating for Constellation Energy. At today’s price of $88.20, the utility stock looks to be 11% overvalued from its estimated intrinsic value of $78.18. The key concerns are:

- As a new spin-off business, Constellation Energy looks to be trying to find its footing as an independent public company heavily focused on Nuclear Energy

- With its aging fleet of Nuclear Power Plants, the amortization of its assets looks to be in line with the looming need to maintain the facilities or build new ones. The amortization helps to give a fair picture of the company’s assets. A new nuclear plant hasn’t been built in 30+ years.

- Gross margin is very sensitive to energy prices. The company is using hedges to minimize the risk to their gross margin.

Constellation valuation estimates are:

- CEG Over-Valued at $86.00

- CEG Fair-Value Estimate: $78.18

- CEG Under-Valued at $70.37

Constellation Energy Corp. (CEG) Price Forecast

- 2024 Price Forecast: $95.00

- 2026 Price Forecast: $116.31

Constellation Energy can have solid price growth if they can workout problems with its business. Constellation Energy recently spun off of Exelon Corporation with a focus on Nuclear Power Generation. If Constellation can overcome issues with its margins and aging fleet of power generation, Constellation cold increase in price for the next five years.

What is CEG’s Valuation?

As of Q4 2022, Constellation Energy has the following key metrics:

- Earnings Per Share: $2.15

- Book Value per Share: $33.03

- Earnings Growth (YoY): Volatile

Our valuation analysis didn’t have decades of earnings growth to assess, and recent quarterly earnings have even been losses. Growth has not occurred in its earnings in the last few years, but there isn’t enough data to really see a trend. Rather, we deep dived into their investor presentations to understand what is driving their operations margins. These margins have recently been negative and understanding how these margins will be fixed shows how earnings growth may continue in the future.

EBITDA vs. Earnings per share

Earnings Before Interest Depreciation and Amortization (EBITDA) helps to give clear picture of the company’s operational earnings. This non-GAAP metric is preferred by the executive team over EPS on its most recent investor deck.

EBITDA is preferred over EPS by CEG – but why?

We can only theorize (or they may have said why on the call), but it seems that depreciation of its power plants and the volatility of its cost of revenue (COGs) are forcing the company to choose EBITDA to keep a focus on something they need to control.

Book Value per Share

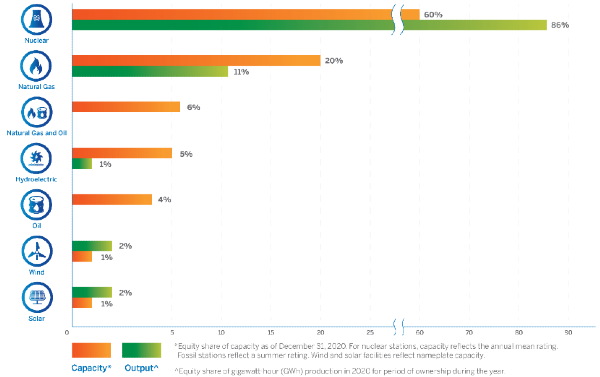

Constellation has a diversified portfolio of power sources, but one source that really stands out is its fleet of Nuclear Power plants.

There is a risk that nuclear power plants may only last 40 years (source: iaea.org, while regulatory sources indicate that Nuclear power plants are looking to license their plants for 80 years (source: energy.gov. These are two widely different possibilities that change how fast depreciation is added to the balance sheet.

And regardless of timeline, a new nuclear power plant hasn’t been commissioned in more than 30 years, with the next power plant potentially being commissioned by Southern Company in 2023.

What’s worrying is that the true timescale is really not known, and the depreciation schedule currently used by CEG’s accountants is too optimistic.

And CEG is highly exposed to nuclear power generation. Constellation Energy runs 23 of the United State’s 177 nuclear power plants.

Due to these risks, we lowered the actual BVPS by 2% when doing our analysis to account for Constellation’s aging nuclear power fleet.

Earnings per Share

There is significant “fog of war” when you start to deep dive into Constellation Energy’s earnings. When Constellation Energy was spun off, one of the reasons noted was that:

“…[Exelon] determined last year that the more predictable utilities side of its business contrasted with the market-based power side…” – naturalgasintel.com

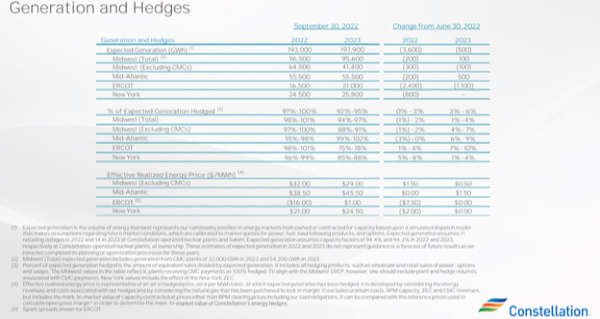

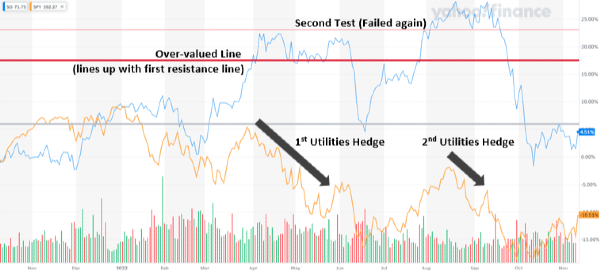

While Exelon’s transmission and distribution business can pass the costs of energy materials (oil, gas, uranium) to its customers, the power plant ultimately does not have the same option. Constellation Energy looks to be using hedging financial instruments to minimize the risks to its cash flow. Financial hedges have been used by power generators for decades now [ 1]. As you can see in the slide below, Constellation Energy uses hedges to try and stabilize its margins:

Hedging is not a new practice for utilities; however, Constellation Energy is much more focused on power generation after its spin-off. This means that it has more volatility with its margins. The good news is that the company can focus on this issue, which it looks to be doing per its investor presentation.

As such, we reduced our EPS growth projections by 3% to cover these risks. Based on previous years, the company has a median EPS growth rate of 19.44%; however, that data comes from only a few data points which have swung wildly the last few years.

Final Thoughts

Constellation Energy is currently assessed as a “sell”. The company has a variety of risks that its spin-off has really put into focus. This is good as it allows the executive team to focus on these issues. Regardless of its current valuation, Constellation Energy does not look to be a good investment for income investors. Besides an abysmal dividend rate of 0.63%, the company seems to really need to build a growth plan not just for revenue but for its operating margins.

Constellation Energy looks like a future dividend growth opportunity if its executive team can turn around its margins and build a capital project plan for growth.

References

1). Financial Hedges for United States Gas-Fired Power Generation Facilities

I/we have no positions in any asset mentioned, and no plans to initiate any positions for the next 7 days

Image by Markus Distelrath from Pixabay

Is Constellation Energy a Good Stock to Buy?

I’m giving a sell rating for Constellation Energy. At today’s price of $88.20, the utility stock looks to be 11% overvalued from its estimated intrinsic value of $78.18. The key concerns are:

Source https://yhoo.it/3uXemWL

Constellation Energy Corp. (CEG) Price Forecast

Constellation Energy can have solid price growth if they can workout problems with its business. Constellation Energy recently spun off of Exelon Corporation with a focus on Nuclear Power Generation. If Constellation can overcome issues with its margins and aging fleet of power generation, Constellation cold increase in price for the next five years.

What is CEG’s Valuation?

As of Q4 2022, Constellation Energy has the following key metrics:

Our valuation analysis didn’t have decades of earnings growth to assess, and recent quarterly earnings have even been losses. Growth has not occurred in its earnings in the last few years, but there isn’t enough data to really see a trend. Rather, we deep dived into their investor presentations to understand what is driving their operations margins. These margins have recently been negative and understanding how these margins will be fixed shows how earnings growth may continue in the future.

EBITDA vs. Earnings per share

Earnings Before Interest Depreciation and Amortization (EBITDA) helps to give clear picture of the company’s operational earnings. This non-GAAP metric is preferred by the executive team over EPS on its most recent investor deck.

We can only theorize (or they may have said why on the call), but it seems that depreciation of its power plants and the volatility of its cost of revenue (COGs) are forcing the company to choose EBITDA to keep a focus on something they need to control.

Book Value per Share

Constellation has a diversified portfolio of power sources, but one source that really stands out is its fleet of Nuclear Power plants.

Source: Constellation Energy website

There is a risk that nuclear power plants may only last 40 years (source: iaea.org, while regulatory sources indicate that Nuclear power plants are looking to license their plants for 80 years (source: energy.gov. These are two widely different possibilities that change how fast depreciation is added to the balance sheet. And regardless of timeline, a new nuclear power plant hasn’t been commissioned in more than 30 years, with the next power plant potentially being commissioned by Southern Company in 2023. What’s worrying is that the true timescale is really not known, and the depreciation schedule currently used by CEG’s accountants is too optimistic.

And CEG is highly exposed to nuclear power generation. Constellation Energy runs 23 of the United State’s 177 nuclear power plants. Due to these risks, we lowered the actual BVPS by 2% when doing our analysis to account for Constellation’s aging nuclear power fleet.

Earnings per Share

There is significant “fog of war” when you start to deep dive into Constellation Energy’s earnings. When Constellation Energy was spun off, one of the reasons noted was that:

While Exelon’s transmission and distribution business can pass the costs of energy materials (oil, gas, uranium) to its customers, the power plant ultimately does not have the same option. Constellation Energy looks to be using hedging financial instruments to minimize the risks to its cash flow. Financial hedges have been used by power generators for decades now [ 1]. As you can see in the slide below, Constellation Energy uses hedges to try and stabilize its margins:

Source: Constellation Energy Investor Presentation

Hedging is not a new practice for utilities; however, Constellation Energy is much more focused on power generation after its spin-off. This means that it has more volatility with its margins. The good news is that the company can focus on this issue, which it looks to be doing per its investor presentation. As such, we reduced our EPS growth projections by 3% to cover these risks. Based on previous years, the company has a median EPS growth rate of 19.44%; however, that data comes from only a few data points which have swung wildly the last few years.

Final Thoughts

Constellation Energy is currently assessed as a “sell”. The company has a variety of risks that its spin-off has really put into focus. This is good as it allows the executive team to focus on these issues. Regardless of its current valuation, Constellation Energy does not look to be a good investment for income investors. Besides an abysmal dividend rate of 0.63%, the company seems to really need to build a growth plan not just for revenue but for its operating margins.

Constellation Energy looks like a future dividend growth opportunity if its executive team can turn around its margins and build a capital project plan for growth.

References

1). Financial Hedges for United States Gas-Fired Power Generation Facilities

I/we have no positions in any asset mentioned, and no plans to initiate any positions for the next 7 days