It’s truly amazing how far AI has come in such a short period. Not only can it answer most questions, but it can also generate online posts, research papers, and even poetry. However, it still has its limitations. Although it may seem like an omniscient resource, it hasn’t reached the point of infallibility. So, you probably don’t want it guiding important decisions that affect your financial security. Despite the strides it has made in recent years. here are 5 reasons not to use ChatGPT for financial advice.

5 Reasons Why You Shouldn’t Use ChatGPT for Financial Advice

1. ChatGPT often makes things up.

Those who rely on ChatGPT may not realize that AI often makes things up. These mistakes are referred to as “hallucinations” in which AI makes statements that sound logical but are false.

It is a well-known problem among those familiar with AI and has continued to be a challenge for engineers. Unfortunately, this issue doesn’t seem like it will ever completely disappear. Even though we continue to make technological advances every year, you should never become overly reliant on AI. Therefore, you should still fact-check any information you receive from ChatGPT before blindly accepting it as true.

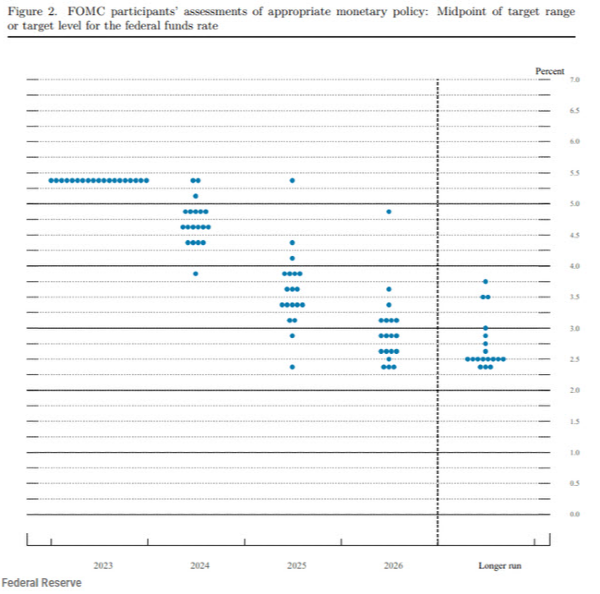

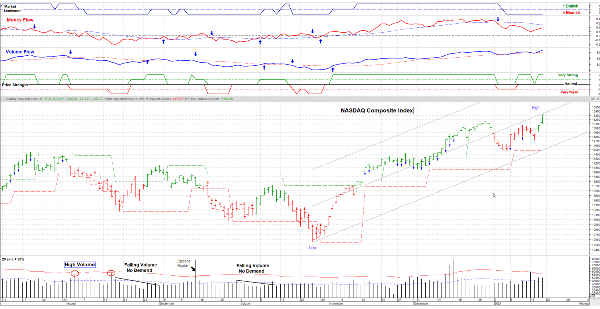

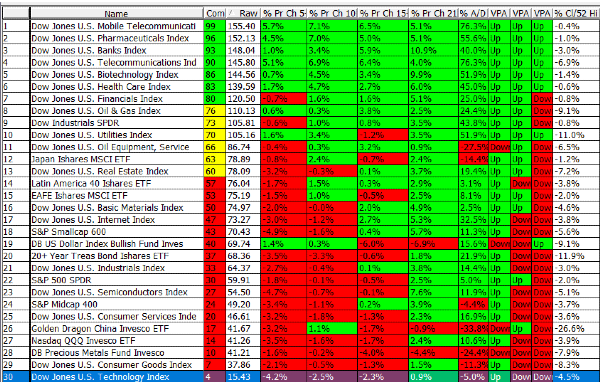

2. It’s not updated on current economic trends and market conditions.

Although ChatGPT can access the far corners of the internet, its knowledge base is not up-to-date on current events. Since it can only access information up to September 2021, it isn’t aware of any economic changes that have happened since then. This means that it can’t provide real-time data. This isn’t very helpful for those needing to make informed decisions or adjustments to your portfolio based on the current conditions.

3. ChatGPT doesn’t account for your risk tolerance or personal situation.

When you are seeking a financial advisor, any professional worth their salt with discuss your level of risk tolerance and consider your situation. They will look at factors such as income, debt, liabilities, financial obligations, years to retirement, and any other considerations that would affect your investment strategy.

Advisors understand that each person and financial situation is different, therefore your strategy must be as well. On the other hand, AI doesn’t account for risk tolerance and other preferences. Even if ChatGPT can efficiently allocate the assets within your portfolio, it’s not a good idea to rely on it to make decisions that could affect your future.

4. AI has no personal accountability.

All investors should know that past performance never guarantees future results. However, it can provide more credibility and trust between financial advisors and their clients.

But if you choose to use AI, ChatGPT doesn’t even have a track record you can consult. Furthermore, there are no financial institutions that claim responsibility for the advice they provide. And, there are no governing bodies like FINRA that you can report to if it doesn’t adhere to industry rules. So if it makes a mistake that results in significant losses, you have no recourse or avenues to recover the lost funds.

5. It can’t replace a licensed financial advisor.

Despite how intuitive AI can be, it cannot replace human intelligence and experience. Even though it has access to over a billion sites, it is programmed as a chatbot using a large language model, not a trained financial advisor.

ChatGPT has no industry credentials, and it can’t analyze current conditions or make adjustments based on your customized investment strategy. While it may be sufficient for generic advice and proven principles, it isn’t as reliable as a human with professional financial experience. So when it comes down to protecting your assets and your future, it’s better to stick with a human expert who can help you navigate the ever-changing financial landscapes.

Read More

It’s truly amazing how far AI has come in such a short period. Not only can it answer most questions, but it can also generate online posts, research papers, and even poetry. However, it still has its limitations. Although it may seem like an omniscient resource, it hasn’t reached the point of infallibility. So, you probably don’t want it guiding important decisions that affect your financial security. Despite the strides it has made in recent years. here are 5 reasons not to use ChatGPT for financial advice.

5 Reasons Why You Shouldn’t Use ChatGPT for Financial Advice

1. ChatGPT often makes things up.

Those who rely on ChatGPT may not realize that AI often makes things up. These mistakes are referred to as “hallucinations” in which AI makes statements that sound logical but are false.

It is a well-known problem among those familiar with AI and has continued to be a challenge for engineers. Unfortunately, this issue doesn’t seem like it will ever completely disappear. Even though we continue to make technological advances every year, you should never become overly reliant on AI. Therefore, you should still fact-check any information you receive from ChatGPT before blindly accepting it as true.

2. It’s not updated on current economic trends and market conditions.

Although ChatGPT can access the far corners of the internet, its knowledge base is not up-to-date on current events. Since it can only access information up to September 2021, it isn’t aware of any economic changes that have happened since then. This means that it can’t provide real-time data. This isn’t very helpful for those needing to make informed decisions or adjustments to your portfolio based on the current conditions.

3. ChatGPT doesn’t account for your risk tolerance or personal situation.

When you are seeking a financial advisor, any professional worth their salt with discuss your level of risk tolerance and consider your situation. They will look at factors such as income, debt, liabilities, financial obligations, years to retirement, and any other considerations that would affect your investment strategy.

Advisors understand that each person and financial situation is different, therefore your strategy must be as well. On the other hand, AI doesn’t account for risk tolerance and other preferences. Even if ChatGPT can efficiently allocate the assets within your portfolio, it’s not a good idea to rely on it to make decisions that could affect your future.

4. AI has no personal accountability.

All investors should know that past performance never guarantees future results. However, it can provide more credibility and trust between financial advisors and their clients.

But if you choose to use AI, ChatGPT doesn’t even have a track record you can consult. Furthermore, there are no financial institutions that claim responsibility for the advice they provide. And, there are no governing bodies like FINRA that you can report to if it doesn’t adhere to industry rules. So if it makes a mistake that results in significant losses, you have no recourse or avenues to recover the lost funds.

5. It can’t replace a licensed financial advisor.

Despite how intuitive AI can be, it cannot replace human intelligence and experience. Even though it has access to over a billion sites, it is programmed as a chatbot using a large language model, not a trained financial advisor.

ChatGPT has no industry credentials, and it can’t analyze current conditions or make adjustments based on your customized investment strategy. While it may be sufficient for generic advice and proven principles, it isn’t as reliable as a human with professional financial experience. So when it comes down to protecting your assets and your future, it’s better to stick with a human expert who can help you navigate the ever-changing financial landscapes.

Read More

Originally Posted on budgetandinvest.com