What is Caterpillar?

Caterpillar is an industrial company best known for its construction equipment. Some lesser known components of its business are diesel engines, mining equipment, and financing.

If you’re new to investing, when you assess a stock, you should ask yourself two fundamental questions: is this stock a good investment? And is this stock a good investment right now?

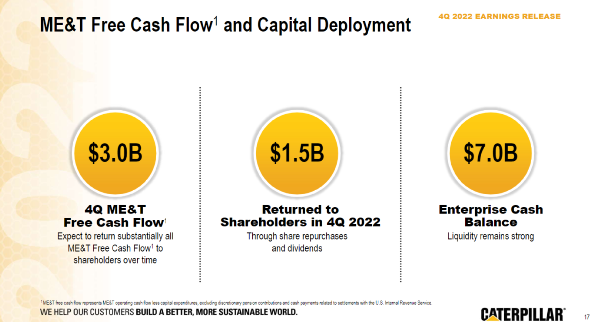

Caterpillar is a good long term investment. The executive team raved about their status as a dividend aristocrat on their Q4 2022 presentation. The company has increased their annual dividend for 29 years, so they definitely deserve the bragging rights.

And there’s no games played with the dividend. The dividend comes straight out of earnings with a dividend payout ratio of 38%.

For reference, utilities with stable cash flows pay out 50 to 55 percent. Utilities playing games with their dividend will payout 80% or higher of their earnings. This is a potential sign that the dividend is about to get cut.

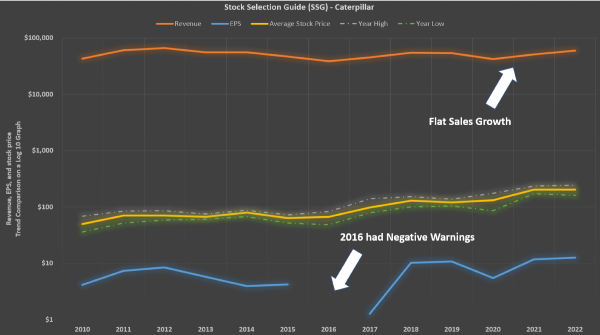

Caterpillar does have problems which are easier to see on a stock selection guide. To simplify what you’re seeing here, we want this graph to be up, straight and parallel. This means revenue IS GROWING (the up), growth is exponential (straight), and costs are under control (parallel profit line). Looking at the chart, you can see that caterpillar hasn’t been growing revenue too significantly.

For more information on the powerful stock selection guide tool, check out BetterInvesting &trade coreSSG for more information.

Since 2010, Caterpillar’s revenue has increased 83%, and while that’s great for a blue chip stock, don’t expect the kind of all-star growth we’ve seen with stocks like Tesla or Google.

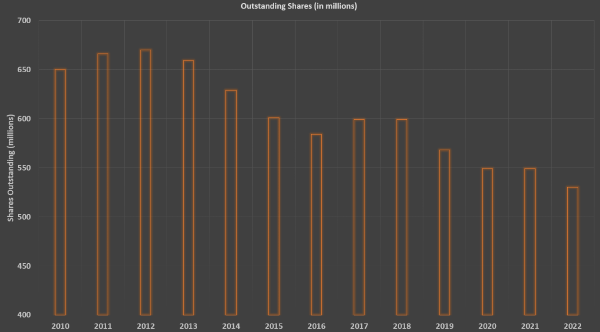

What Caterpillar does provide is fantastic cash flow. The company has used this cash flow to pay its dividend, buy back shares, and reinvest in the company. In fact, the number of outstanding shares has fallen 18% since 2010. This is one reason why earnings per share has grown faster than revenue.

How to Invest in Caterpillar

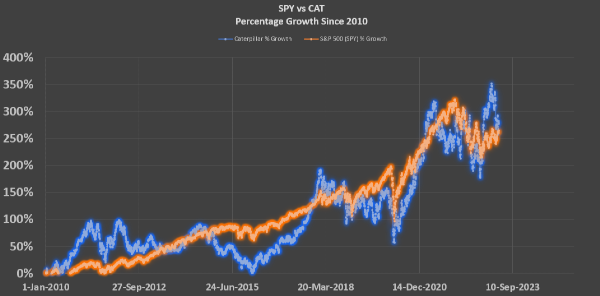

With a beta of 1.10, Caterpillar rises and falls with the market, albeit with higher highs and lower lows. Caterpillar is affected by the price of oil, the price of mined commodities, and the price of food. This is because Caterpillar’s equipment services these industries. So Caterpillar will have big swings in revenue, earnings, and price.

This stock is one you don’t want to hold on to when it’s overvalued, so reassessing its valuation at least quarterly is highly recommended.

Caterpillar is a long term hold that needs some TLC.

So is it a buy right now?

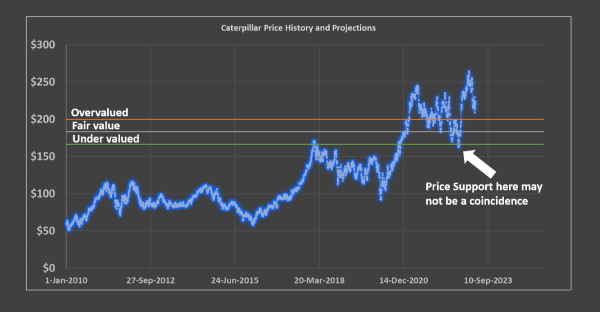

In Q2 2023, we assess Caterpillar as a sell. Caterpillar’s price stands around $209. This price looks to be significantly overvalued. We assess Caterpillar to be overvalued at $200, fairly valued at $182, and under-valued at $164.

We calculated Caterpillar’s fair market value by taking its $30.73 book value per share and adding it to a 10 year projected earnings per share outlook of $12.64 grown at a 7% rate and discounted at the current federal funds rate.

Where did 7% come from? We took the median annual EPS growth rate. Would average be better? Nope, because Caterpillar’s earnings growth is too volatile.

We dropped book value per share by two percent because Caterpillar took a $1 Billion Goodwill impairment to its rail unit. Being that Caterpillar noted the rest of their Goodwill assessments were fair or undervalued, this 2% risk assessment seems reasonable.

We also slapped a 2% risk assessment onto earnings. This comes mostly due to Caterpillars natural earnings volatility.

Finally Caterpillar stock likely suffers from the companies name recognition. Stocks with name recognition, and this is anecdotal, tend to hover above their calculated fair market value. If this conjecture is true, then it results in a premium to buy caterpillar.

Wait until Caterpillar reaches your undervalued price point. Its also important to hold Caterpillar until its overvalued, and then protect yourself with limit orders. Caterpillar swings low due to its ties to commodities, but also swings high due to its brand recognition.

Happy Investing. Never invested before? The time to start is right now.

Want to learn more? Check out our video on Caterpillar:

https://youtu.be/LAmFAke7AKA

What is Caterpillar?

Caterpillar is an industrial company best known for its construction equipment. Some lesser known components of its business are diesel engines, mining equipment, and financing.

If you’re new to investing, when you assess a stock, you should ask yourself two fundamental questions: is this stock a good investment? And is this stock a good investment right now?

Caterpillar is a good long term investment. The executive team raved about their status as a dividend aristocrat on their Q4 2022 presentation. The company has increased their annual dividend for 29 years, so they definitely deserve the bragging rights. And there’s no games played with the dividend. The dividend comes straight out of earnings with a dividend payout ratio of 38%.

Source: 4Q 2022 CATERPILLAR INC. EARNINGS CONFERENCE CALL

For reference, utilities with stable cash flows pay out 50 to 55 percent. Utilities playing games with their dividend will payout 80% or higher of their earnings. This is a potential sign that the dividend is about to get cut.

Caterpillar does have problems which are easier to see on a stock selection guide. To simplify what you’re seeing here, we want this graph to be up, straight and parallel. This means revenue IS GROWING (the up), growth is exponential (straight), and costs are under control (parallel profit line). Looking at the chart, you can see that caterpillar hasn’t been growing revenue too significantly.

For more information on the powerful stock selection guide tool, check out BetterInvesting &trade coreSSG for more information.

Since 2010, Caterpillar’s revenue has increased 83%, and while that’s great for a blue chip stock, don’t expect the kind of all-star growth we’ve seen with stocks like Tesla or Google.

What Caterpillar does provide is fantastic cash flow. The company has used this cash flow to pay its dividend, buy back shares, and reinvest in the company. In fact, the number of outstanding shares has fallen 18% since 2010. This is one reason why earnings per share has grown faster than revenue.

How to Invest in Caterpillar

With a beta of 1.10, Caterpillar rises and falls with the market, albeit with higher highs and lower lows. Caterpillar is affected by the price of oil, the price of mined commodities, and the price of food. This is because Caterpillar’s equipment services these industries. So Caterpillar will have big swings in revenue, earnings, and price.

This stock is one you don’t want to hold on to when it’s overvalued, so reassessing its valuation at least quarterly is highly recommended.

Caterpillar is a long term hold that needs some TLC.

So is it a buy right now?

In Q2 2023, we assess Caterpillar as a sell. Caterpillar’s price stands around $209. This price looks to be significantly overvalued. We assess Caterpillar to be overvalued at $200, fairly valued at $182, and under-valued at $164.

We calculated Caterpillar’s fair market value by taking its $30.73 book value per share and adding it to a 10 year projected earnings per share outlook of $12.64 grown at a 7% rate and discounted at the current federal funds rate.

Where did 7% come from? We took the median annual EPS growth rate. Would average be better? Nope, because Caterpillar’s earnings growth is too volatile.

We dropped book value per share by two percent because Caterpillar took a $1 Billion Goodwill impairment to its rail unit. Being that Caterpillar noted the rest of their Goodwill assessments were fair or undervalued, this 2% risk assessment seems reasonable.

We also slapped a 2% risk assessment onto earnings. This comes mostly due to Caterpillars natural earnings volatility.

Finally Caterpillar stock likely suffers from the companies name recognition. Stocks with name recognition, and this is anecdotal, tend to hover above their calculated fair market value. If this conjecture is true, then it results in a premium to buy caterpillar. Wait until Caterpillar reaches your undervalued price point. Its also important to hold Caterpillar until its overvalued, and then protect yourself with limit orders. Caterpillar swings low due to its ties to commodities, but also swings high due to its brand recognition.

Happy Investing. Never invested before? The time to start is right now.

Want to learn more? Check out our video on Caterpillar:

https://youtu.be/LAmFAke7AKA