Hey everyone

It’s time to sit down and look over what happened in our portfolio in 2023. We had a great year but there is still room for improvement. I still chase value at times vs quality and would like to get our dividend growth increases up. But this is a long term game and lucky for us there is lots of time to make things better.

New Capital

Including drips we put $43,460.72 of capital into the market. That’s a tonne of money, no question. Especially considering combined we probably make around 160k before taxes. (not including passive income – all tax free or tax deferred)

Living in Ontario Canada we would lose roughly $47,192 bucks of that income to taxes alone. (without factoring rrsp contributions, donations etc) So we would have roughly $112,808 to live on with a family of 4. We also brought in $24,294 in passive income last year (tax free or deferred), so we had approximately $137,102 to live and invest with.

Overall our savings rate was around 31.69% Pretty insane when you do the math and see it all on paper.

We see all these news articles that you need an income of like 90k to live solo in the gta but if you manage your money right I disagree. It certainly helps with a 2 income household though. Housing is a major issue in Canada..

I think we live our life pretty good. Going on vacations twice a year, wonderland season passes and tonnes of camping. Our kids are in sports and ones in rep. (which definitely ain’t cheap) They attend after school care which adds up as well.

So we are definitely spending money but I can tell ya a couple things we don’t do that save us a tonne of money that a lot of people do.

Car payments

The stats are in and payments are absolutely insane. According to the Globe and Mail in July 2023 the average new car payment for Canadians was $880 per month, with 30% of buyers paying over 1,000 a month. This is in my opinion one of the biggest wastes of money people make.

That is a tonne of money and its a 2023 stat, what would it be today? Our cars are paid for and both are 2013 models, rocking over 200k on each. Based on these numbers if we both had new cars we would be throwing away over $1,700 a month or 20 thousand four hundred a year on payments….. not to mention higher insurance rates.. I’ll say it again $20,400! wtf. That’s 3 amazing family vacations..

Uber Eats

Clearly there is demand for this stuff but the markup is astronomical. Every time I go to a fast food place there is lots of people picking up uber eats etc. I have done it the odd time, mostly while having a bunch of drinks. 2 schwarma’s that should be like 25 bucks would be over 50 bucks with tip.. So you get that hangover and that financial hangover… dammmm! haha Do it once in awhile but don’t make it a habit.

Obviously there’s lots of minor things we do like make our own coffee etc but these things stand out to me as major wastes of money. We all value certain things differently but I think we all need to be honest with ourselves with stuff we spend too much money on.. Mine may be fish =)

The original wealthy barber book still gave me the most important info I’ve ever learn t about investing – pay yourself first. Get into this habit and your lifestyle will “gel” around it.

2023 Portfolio Moves

We made 2 sales in 2023.

We sold our small position of 27 shares of stanley black and decker for a small profit after realizing it wasn’t a position I really wanted to keep growing.

We also sold 8 shares of microsoft when it hit like 370 a share and made up over 8% of the portfolio. Clearly the stock has kept running but we put those proceeds at home depot under 300 and its done quite well too. Maybe its just a reminder to just let your winners run but the trade has worked out either way.

All the proceeds from these sales were put back into the market.

Purchases in 2023

- 7 Microsoft

- 53 bep

- 23 bce

- 80 td

- 10 txn

- 25 Nutrien

- 58 couchetard

- 208 telus

- 19 hd

- 31 bam

- 12 national bank

- 3 lmt

- 9 cnr

- 46 costco cdr

- 280 allied property reit

- 26 bam

We got a decent mix of growth and income. Moving forward I’d like to get more growth in the portfolio. Lower starting yields but higher dividend growth and stock price appreciation = higher total return

Drips In 2023

- bce – 10

- aecon – 39

- tc energy – 8

- cisco – 3

- telus – 4

- xaw etf – 4

- aqn – 60

- td – 2

- general mills – 3

- suncor – 14

- bep – 10

- fortis – 6

- enbridge – 15

In total our drips added $4,660.51 of value to the portfolio at time of purchase. I’m a huge fan of the drip program as it buys stuff no matter the price if you have enough money for shares. This can be a huge benefit when stocks are down. Aecon stands out here. I was really debating growing our position at 8 or 9 bucks a share but couldn’t pull the trigger, here we are north of $14.50. I’m glad the drips averaged our price costs down.

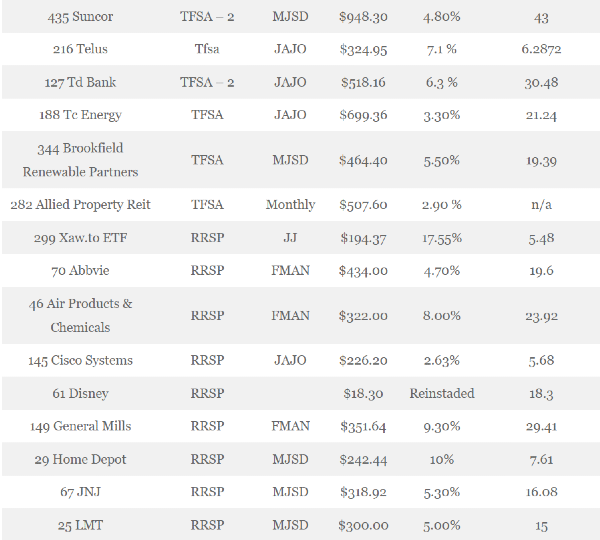

Dividend Raises

Brookfield Asset Management and Aecon were the only 2 stocks we hold that didn’t announce a dividend raise in 2023. Although Bam was basically restructured so that one gets a pass. Here’s hoping Aecon announces a raise this year as their profits grow now that the pandemic jobs finish. (Their prices skyrocketed on jobs they already quoted)

Algonquin is the only one that announced a cut in 2023. Lets be honest aqn, had investors up against the ropes and threw everything they could at us.. uppercut jab jab… This continues to be the only stock I debate cutting from the portfolio but wonder if this year may be the time they Bob Seger – Turn the page. Time will tell but they better keep those water assets.

Overall the dividend raises were quite low at over 200 bucks on a 10k portfolio but without that cut would of been better at roughly 4.5% average. Couchetard comes out victorious once again with the biggest increase of 25%. That’s a big reason we added so much to them once again. Gotta always be rewarding these big raises with more of our money.

Wrapping up

The portfolio had a good year but under performed the market with a 5.51% return in 2023. Lots of interest rate sensitive stocks in here and we only hold one of the magnificient 7 stocks. But at the end of 2022 we had a forward dividend income of $8,350.93. December 31st 2023 we had forward dividend income of $10,551.29. An increase of $2,200.36 yr over yr. The math is Mathing as Braden Dennis from the Canadian Investor podcast would say.

Im happy to put it all down on paper and see the numbers more clearly. Moving forward in 2024 I plan on increasing our low yield high growth positions and getting that overall dividend growth % up. I also plan on increasing our financial sector as its our 2nd lowest sector in terms of portfolio allocation ahead of reits which I don’t necessarily care for. (low growth and div growth)

Well there ya have it, another year in the books and we are already 8% into 2024. Time is flying. What are your thoughts? What could we be doing better and how did you do last year overall?

cheers!

Hey everyone

It’s time to sit down and look over what happened in our portfolio in 2023. We had a great year but there is still room for improvement. I still chase value at times vs quality and would like to get our dividend growth increases up. But this is a long term game and lucky for us there is lots of time to make things better.

New Capital

Including drips we put $43,460.72 of capital into the market. That’s a tonne of money, no question. Especially considering combined we probably make around 160k before taxes. (not including passive income – all tax free or tax deferred)

Living in Ontario Canada we would lose roughly $47,192 bucks of that income to taxes alone. (without factoring rrsp contributions, donations etc) So we would have roughly $112,808 to live on with a family of 4. We also brought in $24,294 in passive income last year (tax free or deferred), so we had approximately $137,102 to live and invest with.

Overall our savings rate was around 31.69% Pretty insane when you do the math and see it all on paper.

We see all these news articles that you need an income of like 90k to live solo in the gta but if you manage your money right I disagree. It certainly helps with a 2 income household though. Housing is a major issue in Canada..

I think we live our life pretty good. Going on vacations twice a year, wonderland season passes and tonnes of camping. Our kids are in sports and ones in rep. (which definitely ain’t cheap) They attend after school care which adds up as well.

So we are definitely spending money but I can tell ya a couple things we don’t do that save us a tonne of money that a lot of people do.

Car payments

The stats are in and payments are absolutely insane. According to the Globe and Mail in July 2023 the average new car payment for Canadians was $880 per month, with 30% of buyers paying over 1,000 a month. This is in my opinion one of the biggest wastes of money people make.

That is a tonne of money and its a 2023 stat, what would it be today? Our cars are paid for and both are 2013 models, rocking over 200k on each. Based on these numbers if we both had new cars we would be throwing away over $1,700 a month or 20 thousand four hundred a year on payments….. not to mention higher insurance rates.. I’ll say it again $20,400! wtf. That’s 3 amazing family vacations..

Uber Eats

Clearly there is demand for this stuff but the markup is astronomical. Every time I go to a fast food place there is lots of people picking up uber eats etc. I have done it the odd time, mostly while having a bunch of drinks. 2 schwarma’s that should be like 25 bucks would be over 50 bucks with tip.. So you get that hangover and that financial hangover… dammmm! haha Do it once in awhile but don’t make it a habit.

Obviously there’s lots of minor things we do like make our own coffee etc but these things stand out to me as major wastes of money. We all value certain things differently but I think we all need to be honest with ourselves with stuff we spend too much money on.. Mine may be fish =)

The original wealthy barber book still gave me the most important info I’ve ever learn t about investing – pay yourself first. Get into this habit and your lifestyle will “gel” around it.

2023 Portfolio Moves

We made 2 sales in 2023.

We sold our small position of 27 shares of stanley black and decker for a small profit after realizing it wasn’t a position I really wanted to keep growing.

We also sold 8 shares of microsoft when it hit like 370 a share and made up over 8% of the portfolio. Clearly the stock has kept running but we put those proceeds at home depot under 300 and its done quite well too. Maybe its just a reminder to just let your winners run but the trade has worked out either way.

All the proceeds from these sales were put back into the market.

Purchases in 2023

We got a decent mix of growth and income. Moving forward I’d like to get more growth in the portfolio. Lower starting yields but higher dividend growth and stock price appreciation = higher total return

Drips In 2023

In total our drips added $4,660.51 of value to the portfolio at time of purchase. I’m a huge fan of the drip program as it buys stuff no matter the price if you have enough money for shares. This can be a huge benefit when stocks are down. Aecon stands out here. I was really debating growing our position at 8 or 9 bucks a share but couldn’t pull the trigger, here we are north of $14.50. I’m glad the drips averaged our price costs down.

Dividend Raises

Brookfield Asset Management and Aecon were the only 2 stocks we hold that didn’t announce a dividend raise in 2023. Although Bam was basically restructured so that one gets a pass. Here’s hoping Aecon announces a raise this year as their profits grow now that the pandemic jobs finish. (Their prices skyrocketed on jobs they already quoted)

Algonquin is the only one that announced a cut in 2023. Lets be honest aqn, had investors up against the ropes and threw everything they could at us.. uppercut jab jab… This continues to be the only stock I debate cutting from the portfolio but wonder if this year may be the time they Bob Seger – Turn the page. Time will tell but they better keep those water assets.

Overall the dividend raises were quite low at over 200 bucks on a 10k portfolio but without that cut would of been better at roughly 4.5% average. Couchetard comes out victorious once again with the biggest increase of 25%. That’s a big reason we added so much to them once again. Gotta always be rewarding these big raises with more of our money.

Wrapping up

The portfolio had a good year but under performed the market with a 5.51% return in 2023. Lots of interest rate sensitive stocks in here and we only hold one of the magnificient 7 stocks. But at the end of 2022 we had a forward dividend income of $8,350.93. December 31st 2023 we had forward dividend income of $10,551.29. An increase of $2,200.36 yr over yr. The math is Mathing as Braden Dennis from the Canadian Investor podcast would say.

Im happy to put it all down on paper and see the numbers more clearly. Moving forward in 2024 I plan on increasing our low yield high growth positions and getting that overall dividend growth % up. I also plan on increasing our financial sector as its our 2nd lowest sector in terms of portfolio allocation ahead of reits which I don’t necessarily care for. (low growth and div growth)

Well there ya have it, another year in the books and we are already 8% into 2024. Time is flying. What are your thoughts? What could we be doing better and how did you do last year overall?

cheers!

Originally Posted on passivecanadianincome.ca