The Top Utility Stocks by Wind Power Generation

Below are the top utility stocks by total wind power generation. These utilities are mid-cap or large-cap stocks whose customer base exceed 5 million. Total wind power is labeled as MW (MegaWatts), which is a measure of energy a power plant can generate per unit of time. A megawatt of capacity can produce enough energy for 400 to 900 homes a year.

Each utility uses a diversified fleet of power plants to meet their customers’ electricity demands. The percentage of that utility's fleet which is wind power is in parenthesis.

1). NextEra Energy (NEE) – 16,517 MW (29.19%)

2). Duke Energy (DUK) – 2,800 MW (5.60%)

3). The Southern Company (SO) – 2,533 MW (5.76%)

4). American Electric Power Company (AEP) – 1,260 MW (4.85%)

5). Exelon (EXC) – 1,400 MW (4.20%)

If you are just interested in supporting environmentally friendly ESG stocks, then invest in these 5 stocks. But buyer beware, some of these stocks may be overvalued! The stock market may be placing a premium on our number one stock, NextEra Energy, which is why it recently collapsed after earnings.

Is NextEra Energy Overvalued?

NextEra Energy may be twice its intrinsic value as of Friday’s price of $75.58. On Thursday, NEE collapsed 8.7% following an abysmal earnings report. Financial media went wild! Here are some examples:

So first, what are the red herrings? The campaign-finance allegations are immaterial. NextEra may be paying up to $2 Million in fees for this complaint. This amount is so small that it will not be seen on financial reports. It’s too small to even be a rounding error.

The second red herring is the CEO retiring. Don’t get me wrong, a change in leadership can be a serious problem for a company. But in this case, the valuation of the company is just too high relative to the intrinsic value of NextEra Energy.

NextEra Energy’s Intrinsic Value

Using a standard methodology to evaluate the intrinsic value of a utility stock, we will use the following data to determine the intrinsic value of NextEra Energy:

- Book value per share: $19.44

- Current Earnings Per Share: $1.94

- Interest Rate of the 10-year T-Note: 3.88%

- Historical Earnings Growth: 5.60%

This gives us an intrinsic value of $42.64!

Check out our example calculator here for NEE

This is -44.33% below its current market price!

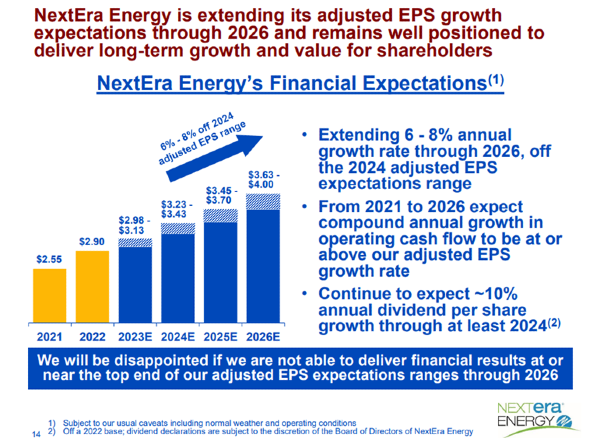

The company’s latest presentation noted that they believe that growth will be 6% to 8%.

In our analysis, we used historical EPS growth of 5.60% to estimate future EPS growth. But instead, if we are as optimistic as the leadership team and assume EPS growth will be 8% for the next 10 years, the intrinsic value is still well short of the current price. At 8% EPS growth, the intrinsic value is at $46.36. This is still 39.5% below the current stock price!

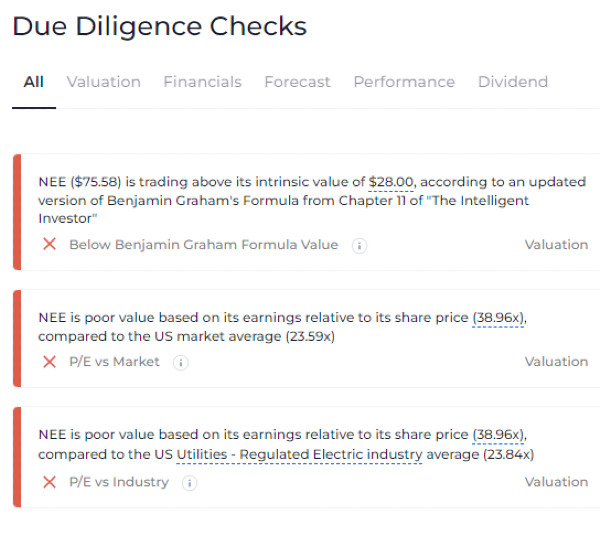

And we are not the only ones that are noticing this valuation discrepancy. Here is a snap shot of wallstreetzen.com after the earnings call and after the precipitous drop in price:

Source: wallstreetzen.com, screen shot taken January 28th, 2023

Why is NextEra Energy Overvalued?

There may be a few reasons why NextEra Energy is being overvalued. Note that these are all just conjecture, but we’ll put some data behind our thoughts and let you decide.

NEE in Actively Managed ETFs vs. Broad-based ETFs

The likely drivers of large stock price falls like this are institutional investors. One tranche are ETF funds. Using data provided by etf.com, we see that 255 ETFs hold NEE. These ETFs hold 292 Million shares of NEE, which is roughly 14% of the utilities shares.

Actively managed ETFs may have also realized NEE is overvalued after the latest earnings call and responded accordingly. Actively managed ETFs need to get out as soon as possible because the price depreciation will force passively managed ETFs to reduce their stake in NEE. The reason is that the largest ETFs are “cap-weighted”. This means they balance their portfolio of utilities based on the market capitalization of the utility. If NextEra Energy’s price falls, then its market cap falls, which means it percentage in passive ETFs also falls.

Note that passive ETFs only rebalance periodically, typically monthly or quarterly. This means that there could be another precipitous drop in NEEs price that “echoes” this recent fall when the passive ETFs rebalance.

Read More: The Top Utility ETFs for Passive Income

Renewable Energy ETFs

There are more renewable energy ETFs that carry NEE in their portfolio. ETFs like BlackRock U.S. Carbon Transition Readiness ETF (LCTU) and SPDR S&P Kensho Clean Power ETF (CNRG) were both founded in 2019.

Since these are passive ETFs, they will not react to a utility stock being over-valued until the rest of the market sells off the shares. NextEra Energy may take longer to readjust back to its intrinsic value as more ETFs are being created with new themes. Renewable energy ETFs are just one of many new themes. Other themes like infrastructure, income, and dividend aristocrats all hold NEE. Examples include:

iShares U.S. Infrastructure ETF (IFRA) – Infrastructure

FT Cboe Vest S&P 500 Dividend Aristocrats Target Income ETF (KNG)) – Income

WisdomTree U.S. Total Dividend Fund (DTD)) – Dividend

The “Poster Child” of Renewable Energy

Even our own team at StockBossUp has suggested NEE because of its renewable energy accomplishments before checking out its valuation. We did this very mistake in our article on the top solar power stocks. To be fair, NextEra Energy is still a good long-term investment. The problem is that even a great investment can be overvalued.

This same mistake is repeated over and over in financial media. NextEra will constantly make the top list of renewable energy stock lists without consideration of its overvaluation. That doesn't mean NEE is a bad stock or poorly managed, but it could mean that investing in NEE will come with a premium that is being manifested by the stock market.

The Bottom Line

Even if you want to help the world by investing in renewable energy, do not invest in overvalued companies. By investing in renewable energy companies at the right price you can allocate your investment to more renewable energy projects. You can’t invest in ESG stocks if you’re losing money.

You can check if a utility is properly valued by using our guide to evaluating utility stocks. A utility business is relatively stable which allows you to make a reasonable assessment of its future valuation.

Read more: The Top Utility Stocks Suggested by Our Top Performers

The stock selection guide (SSG) is another resource to evaluate stocks. The SSG provides a visual way of assessing stocks based on trends in the stock’s fundamentals. You can learn how to read these trends in our article on how to analyze stocks using a stock selection guide.

I/we have no positions in any asset mentioned, and no plans to initiate any positions for the next 7 days

Cover Image by Oimheidi from Pixabay

The Top Utility Stocks by Wind Power Generation

Below are the top utility stocks by total wind power generation. These utilities are mid-cap or large-cap stocks whose customer base exceed 5 million. Total wind power is labeled as MW (MegaWatts), which is a measure of energy a power plant can generate per unit of time. A megawatt of capacity can produce enough energy for 400 to 900 homes a year. Each utility uses a diversified fleet of power plants to meet their customers’ electricity demands. The percentage of that utility's fleet which is wind power is in parenthesis.

1). NextEra Energy (NEE) – 16,517 MW (29.19%)

2). Duke Energy (DUK) – 2,800 MW (5.60%)

3). The Southern Company (SO) – 2,533 MW (5.76%)

4). American Electric Power Company (AEP) – 1,260 MW (4.85%)

5). Exelon (EXC) – 1,400 MW (4.20%)

If you are just interested in supporting environmentally friendly ESG stocks, then invest in these 5 stocks. But buyer beware, some of these stocks may be overvalued! The stock market may be placing a premium on our number one stock, NextEra Energy, which is why it recently collapsed after earnings.

Is NextEra Energy Overvalued?

NextEra Energy may be twice its intrinsic value as of Friday’s price of $75.58. On Thursday, NEE collapsed 8.7% following an abysmal earnings report. Financial media went wild! Here are some examples:

So first, what are the red herrings? The campaign-finance allegations are immaterial. NextEra may be paying up to $2 Million in fees for this complaint. This amount is so small that it will not be seen on financial reports. It’s too small to even be a rounding error. The second red herring is the CEO retiring. Don’t get me wrong, a change in leadership can be a serious problem for a company. But in this case, the valuation of the company is just too high relative to the intrinsic value of NextEra Energy.

NextEra Energy’s Intrinsic Value

Using a standard methodology to evaluate the intrinsic value of a utility stock, we will use the following data to determine the intrinsic value of NextEra Energy:

This gives us an intrinsic value of $42.64!

This is -44.33% below its current market price!

The company’s latest presentation noted that they believe that growth will be 6% to 8%.

Source: Investor Presentation

In our analysis, we used historical EPS growth of 5.60% to estimate future EPS growth. But instead, if we are as optimistic as the leadership team and assume EPS growth will be 8% for the next 10 years, the intrinsic value is still well short of the current price. At 8% EPS growth, the intrinsic value is at $46.36. This is still 39.5% below the current stock price! And we are not the only ones that are noticing this valuation discrepancy. Here is a snap shot of wallstreetzen.com after the earnings call and after the precipitous drop in price:

Source: wallstreetzen.com, screen shot taken January 28th, 2023

Why is NextEra Energy Overvalued?

There may be a few reasons why NextEra Energy is being overvalued. Note that these are all just conjecture, but we’ll put some data behind our thoughts and let you decide.

NEE in Actively Managed ETFs vs. Broad-based ETFs

The likely drivers of large stock price falls like this are institutional investors. One tranche are ETF funds. Using data provided by etf.com, we see that 255 ETFs hold NEE. These ETFs hold 292 Million shares of NEE, which is roughly 14% of the utilities shares. Actively managed ETFs may have also realized NEE is overvalued after the latest earnings call and responded accordingly. Actively managed ETFs need to get out as soon as possible because the price depreciation will force passively managed ETFs to reduce their stake in NEE. The reason is that the largest ETFs are “cap-weighted”. This means they balance their portfolio of utilities based on the market capitalization of the utility. If NextEra Energy’s price falls, then its market cap falls, which means it percentage in passive ETFs also falls.

Note that passive ETFs only rebalance periodically, typically monthly or quarterly. This means that there could be another precipitous drop in NEEs price that “echoes” this recent fall when the passive ETFs rebalance.

Renewable Energy ETFs

There are more renewable energy ETFs that carry NEE in their portfolio. ETFs like BlackRock U.S. Carbon Transition Readiness ETF (LCTU) and SPDR S&P Kensho Clean Power ETF (CNRG) were both founded in 2019. Since these are passive ETFs, they will not react to a utility stock being over-valued until the rest of the market sells off the shares. NextEra Energy may take longer to readjust back to its intrinsic value as more ETFs are being created with new themes. Renewable energy ETFs are just one of many new themes. Other themes like infrastructure, income, and dividend aristocrats all hold NEE. Examples include:

iShares U.S. Infrastructure ETF (IFRA) – Infrastructure

FT Cboe Vest S&P 500 Dividend Aristocrats Target Income ETF (KNG)) – Income

WisdomTree U.S. Total Dividend Fund (DTD)) – Dividend

The “Poster Child” of Renewable Energy

Even our own team at StockBossUp has suggested NEE because of its renewable energy accomplishments before checking out its valuation. We did this very mistake in our article on the top solar power stocks. To be fair, NextEra Energy is still a good long-term investment. The problem is that even a great investment can be overvalued.

This same mistake is repeated over and over in financial media. NextEra will constantly make the top list of renewable energy stock lists without consideration of its overvaluation. That doesn't mean NEE is a bad stock or poorly managed, but it could mean that investing in NEE will come with a premium that is being manifested by the stock market.

The Bottom Line

Even if you want to help the world by investing in renewable energy, do not invest in overvalued companies. By investing in renewable energy companies at the right price you can allocate your investment to more renewable energy projects. You can’t invest in ESG stocks if you’re losing money. You can check if a utility is properly valued by using our guide to evaluating utility stocks. A utility business is relatively stable which allows you to make a reasonable assessment of its future valuation.

The stock selection guide (SSG) is another resource to evaluate stocks. The SSG provides a visual way of assessing stocks based on trends in the stock’s fundamentals. You can learn how to read these trends in our article on how to analyze stocks using a stock selection guide.

I/we have no positions in any asset mentioned, and no plans to initiate any positions for the next 7 days