Summary

• Trends support the industry

• Result shows growth with lower leverage

• Market leader

• Long-term Strategy

Why buy Enel is a long-term investment

This company is revolutionizing the market and it came to stay. Try not to focus on the 20% stock price growth of the current year. This company has the potential to surpass the current valuation and earn investors a little money. Enel valuation of around 6 USD is not fair when comparing it to its performance and forecasting. Furthermore, I am not the only one saying it, with an average expected valuation of 7.5 USD per share from the largest investors in the world there is still an opportunity to jump into this energic trend of the industry and earn some money.

What is Enel

Enel began as an energy utility company like many others. With the capacity to power society growing, the company became more interested in incorporating innovative technologies into our everyday lives. As global energy problems became more evident, Enel became clearer about its mission. Focused on helping society, and the environment. This company was instituted in Italy and currently operates in more than 30 countries located all around the world.

Targeting innovation, this company focuses on the development and production of alternative sources of energy. Enel utilizes solar, wind, Hydro, geothermal, and other types of energy to lead the transition to green energy.

Finally, this company provides a wide variety while targeting the zero-emission goal. It provides customers with a supply of energy through different mechanisms such as electricity, chargers, and gas.

What makes Enel different?

With the world trends changing to sustainable energy and zero emissions Enel disrupted the industry providing a green source of energy and competing with traditional oil companies. Their innovation process and quality product stand out in the market making them the leaders in the industry. The variety of resources and diversification process have allowed them to grow at a fast pace and provide a secure and stable supply in over 30 countries.

The energy of the Financial Industry $$

For us investors, the most important thing is not if the company is sustainable or innovative. The first thing we look for in a company is results. The key numbers when we investigate Enel are EBITDA, RES Capacity, and FFO (funds from operations). This data is available on the Enel Investor Relations website.

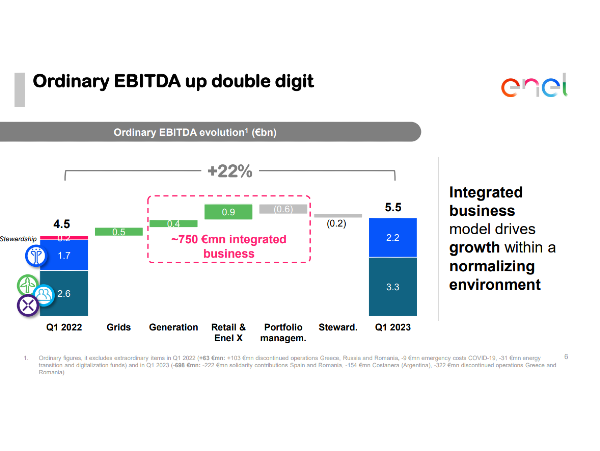

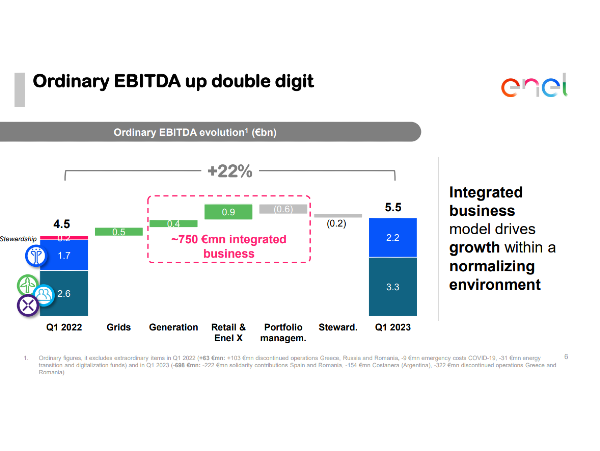

EBITDA

This indicator shows the earnings as its name represents. Overall demonstrates how is the performance of the company and if the company is growing. In the case of developing industries like renewable energy, is expected to have large revenue growth with a similar rate in expenses explained by the expansion. EBITDA considers these two indicators and summarizes the total performance in an earnings ratio. In the case of Enel, we have a growth of over 20% reflecting the fast-growing performance of the industry and the success of the company.

RES Capacity

Simply put, it is the amount of energy that the company can produce. This metric allows us to understand the growth rate of the company from the production side and how they are increasing their market share in the different subsidiaries. Over the last year, the production capacity grew by around 8%, meaning that they can distribute more energy to more customers and earn from the distribution. In this industry, the highest cost is from the initial investment, meaning that in the long-term higher capacity will provide more market share, lower cost, and more earnings.

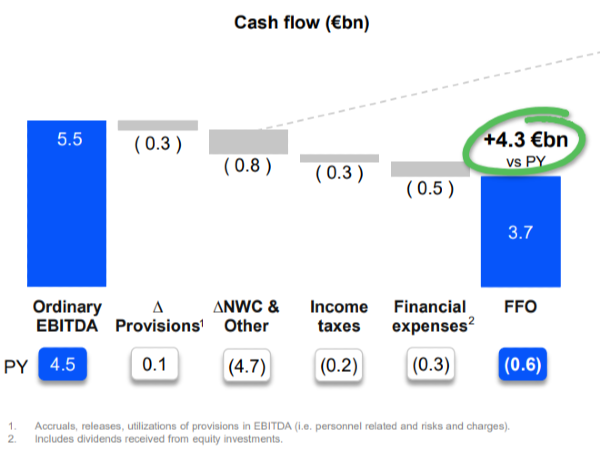

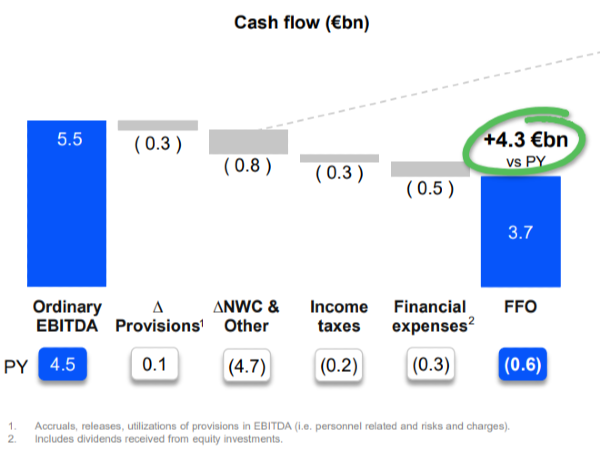

FFO

Funds from operations is the figure used by real estate investment trusts to define the cash flow from their operations. In the case of Enel, this indicator shows a normalization from the previous year's behavior. Achieving an increase of +4.3 is mainly explained by the normalization of the working capital after the government regulatory measures and the energy market context.

Innovation and Diversification

Being a rising topic today, renewable energy has become a necessity for the long-term sustainability of mankind. Enel decided to put their hands on the job and develop technologies to achieve this goal. The company distributes its resources from the whole world and optimizes energy production from each unique location. This allows the company to achieve economic goals and energy distribution requirements for the customers. The diversification of the company makes the customers and investors secure as they know their money is in good hands. Keeping with the strategy the company plans to increase its capacity even more by 2025 (+ 15%) fully compromised with the energy transition. Maybe in the future, they will take some energy from Mordor too.

Closure

If you don’t know anything about Enel it could be hard to invest in it, I hope this small summary helped you to learn a little more about the company and open your curiosity. Enel is the largest company in renewable energy making it hard to value, but the financial results a clear strategy, and the recommendations for long-term investment in all the portals can be enough to change anybody's mind.

Summary • Trends support the industry • Result shows growth with lower leverage • Market leader • Long-term Strategy

Why buy Enel is a long-term investment This company is revolutionizing the market and it came to stay. Try not to focus on the 20% stock price growth of the current year. This company has the potential to surpass the current valuation and earn investors a little money. Enel valuation of around 6 USD is not fair when comparing it to its performance and forecasting. Furthermore, I am not the only one saying it, with an average expected valuation of 7.5 USD per share from the largest investors in the world there is still an opportunity to jump into this energic trend of the industry and earn some money.

What is Enel Enel began as an energy utility company like many others. With the capacity to power society growing, the company became more interested in incorporating innovative technologies into our everyday lives. As global energy problems became more evident, Enel became clearer about its mission. Focused on helping society, and the environment. This company was instituted in Italy and currently operates in more than 30 countries located all around the world. Targeting innovation, this company focuses on the development and production of alternative sources of energy. Enel utilizes solar, wind, Hydro, geothermal, and other types of energy to lead the transition to green energy. Finally, this company provides a wide variety while targeting the zero-emission goal. It provides customers with a supply of energy through different mechanisms such as electricity, chargers, and gas.

What makes Enel different? With the world trends changing to sustainable energy and zero emissions Enel disrupted the industry providing a green source of energy and competing with traditional oil companies. Their innovation process and quality product stand out in the market making them the leaders in the industry. The variety of resources and diversification process have allowed them to grow at a fast pace and provide a secure and stable supply in over 30 countries.

The energy of the Financial Industry $$ For us investors, the most important thing is not if the company is sustainable or innovative. The first thing we look for in a company is results. The key numbers when we investigate Enel are EBITDA, RES Capacity, and FFO (funds from operations). This data is available on the Enel Investor Relations website.

EBITDA This indicator shows the earnings as its name represents. Overall demonstrates how is the performance of the company and if the company is growing. In the case of developing industries like renewable energy, is expected to have large revenue growth with a similar rate in expenses explained by the expansion. EBITDA considers these two indicators and summarizes the total performance in an earnings ratio. In the case of Enel, we have a growth of over 20% reflecting the fast-growing performance of the industry and the success of the company.

RES Capacity Simply put, it is the amount of energy that the company can produce. This metric allows us to understand the growth rate of the company from the production side and how they are increasing their market share in the different subsidiaries. Over the last year, the production capacity grew by around 8%, meaning that they can distribute more energy to more customers and earn from the distribution. In this industry, the highest cost is from the initial investment, meaning that in the long-term higher capacity will provide more market share, lower cost, and more earnings.

FFO Funds from operations is the figure used by real estate investment trusts to define the cash flow from their operations. In the case of Enel, this indicator shows a normalization from the previous year's behavior. Achieving an increase of +4.3 is mainly explained by the normalization of the working capital after the government regulatory measures and the energy market context.

Innovation and Diversification Being a rising topic today, renewable energy has become a necessity for the long-term sustainability of mankind. Enel decided to put their hands on the job and develop technologies to achieve this goal. The company distributes its resources from the whole world and optimizes energy production from each unique location. This allows the company to achieve economic goals and energy distribution requirements for the customers. The diversification of the company makes the customers and investors secure as they know their money is in good hands. Keeping with the strategy the company plans to increase its capacity even more by 2025 (+ 15%) fully compromised with the energy transition. Maybe in the future, they will take some energy from Mordor too.

Closure If you don’t know anything about Enel it could be hard to invest in it, I hope this small summary helped you to learn a little more about the company and open your curiosity. Enel is the largest company in renewable energy making it hard to value, but the financial results a clear strategy, and the recommendations for long-term investment in all the portals can be enough to change anybody's mind.