Summary

• Strong EPS supporting the Valuation

• Culture of innovation leading the in the intelligent labels

• Low risk with solid financial statement

What is Avery Dennison?

The company specializes in the design and manufacture of a wide variety of labeling and functional materials. Avery Dennison (AD) provides innovative, sustainable, and intelligent solutions on a global scale for its customers. AD is involved with all kinds of industries and is responsible for one-third of the global label production, working with companies with worldwide scale such as Zara. Nevertheless, the company focuses on more than just labels, as it also produces tapes and polymers with intelligent materials.

What makes Avery Dennison different?

Besides being one of the largest companies in the industry and the large network this company has developed over the years. This company has a clear focus on its objective, leveraging its innovation to enter new markets and industries as the global shift towards sustainability and corporate social responsibility strengthens. This has become gradually a reality as AD has earned a leading position in the UHF RFID segment, specializing in product tracking systems.

Quick financial statement check

In simple words, this company is stable and running well. To analyze the performance of AD during the last years and expectations over the next years we must focus on two main metrics. First, we are going to review the sales of the company and the revenue per share. This data can be found on the Investor Relations website.

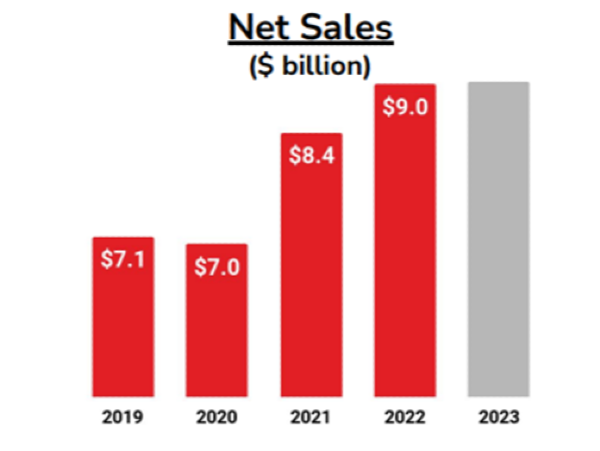

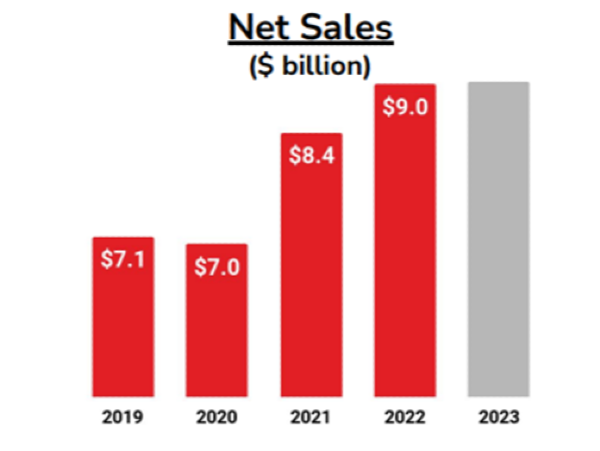

Sales

Over the last years, this company has been selling and selling. AD’s strategy targets diversification, and it has achieved even more than expected. Materials, its core business has had a steadily growing performance. The second segment is Solutions and it has been developing and gaining market share each year, this growing business line is expected to become a 1 billion revenue business by 2023.

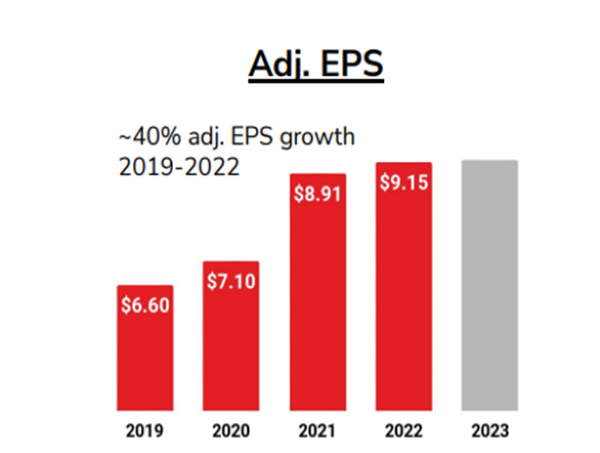

EPS

This indicator shows us how the company is using its equity to work, providing evidence of how AD is generating more income without leverage. Additionally, by 2022 the company achieved $9.15 earnings per share, meaning 40% more earnings per share than in 2019. This trend is expected to continue during 2023 keeping an EPS of approximately $9 USD.

During the last three years, the company has been breaking income records each quarter, regardless of AD’s increase in OPEX as the firm is investing in their key platforms.

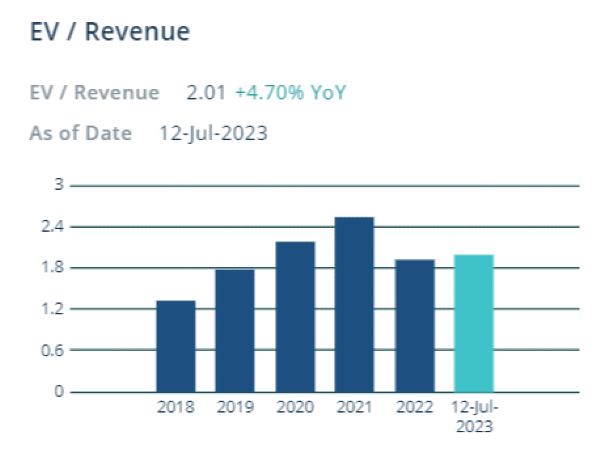

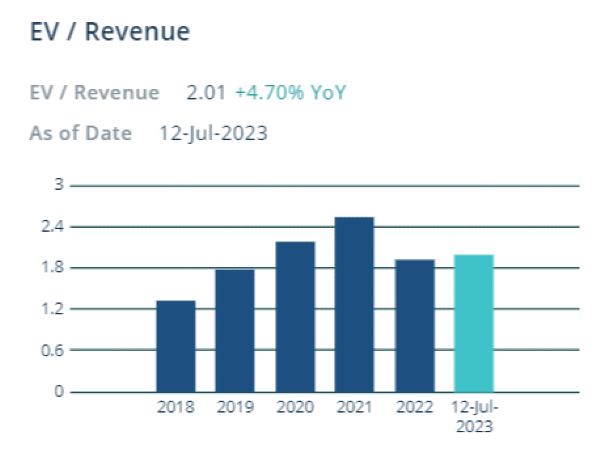

EV/Revenue

The company’s performance had a great impact on the investor community, achieving its highest valuation during Covid’19. As expected, this peak was not sustainable given the mature stage the company is at, but in the last few years the price has been stabilizing. Right now, the company has a fair valuation comparing the EV/Revenue ratio against its competitors and peers.

Innovation

Avery Dennison closed 2022 with a strategy disclosed in their last investor call of the year. The company is diversifying more and more each year with a clear vision of developing labeling technologies and adapting materials to sustainable requirements.

Innovation is not only about generating more revenue or developing a new way to do things. For Avery Dennison innovation is to create the best product possible for the customer while considering its impact on the environment. With the increasing trend of sustainability, it is important to develop new materials and solutions to face the challenges of an industry that produces non-renewable materials. In this sense, the company is purchasing businesses with a competitive advantage over sustainable materials and peak technology solutions, while earning market share in intelligent labels and non-polluting materials. These purchases have reduced the income of the company but can be the main driver of revenue in the future to come.

Closure

Avery Dennison is a great opportunity for long-term investment. It is a stable company with low risk providing an outstanding level of revenue. Furthermore, this company has a bright future with innovation and acquisitions they are leading the new trends of labeling and are working on new technologies to earn more market share and grow in new segments.

Summary • Strong EPS supporting the Valuation • Culture of innovation leading the in the intelligent labels • Low risk with solid financial statement

What is Avery Dennison? The company specializes in the design and manufacture of a wide variety of labeling and functional materials. Avery Dennison (AD) provides innovative, sustainable, and intelligent solutions on a global scale for its customers. AD is involved with all kinds of industries and is responsible for one-third of the global label production, working with companies with worldwide scale such as Zara. Nevertheless, the company focuses on more than just labels, as it also produces tapes and polymers with intelligent materials.

What makes Avery Dennison different? Besides being one of the largest companies in the industry and the large network this company has developed over the years. This company has a clear focus on its objective, leveraging its innovation to enter new markets and industries as the global shift towards sustainability and corporate social responsibility strengthens. This has become gradually a reality as AD has earned a leading position in the UHF RFID segment, specializing in product tracking systems.

Quick financial statement check In simple words, this company is stable and running well. To analyze the performance of AD during the last years and expectations over the next years we must focus on two main metrics. First, we are going to review the sales of the company and the revenue per share. This data can be found on the Investor Relations website.

Sales Over the last years, this company has been selling and selling. AD’s strategy targets diversification, and it has achieved even more than expected. Materials, its core business has had a steadily growing performance. The second segment is Solutions and it has been developing and gaining market share each year, this growing business line is expected to become a 1 billion revenue business by 2023.

EPS This indicator shows us how the company is using its equity to work, providing evidence of how AD is generating more income without leverage. Additionally, by 2022 the company achieved $9.15 earnings per share, meaning 40% more earnings per share than in 2019. This trend is expected to continue during 2023 keeping an EPS of approximately $9 USD.

During the last three years, the company has been breaking income records each quarter, regardless of AD’s increase in OPEX as the firm is investing in their key platforms.

EV/Revenue The company’s performance had a great impact on the investor community, achieving its highest valuation during Covid’19. As expected, this peak was not sustainable given the mature stage the company is at, but in the last few years the price has been stabilizing. Right now, the company has a fair valuation comparing the EV/Revenue ratio against its competitors and peers.

Innovation Avery Dennison closed 2022 with a strategy disclosed in their last investor call of the year. The company is diversifying more and more each year with a clear vision of developing labeling technologies and adapting materials to sustainable requirements.

Innovation is not only about generating more revenue or developing a new way to do things. For Avery Dennison innovation is to create the best product possible for the customer while considering its impact on the environment. With the increasing trend of sustainability, it is important to develop new materials and solutions to face the challenges of an industry that produces non-renewable materials. In this sense, the company is purchasing businesses with a competitive advantage over sustainable materials and peak technology solutions, while earning market share in intelligent labels and non-polluting materials. These purchases have reduced the income of the company but can be the main driver of revenue in the future to come.

Closure Avery Dennison is a great opportunity for long-term investment. It is a stable company with low risk providing an outstanding level of revenue. Furthermore, this company has a bright future with innovation and acquisitions they are leading the new trends of labeling and are working on new technologies to earn more market share and grow in new segments.