Summary:

- With a well-balanced mix of industrial, residential, and commercial users, Entergy provides service to a wide range of customers.

- The business is set up to increase EPS at a 5-7% rate over the following three years. Which could result in a total return of 9% to 11%.

- Because of its strong emphasis on renewable energy, Entergy may eventually win over the ESG crowd and the enormous sums of money they control.

- The company is significantly more leveraged than its competitors, which could put it at high risk.

- The stock currently seems moderately undervalued, so that it may be worthy of inclusion in your portfolio.

- Looking for some help in the marketplace? Members of Energy Profits in Dividends receive special tips and advice for surviving any weather.

Customers in Texas, Louisiana, Mississippi, Arkansas, and other states are served by Entergy Corporation (NYSE: ETR). Due to the stability of these businesses and the fact that they typically produce annual earnings growth. The utility sector has long been a favorite among conservative investors. However, the company's earnings per share decreased year over year. This is generally reflected in Entergy's first-quarter 2022 earnings. The decline in revenues might not be as severe of an issue as initially believed.

Overall, Entergy has many positive aspects, including its potential for growth and its attractive current yield of 3.45%, which is expected to rise over time. Additionally, the company has an incredibly attractive valuation, increasing its allure. Those looking to diversify their portfolio with a utility should give this company some thought.

Read More: Top Electrical Stocks, Top Utility Stocks, How to assess utility stocks, How to screen for utility stocks

Who is the parent company of Entergy?

Middle South Utilities Inc. (MSU) is established as a holding company for AP&L, LP&L, MP&L, and NOPSI, with its corporate headquarters in New York. On May 31, 1949 the common stock of the company will start trading on the New York Stock Exchange. The company, which serves more than 625,000 customers in more than 1,600 communities in Arkansas, Louisiana, and Mississippi, names Edgar Dixon as its first chief executive.

Read More: Nvidia Stock Price & Forecast

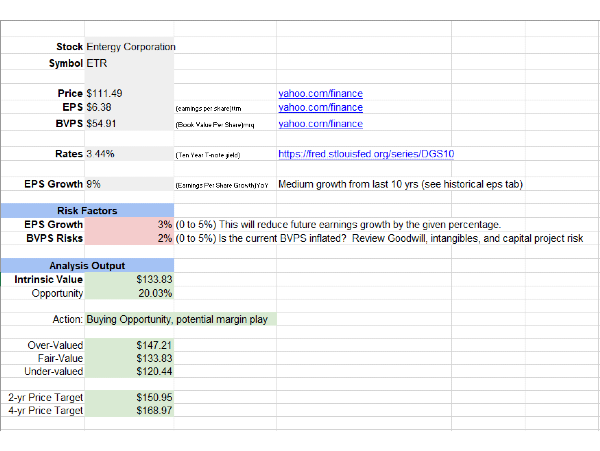

Entergy Corporation (ETR) Price Forecast

- 2024 Price Forecast: $150.95

- 2026 Price Forecast: $168.97

Earnings per share guidance

Entergy's adjusted EPS guidance for 2022 has been reduced from $6.25 to $6.45. Regarding the non-GAAP measure of Entergy adjusted EPS, the company has provided 2022 earnings guidance. The effect of adjustments, as described under "Non-GAAP financial measures" below, is not included in this measure's comparison to the corresponding GAAP financial measure.

Because the company cannot predict and quantify with a reasonable degree of confidence. All the adjustments that may take place during the period it has not provided a reconciliation of such non-GAAP guidance to guidance presented on a GAAP basis. EWC earnings are excluded from Entergy's adjusted EPS as one adjustment. According to our current projections, EWC will contribute roughly 25 cents to Entergy's as-reported EPS in 2022.

Facts About Entergy

Valuation

Never pay more than necessary for any asset in your portfolios. This is because paying too much for any help will almost always result in a return that is below average. The price-to-earnings growth ratio is one metric we can use to value a utility like Entergy Corporation. This is a modified version of the well-known price-to-earnings balance that considers the company's growth in earnings per share.

A stock may be undervalued in its expected growth in earnings per share if the price-to-earnings growth ratio is less than 1.0, and vice versa. The best way to use it is to compare the company's valuation to that of its competitors to identify which stock has the most attractive relative price since very few stores have a ratio that low.

Over the next three to five years, Entergy Corporation will increase its earnings per share by 6.07%. This is a pretty accurate estimate since it aligns with the number we previously used to calculate the potential total return. This current price results in a price-to-earnings-growth ratio for the stock of 3.05. This is how it compares to some of the competitors of the business:

Company PEG Ratio

Clearly, Entergy is trading at a significantly lower valuation than its competitors. As a result, the company is currently undervalued. This might be due to the company's significant debt load, making it more vulnerable to risks than these other companies. However, the stock might present a chance in this situation, especially for a buyer ready to assume a little bit more risk.

Conclusion

Finally, Entergy has a lot to offer prospective investors. However, its relatively high debt load does make it slightly riskier than many of its peers. The company's high yield and appealing valuation make it an excellent pick in the utility space. Given its location in the Deep South, the company's strong commitment to deploying renewable energy may come as a surprise. But it may also win over the managers of the numerous wealthy environmental, social, and government funds that have grown to be a significant force in the market over the past few years. Overall, it would be best to consider including this company in your portfolio.

Read More:

5 Gym Stocks to Check Out, AMC Stock Forecast

Summary:

Customers in Texas, Louisiana, Mississippi, Arkansas, and other states are served by Entergy Corporation (NYSE: ETR). Due to the stability of these businesses and the fact that they typically produce annual earnings growth. The utility sector has long been a favorite among conservative investors. However, the company's earnings per share decreased year over year. This is generally reflected in Entergy's first-quarter 2022 earnings. The decline in revenues might not be as severe of an issue as initially believed.

Overall, Entergy has many positive aspects, including its potential for growth and its attractive current yield of 3.45%, which is expected to rise over time. Additionally, the company has an incredibly attractive valuation, increasing its allure. Those looking to diversify their portfolio with a utility should give this company some thought.

Read More: Top Electrical Stocks, Top Utility Stocks, How to assess utility stocks, How to screen for utility stocks

Who is the parent company of Entergy?

Middle South Utilities Inc. (MSU) is established as a holding company for AP&L, LP&L, MP&L, and NOPSI, with its corporate headquarters in New York. On May 31, 1949 the common stock of the company will start trading on the New York Stock Exchange. The company, which serves more than 625,000 customers in more than 1,600 communities in Arkansas, Louisiana, and Mississippi, names Edgar Dixon as its first chief executive.

Read More: Nvidia Stock Price & Forecast

Entergy Corporation (ETR) Price Forecast

Earnings per share guidance

Entergy's adjusted EPS guidance for 2022 has been reduced from $6.25 to $6.45. Regarding the non-GAAP measure of Entergy adjusted EPS, the company has provided 2022 earnings guidance. The effect of adjustments, as described under "Non-GAAP financial measures" below, is not included in this measure's comparison to the corresponding GAAP financial measure.

Because the company cannot predict and quantify with a reasonable degree of confidence. All the adjustments that may take place during the period it has not provided a reconciliation of such non-GAAP guidance to guidance presented on a GAAP basis. EWC earnings are excluded from Entergy's adjusted EPS as one adjustment. According to our current projections, EWC will contribute roughly 25 cents to Entergy's as-reported EPS in 2022.

Facts About Entergy

Valuation

Never pay more than necessary for any asset in your portfolios. This is because paying too much for any help will almost always result in a return that is below average. The price-to-earnings growth ratio is one metric we can use to value a utility like Entergy Corporation. This is a modified version of the well-known price-to-earnings balance that considers the company's growth in earnings per share. A stock may be undervalued in its expected growth in earnings per share if the price-to-earnings growth ratio is less than 1.0, and vice versa. The best way to use it is to compare the company's valuation to that of its competitors to identify which stock has the most attractive relative price since very few stores have a ratio that low. Over the next three to five years, Entergy Corporation will increase its earnings per share by 6.07%. This is a pretty accurate estimate since it aligns with the number we previously used to calculate the potential total return. This current price results in a price-to-earnings-growth ratio for the stock of 3.05. This is how it compares to some of the competitors of the business:

Company PEG Ratio

Clearly, Entergy is trading at a significantly lower valuation than its competitors. As a result, the company is currently undervalued. This might be due to the company's significant debt load, making it more vulnerable to risks than these other companies. However, the stock might present a chance in this situation, especially for a buyer ready to assume a little bit more risk.

Conclusion

Finally, Entergy has a lot to offer prospective investors. However, its relatively high debt load does make it slightly riskier than many of its peers. The company's high yield and appealing valuation make it an excellent pick in the utility space. Given its location in the Deep South, the company's strong commitment to deploying renewable energy may come as a surprise. But it may also win over the managers of the numerous wealthy environmental, social, and government funds that have grown to be a significant force in the market over the past few years. Overall, it would be best to consider including this company in your portfolio.

Read More: 5 Gym Stocks to Check Out, AMC Stock Forecast