Updated on August 25th, 2022 by Aristofanis Papadatos

Oil refiners have enjoyed an impressive rally since the start of 2021, thanks to the recovery of global consumption of oil products from the pandemic. The rally has accelerated this year thanks to the sanctions of western countries on Russia in response to its invasion in Ukraine. These sanctions have tightened the global supply of oil products to the extreme and thus they have led refining margins to skyrocket to all-time highs. As a result, oil refiners have outperformed the market by an impressive margin this year.

Year-to-date, the S&P 500 (as measured by SPY, the major ETF that tracks the market index) has declined 13%, whereas the big 4 oil refiners have generated the following returns:

- Phillips 66 (PSX) year-to-date total returns: 24%

- HF Sinclair (DINO) year-to-date total returns: 59%

- Valero Energy (VLO) year-to-date total returns: 60%

- Marathon Petroleum (MPC) year-to-date total returns: 61%

Given the impressive rally of the refiners, investors should be extra careful in their choices. Refiners are currently trading at exceptionally low price-to-earnings ratios thanks to their blowout earnings this year and hence they look extremely cheap on the surface. However, their business is highly cyclical and hence it is prudent to expect their earnings to revert to normal levels in the upcoming years.

You can see our full list of nearly 250 energy stocks (along with important financial metrics like dividend yields and payout ratios) by clicking on the link below:

Click here to instantly download your free list of 200+ dividend-paying energy stocks, along with important investing metrics like price-to-earnings ratios and dividend yields.

As long as the sanctions of the U.S. and Europe on Russia remain in place, refining margins are likely to remain elevated. However, whenever this war in Ukraine comes to an end or sanctions loosen, refining margins are likely to deflate.

In this article, we will compare the expected 5-year returns of the four major refiners by summing their EPS growth, their dividends and their expected P/E expansion or contraction. Expected total return data comes from our more than 700 stocks (and growing) Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

Industry Overview

All the major U.S. refiners have outperformed the S&P 500 by an eye-opening margin so far this year. Phillips 66 has outperformed the index less than its peers due to its diversified business model, i.e., it is the only one that is not a pure refiner. The other three companies have other segments as well but generate the vast portion of their earnings from their refineries. This is the reason behind the vast out performance of HF Sinclair, Valero and Marathon vs. the S&P 500. There are two major reasons behind the impressive rally of the refiners.

First, demand for oil is recovering strongly from the pandemic thanks to the massive distribution of vaccines worldwide. In fact, global oil consumption is expected by the Energy Information Administration (EIA) to reach its pre-pandemic high of 101.5 million barrels per day next year.

Moreover, global supply of refined products has tightened to the extreme this year due to the sanctions of the U.S. and Europe on Russia in response to its invasion in Ukraine. Russia produces 10% of global oil output and an even greater amount of refined products. As a result, the sanctions have greatly limited the global supply of gasoline and diesel and hence refining margins have skyrocketed to unprecedented levels.

The major 4 U.S. oil refiner stocks are discussed in greater detail below.

U.S. Oil Refiner Stock #1: Phillips 66 (PSX)

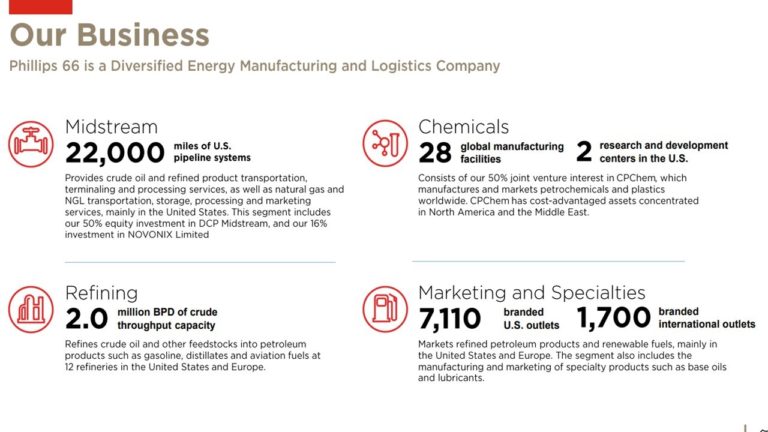

Phillips 66 was spun off from ConocoPhillips (COP) in 2012. Phillips 66 operates four segments:

- Refining

- Chemicals

- Marketing

- Midstream

It is a diversified company with each of its segments behaving differently under various oil price scenarios.

Source: Investor Presentation

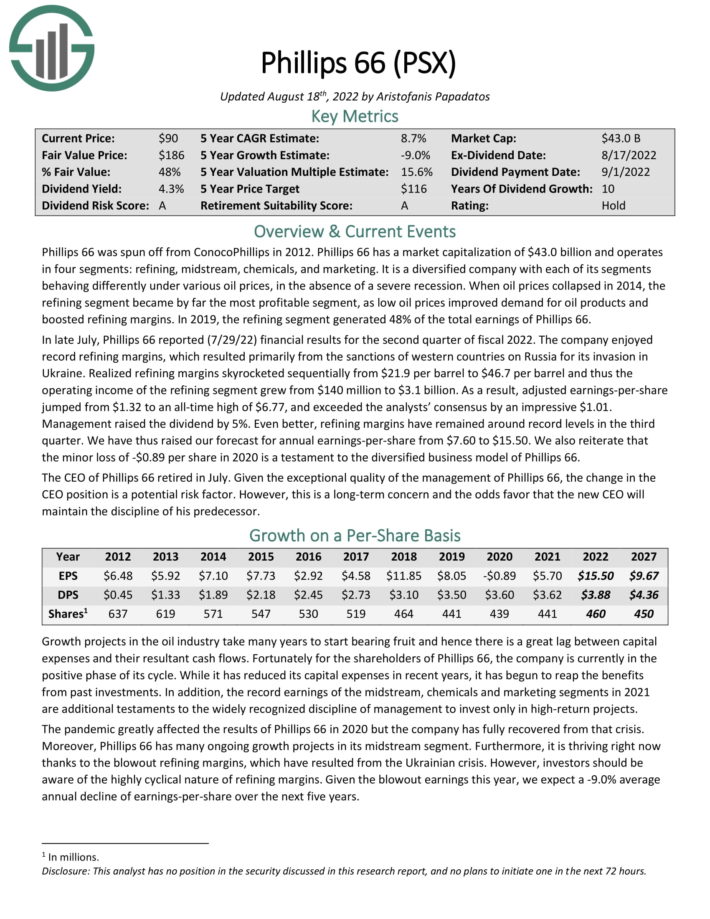

In late July, Phillips 66 reported (7/29/22) financial results for the second quarter of fiscal 2022. The company enjoyed record refining margins thanks to the aforementioned sanctions of western countries on Russia for its invasion in Ukraine. Realized refining margins more than doubled sequentially, from $21.9 per barrel to $46.7 per barrel, and thus the operating income of the refining segment grew from $140 million to $3.1 billion.

As a result, adjusted earnings-per-share jumped from $1.32 to an all-time high of $6.77, and exceeded the analysts’ consensus by an impressive $1.01.

Management raised the dividend by 5%. Even better, refining margins have remained around record levels in the third quarter. As a result, the company is on track to post record earnings-per-share of about $15.50 this year.

It is also important to note that the highly diversified business model of Phillips 66 renders the company much more resilient to the pandemic and other downturns than the pure refiners. The minor loss of -$0.89 per share in 2020, which is in sharp contrast to the hefty losses incurred by the other three major refiners, is a testament to the diversified and defensive business model of Phillips 66.

Overall, Phillips 66 has rallied much less than pure refiners amid all-time high refining margins but it has proved much more resilient to the downturns of the energy market.

Moreover, Phillips 66 is well-known for its exemplary management, which has the discipline to invest only in high-return growth projects. This is a great competitive advantage in this commodity business.

Notably, the CEO of Phillips 66 retired in July. Given the exceptional quality of the management of Phillips 66, the change in the CEO position is a potential risk factor. However, this is a long-term concern and the odds favor that the new CEO will maintain the discipline of his predecessor.

On the other hand, due to the high cyclicality of refining margins, it is prudent to expect refining margins to deflate from their current blowout levels in the upcoming years. We thus expect Phillips 66 to incur a 9.0% average annual EPS decline over the next five years.

Based on expected EPS of $15.50 for 2022, the stock is now trading at a P/E of 5.9, which is far below our fair value P/E of 12. Expansion of the P/E multiple could boost annual returns by 8.3% per year over the next five years. Shares also yield 4.2%.

Overall, the stock is likely to offer an 8.3% average annual return over the next five years.

Click here to download our most recent Sure Analysis report on PSX (preview of page 1 of 3 shown below):

U.S. Oil Refiner Stock #2: HF Sinclair (DINO)

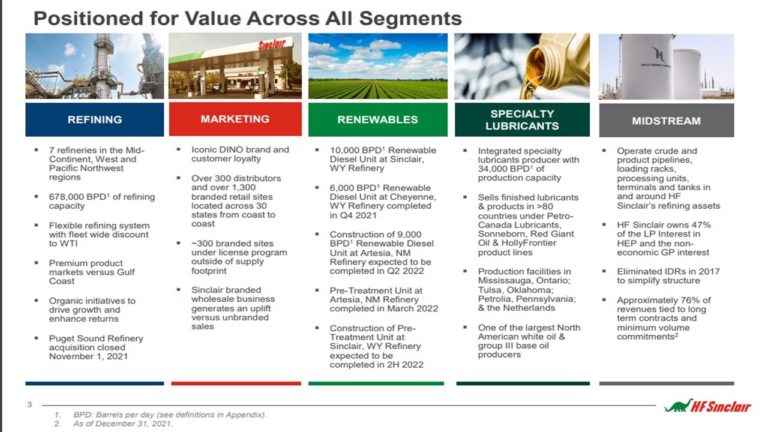

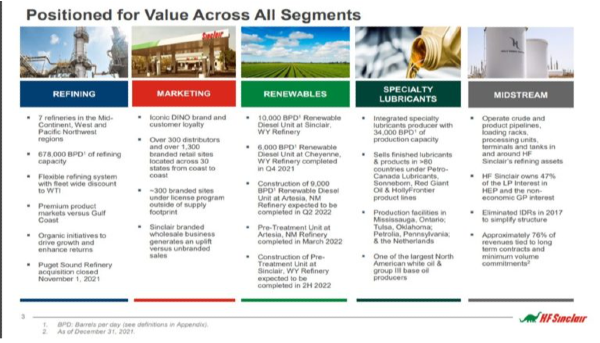

In March 2022, HollyFrontier (HFC) changed its name to HF Sinclair (DINO) to reflect its acquisition of Sinclair Oil. The company was initially formed by the merger of two independent U.S. refiners, Holly Corporation and Frontier Oil, in 2011. It operates in three segments:

- Refining

- Lubricants

- Holly Energy Partners (HEP), a midstream entity

Nevertheless, HollyFrontier should be viewed largely as a refiner. The refining segment generates ~90% of the total operating income of the company.

On March 14th, 2022, the $1.8 billion merger between HollyFrontier and Sinclair Oil was completed. The deal was funded with the issuance of ~60.2 million of shares. Sinclair has two refineries based at Rocky Mountain, a renewable diesel business and a branded marketing business.

Given the record prevailing refining margins, the deal is expected to enhance free cash flow by much more than the initial expectations of 20% in the first year while it has caused a 27% increase in the share count.

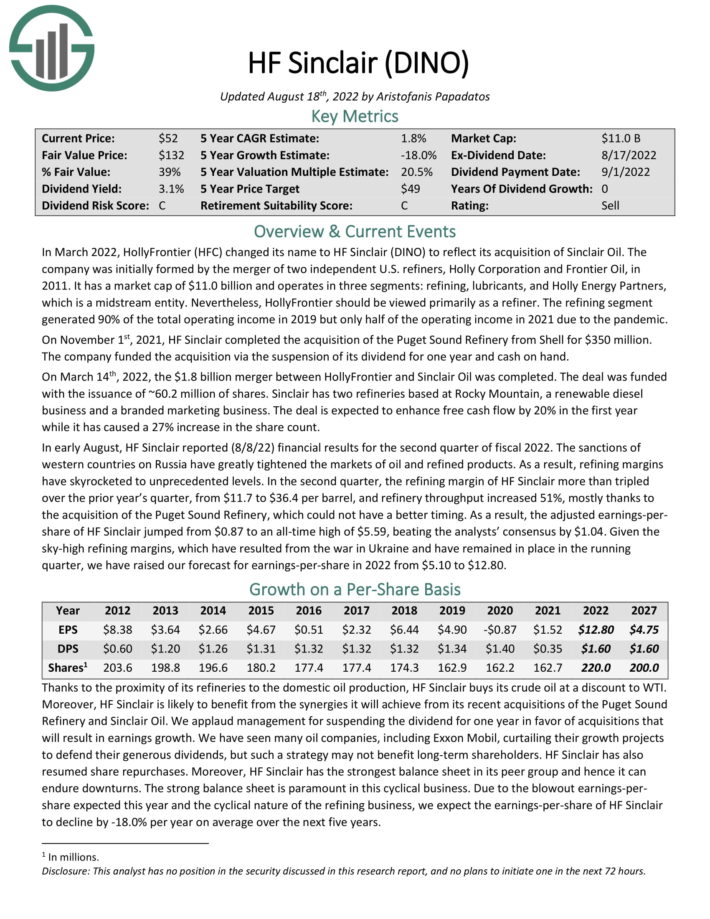

In early August, HF Sinclair reported (8/8/22) financial results for the second quarter of fiscal 2022. Thanks to ongoing sanctions on Russia, which have greatly tightened the markets of oil and refined products, HF Sinclair’s refining margin more than tripled, from $11.7 to $36.4 per barrel. Refinery throughput increased 51%, mostly thanks to the acquisition of the Puget Sound Refinery.

As a result, the adjusted earnings-per-share of HF Sinclair jumped from $0.87 to an all-time high of $5.59, beating the analysts’ consensus by $1.04. Given the sky-high refining margins, which have remained in place in the running quarter, HF Sinclair is on track to achieve all-time high earnings-per-share of $12.80 in 2022.

Moreover, HF Sinclair is likely to benefit from the synergies it will achieve from its recent acquisitions of the Puget Sound Refinery from Shell (SHEL) and Sinclair Oil. We have seen many oil companies, including Exxon Mobil, curtailing their growth projects to defend their generous dividends, but such a strategy may not benefit long-term shareholders. HF Sinclair has also resumed share repurchases.

Furthermore, HF Sinclair has the strongest balance sheet in its peer group and hence it can endure downturns. The strong balance sheet is paramount in this cyclical business. Nevertheless, due to the blowout earnings-per-share expected this year and the cyclical nature of the refining business, we expect the earnings-per-share of HF Sinclair to decline by -18.0% per year on average over the next five years.

The stock is now trading at a P/E of 4.2, which is much lower than its historical average P/E of 10.3. Therefore, if the stock reverts to its average valuation level in the next five years, it will enjoy a 19.5% annualized return from P/E expansion.

Given also its 3.0% dividend, HF Sinclair is likely to offer a 1.0% average annual return over the next five years, as its valuation tailwind and its dividend are likely to be largely offset by the reversion of its earnings to normal levels.

Click here to download our most recent Sure Analysis report on DINO (preview of page 1 of 3 shown below):

U.S. Oil Refiner Stock #3: Valero Energy (VLO)

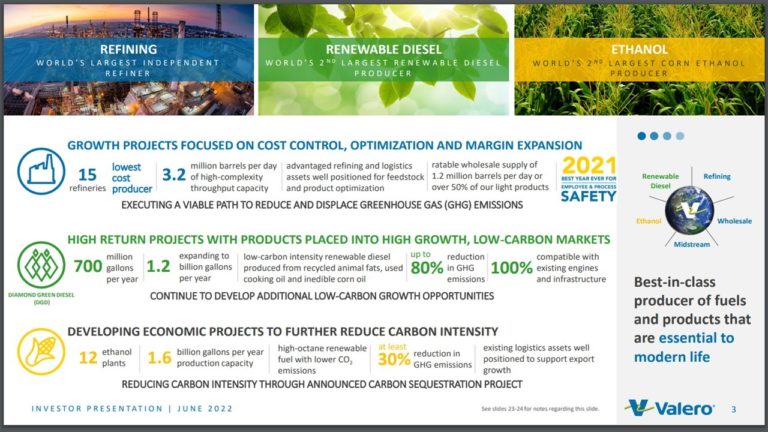

Valero is the largest independent petroleum refiner in the world. It owns 15 refineries in the U.S., Canada and the U.K. and has a total capacity of about 3.2 M barrels/day. It also produces renewable diesel and has a midstream segment, Valero Energy Partners LP, but its contribution to total earnings is under 10%.

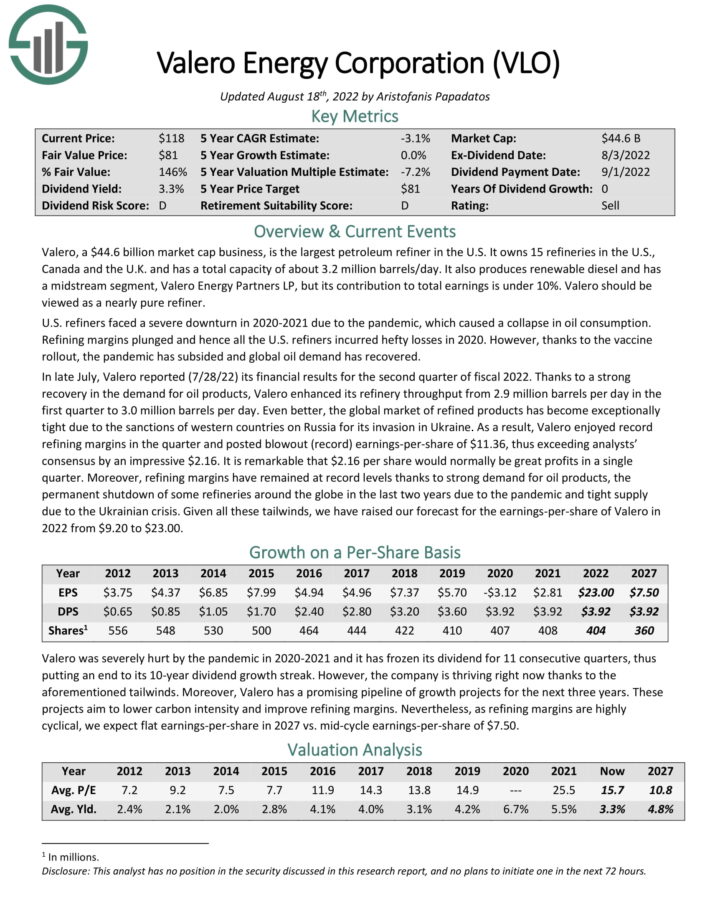

In late July, Valero reported (7/28/22) its financial results for the second quarter of fiscal 2022. Thanks to a strong recovery in the demand for oil products, Valero enhanced its refinery throughput from 2.9 million barrels per day in the first quarter to 3.0 million barrels per day.

Even better, as the global market of refined products has become exceptionally tight, Valero enjoyed record refining margins in the quarter and posted all-time high earnings-per-share of $11.36, thus exceeding the analysts’ consensus by an impressive $2.16.

It is remarkable that the difference of $2.16 per share would normally be great profits in a single quarter. It is also impressive that Valero has never achieved its second-quarter earnings even in a time frame of one year.

Moreover, refining margins have remained at record levels thanks to strong demand for oil products, the permanent shutdown of some refineries around the globe in the last two years due to the pandemic and tight supply due to the Ukrainian crisis. Thanks to all these tailwinds, Valero is poised to achieve record earnings per share of $23.00 this year.

Valero has a competitive advantage over its peers, namely the high complexity of its refineries. Its high complexity renders it the most resilient among pure refiners during downturns, as the least complex refineries are hurt the most during such periods due to their lack of flexibility.

In order to calculate the future return of Valero, we have used mid–cycle earnings–per–share of $7.50. Valero has a promising pipeline of growth projects for the next three years. These projects aim to lower carbon intensity and improve refining margins.

On the other hand, refining margins are likely to revert to their normal range in the upcoming years. We thus expect the refiner to revert to its mid-cycle earnings-per-share of $7.50 by 2027.

Moreover, the stock is now trading at 16.3 times its mid-cycle earnings-per-share of $7.50, which is higher than our fair value estimate (also the 10-year average P/E) of 10.8. If the stock trades at its fair valuation level in five years, it will incur a 7.9% annualized drag in its returns. Such a drag will more than offset the 3.2% dividend yield of the stock and hence Valero is likely to offer a -3.8% average annual total return over the next five years.

In other words, Valero is thriving right now but the stock is likely to prove fully valued whenever refining margins enter their next down cycle.

Click here to download our most recent Sure Analysis report on VLO (preview of page 1 of 3 shown below):

U.S. Oil Refiner Stock #4: Marathon Petroleum (MPC)

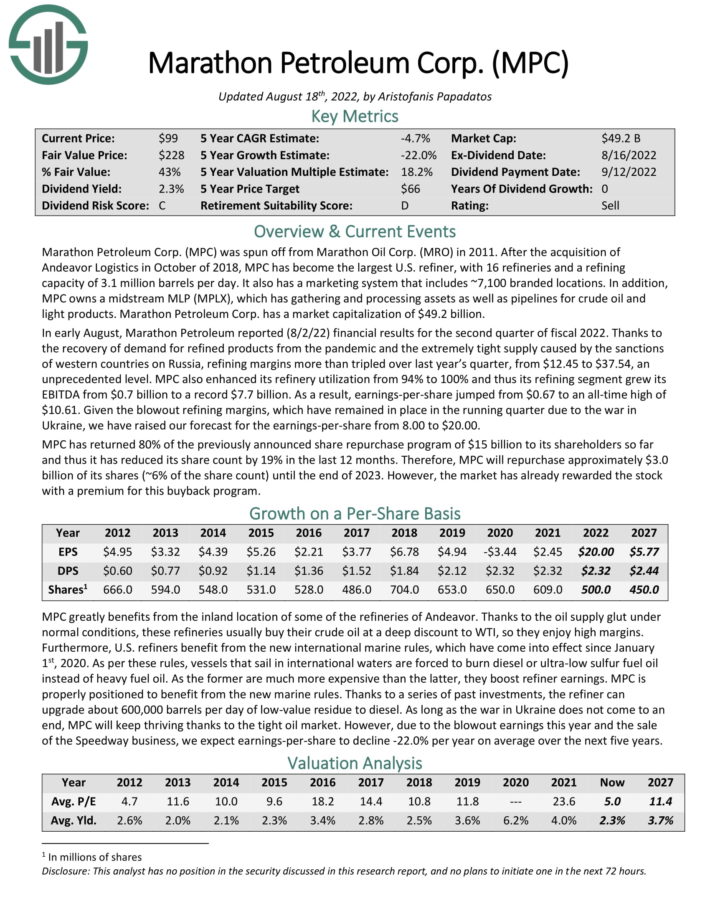

After the acquisition of Andeavor Logistics in October 2018, Marathon Petroleum has become the largest U.S. refiner, along with Valero, with 16 refineries and a refining capacity of 3.1 million barrels per day. It also has a marketing system that includes ~7,100 branded locations.

In addition, MPC owns MPLX LP (MPLX), a midstream Master Limited Partnership, which has gathering and processing assets as well as pipelines for crude oil and light products.

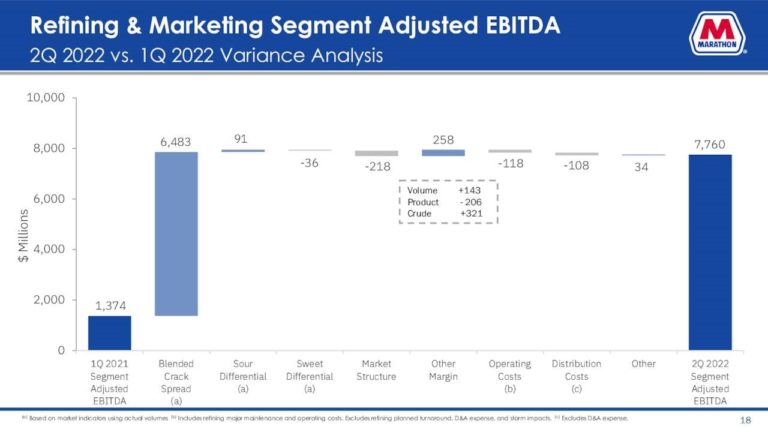

In early August, Marathon Petroleum reported (8/2/22) financial results for the second quarter of fiscal 2022. Thanks to the extremely tight global distillate market, refining margins more than tripled over last year’s quarter, from $12.45 to $37.54, an unprecedented level.

Marathon also enhanced its refinery utilization from 94% to 100% and thus its refining segment grew its EBITDA from $0.7 billion in last year’s quarter and $1.4 billion in the first quarter to a record $7.8 billion.

As a result, earnings-per-share jumped from $0.67 to an all-time high of $10.61. Given the blowout refining margins, which have remained in place in the running quarter due to the war in Ukraine, Marathon is likely to post record earnings-per-share of $20.00 this year.

About a year ago, Marathon completed the sale of its Speedway business to 7–Eleven for after–tax proceeds of $16.5 billion in cash. The deal includes a 15–year fuel supply agreement for about 7.7 billion gallons of fuel per year. Marathon has used most of the proceeds to fund aggressive share repurchases and reduce its debt. The amount of share repurchases has been massive, as it has reduced the share count by 25% since last year.

As long as the war in Ukraine does not come to an end, Marathon will keep thriving thanks to the tight oil market. However, due to the abnormally high earnings this year and the sale of the Speedway business, we expect earnings-per-share to decline -22.0% per year on average over the next five years.

On the other hand, Marathon is now trading at a P/E of only 5.3, which is much lower than its historical average of 10.7. If the stock reverts to its average valuation level in five years, it will enjoy a 16.8% annualized P/E expansion.

Nevertheless, the stock is likely to offer a -5.8% average annual return over the next five years, as the 16.8% valuation tailwind and the 2.2% dividend are likely to be offset by the 22% expected annual EPS decline.

Click here to download our most recent Sure Analysis report on MPC (preview of page 1 of 3 shown below):

Final Thoughts

Thanks to the strong tailwind of the economic reopening and their strong business models, the Big 4 major U.S. refiners are likely to significantly grow their EPS in the next five years. Several refining stocks have outperformed the S&P 500 to start the year, which could make investors hesitant to buy. Fortunately, we still see them as undervalued, with strong total returns expected through their future EPS growth, rising P/E multiples, and dividends.

In the comparison of three of the major refiners, the dividend yield did not differentiate them significantly. The outlier was HollyFrontier, which suspended its dividend this year. Meanwhile, MPC has the lowest projected total return of the group, as it is the stock with the greatest expected P/E contraction (signaling it is the most overvalued).

On the contrary, Phillips 66 seems to have the most attractive mix of valuation, growth prospects, and dividend yield. As a result, PSX is the stock likely to offer the highest 5-year return. Investors should also note that it is the only refiner that is highly diversified and can keep thriving even in a downturn of the refining margins.

In fact, if the price of oil continues to rise in the upcoming years, it will probably exert pressure on refining margins due to its pressure on the demand for oil products. In such a scenario, the midstream segment of Phillips 66 will offset most of the damage of the refining segment. Therefore, in such a scenario, Phillips 66 is likely to outperform its peers by a wide margin.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Updated on August 25th, 2022 by Aristofanis Papadatos

Oil refiners have enjoyed an impressive rally since the start of 2021, thanks to the recovery of global consumption of oil products from the pandemic. The rally has accelerated this year thanks to the sanctions of western countries on Russia in response to its invasion in Ukraine. These sanctions have tightened the global supply of oil products to the extreme and thus they have led refining margins to skyrocket to all-time highs. As a result, oil refiners have outperformed the market by an impressive margin this year.

Year-to-date, the S&P 500 (as measured by SPY, the major ETF that tracks the market index) has declined 13%, whereas the big 4 oil refiners have generated the following returns:

Given the impressive rally of the refiners, investors should be extra careful in their choices. Refiners are currently trading at exceptionally low price-to-earnings ratios thanks to their blowout earnings this year and hence they look extremely cheap on the surface. However, their business is highly cyclical and hence it is prudent to expect their earnings to revert to normal levels in the upcoming years.

You can see our full list of nearly 250 energy stocks (along with important financial metrics like dividend yields and payout ratios) by clicking on the link below:

Click here to instantly download your free list of 200+ dividend-paying energy stocks, along with important investing metrics like price-to-earnings ratios and dividend yields.

As long as the sanctions of the U.S. and Europe on Russia remain in place, refining margins are likely to remain elevated. However, whenever this war in Ukraine comes to an end or sanctions loosen, refining margins are likely to deflate.

In this article, we will compare the expected 5-year returns of the four major refiners by summing their EPS growth, their dividends and their expected P/E expansion or contraction. Expected total return data comes from our more than 700 stocks (and growing) Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

Industry Overview

All the major U.S. refiners have outperformed the S&P 500 by an eye-opening margin so far this year. Phillips 66 has outperformed the index less than its peers due to its diversified business model, i.e., it is the only one that is not a pure refiner. The other three companies have other segments as well but generate the vast portion of their earnings from their refineries. This is the reason behind the vast out performance of HF Sinclair, Valero and Marathon vs. the S&P 500. There are two major reasons behind the impressive rally of the refiners.

First, demand for oil is recovering strongly from the pandemic thanks to the massive distribution of vaccines worldwide. In fact, global oil consumption is expected by the Energy Information Administration (EIA) to reach its pre-pandemic high of 101.5 million barrels per day next year.

Moreover, global supply of refined products has tightened to the extreme this year due to the sanctions of the U.S. and Europe on Russia in response to its invasion in Ukraine. Russia produces 10% of global oil output and an even greater amount of refined products. As a result, the sanctions have greatly limited the global supply of gasoline and diesel and hence refining margins have skyrocketed to unprecedented levels.

The major 4 U.S. oil refiner stocks are discussed in greater detail below.

U.S. Oil Refiner Stock #1: Phillips 66 (PSX)

Phillips 66 was spun off from ConocoPhillips (COP) in 2012. Phillips 66 operates four segments:

It is a diversified company with each of its segments behaving differently under various oil price scenarios.

Source: Investor Presentation

In late July, Phillips 66 reported (7/29/22) financial results for the second quarter of fiscal 2022. The company enjoyed record refining margins thanks to the aforementioned sanctions of western countries on Russia for its invasion in Ukraine. Realized refining margins more than doubled sequentially, from $21.9 per barrel to $46.7 per barrel, and thus the operating income of the refining segment grew from $140 million to $3.1 billion.

As a result, adjusted earnings-per-share jumped from $1.32 to an all-time high of $6.77, and exceeded the analysts’ consensus by an impressive $1.01.

Management raised the dividend by 5%. Even better, refining margins have remained around record levels in the third quarter. As a result, the company is on track to post record earnings-per-share of about $15.50 this year.

It is also important to note that the highly diversified business model of Phillips 66 renders the company much more resilient to the pandemic and other downturns than the pure refiners. The minor loss of -$0.89 per share in 2020, which is in sharp contrast to the hefty losses incurred by the other three major refiners, is a testament to the diversified and defensive business model of Phillips 66.

Overall, Phillips 66 has rallied much less than pure refiners amid all-time high refining margins but it has proved much more resilient to the downturns of the energy market.

Moreover, Phillips 66 is well-known for its exemplary management, which has the discipline to invest only in high-return growth projects. This is a great competitive advantage in this commodity business.

Notably, the CEO of Phillips 66 retired in July. Given the exceptional quality of the management of Phillips 66, the change in the CEO position is a potential risk factor. However, this is a long-term concern and the odds favor that the new CEO will maintain the discipline of his predecessor.

On the other hand, due to the high cyclicality of refining margins, it is prudent to expect refining margins to deflate from their current blowout levels in the upcoming years. We thus expect Phillips 66 to incur a 9.0% average annual EPS decline over the next five years.

Based on expected EPS of $15.50 for 2022, the stock is now trading at a P/E of 5.9, which is far below our fair value P/E of 12. Expansion of the P/E multiple could boost annual returns by 8.3% per year over the next five years. Shares also yield 4.2%.

Overall, the stock is likely to offer an 8.3% average annual return over the next five years.

Click here to download our most recent Sure Analysis report on PSX (preview of page 1 of 3 shown below):

U.S. Oil Refiner Stock #2: HF Sinclair (DINO)

In March 2022, HollyFrontier (HFC) changed its name to HF Sinclair (DINO) to reflect its acquisition of Sinclair Oil. The company was initially formed by the merger of two independent U.S. refiners, Holly Corporation and Frontier Oil, in 2011. It operates in three segments:

Nevertheless, HollyFrontier should be viewed largely as a refiner. The refining segment generates ~90% of the total operating income of the company.

On March 14th, 2022, the $1.8 billion merger between HollyFrontier and Sinclair Oil was completed. The deal was funded with the issuance of ~60.2 million of shares. Sinclair has two refineries based at Rocky Mountain, a renewable diesel business and a branded marketing business.

Given the record prevailing refining margins, the deal is expected to enhance free cash flow by much more than the initial expectations of 20% in the first year while it has caused a 27% increase in the share count.

Source: Investor Presentation

In early August, HF Sinclair reported (8/8/22) financial results for the second quarter of fiscal 2022. Thanks to ongoing sanctions on Russia, which have greatly tightened the markets of oil and refined products, HF Sinclair’s refining margin more than tripled, from $11.7 to $36.4 per barrel. Refinery throughput increased 51%, mostly thanks to the acquisition of the Puget Sound Refinery.

As a result, the adjusted earnings-per-share of HF Sinclair jumped from $0.87 to an all-time high of $5.59, beating the analysts’ consensus by $1.04. Given the sky-high refining margins, which have remained in place in the running quarter, HF Sinclair is on track to achieve all-time high earnings-per-share of $12.80 in 2022.

Moreover, HF Sinclair is likely to benefit from the synergies it will achieve from its recent acquisitions of the Puget Sound Refinery from Shell (SHEL) and Sinclair Oil. We have seen many oil companies, including Exxon Mobil, curtailing their growth projects to defend their generous dividends, but such a strategy may not benefit long-term shareholders. HF Sinclair has also resumed share repurchases.

Furthermore, HF Sinclair has the strongest balance sheet in its peer group and hence it can endure downturns. The strong balance sheet is paramount in this cyclical business. Nevertheless, due to the blowout earnings-per-share expected this year and the cyclical nature of the refining business, we expect the earnings-per-share of HF Sinclair to decline by -18.0% per year on average over the next five years.

The stock is now trading at a P/E of 4.2, which is much lower than its historical average P/E of 10.3. Therefore, if the stock reverts to its average valuation level in the next five years, it will enjoy a 19.5% annualized return from P/E expansion.

Given also its 3.0% dividend, HF Sinclair is likely to offer a 1.0% average annual return over the next five years, as its valuation tailwind and its dividend are likely to be largely offset by the reversion of its earnings to normal levels.

Click here to download our most recent Sure Analysis report on DINO (preview of page 1 of 3 shown below):

U.S. Oil Refiner Stock #3: Valero Energy (VLO)

Valero is the largest independent petroleum refiner in the world. It owns 15 refineries in the U.S., Canada and the U.K. and has a total capacity of about 3.2 M barrels/day. It also produces renewable diesel and has a midstream segment, Valero Energy Partners LP, but its contribution to total earnings is under 10%.

Source: Investor Presentation

In late July, Valero reported (7/28/22) its financial results for the second quarter of fiscal 2022. Thanks to a strong recovery in the demand for oil products, Valero enhanced its refinery throughput from 2.9 million barrels per day in the first quarter to 3.0 million barrels per day.

Even better, as the global market of refined products has become exceptionally tight, Valero enjoyed record refining margins in the quarter and posted all-time high earnings-per-share of $11.36, thus exceeding the analysts’ consensus by an impressive $2.16.

It is remarkable that the difference of $2.16 per share would normally be great profits in a single quarter. It is also impressive that Valero has never achieved its second-quarter earnings even in a time frame of one year.

Moreover, refining margins have remained at record levels thanks to strong demand for oil products, the permanent shutdown of some refineries around the globe in the last two years due to the pandemic and tight supply due to the Ukrainian crisis. Thanks to all these tailwinds, Valero is poised to achieve record earnings per share of $23.00 this year.

Valero has a competitive advantage over its peers, namely the high complexity of its refineries. Its high complexity renders it the most resilient among pure refiners during downturns, as the least complex refineries are hurt the most during such periods due to their lack of flexibility.

In order to calculate the future return of Valero, we have used mid–cycle earnings–per–share of $7.50. Valero has a promising pipeline of growth projects for the next three years. These projects aim to lower carbon intensity and improve refining margins.

On the other hand, refining margins are likely to revert to their normal range in the upcoming years. We thus expect the refiner to revert to its mid-cycle earnings-per-share of $7.50 by 2027.

Moreover, the stock is now trading at 16.3 times its mid-cycle earnings-per-share of $7.50, which is higher than our fair value estimate (also the 10-year average P/E) of 10.8. If the stock trades at its fair valuation level in five years, it will incur a 7.9% annualized drag in its returns. Such a drag will more than offset the 3.2% dividend yield of the stock and hence Valero is likely to offer a -3.8% average annual total return over the next five years.

In other words, Valero is thriving right now but the stock is likely to prove fully valued whenever refining margins enter their next down cycle.

Click here to download our most recent Sure Analysis report on VLO (preview of page 1 of 3 shown below):

U.S. Oil Refiner Stock #4: Marathon Petroleum (MPC)

After the acquisition of Andeavor Logistics in October 2018, Marathon Petroleum has become the largest U.S. refiner, along with Valero, with 16 refineries and a refining capacity of 3.1 million barrels per day. It also has a marketing system that includes ~7,100 branded locations.

In addition, MPC owns MPLX LP (MPLX), a midstream Master Limited Partnership, which has gathering and processing assets as well as pipelines for crude oil and light products.

In early August, Marathon Petroleum reported (8/2/22) financial results for the second quarter of fiscal 2022. Thanks to the extremely tight global distillate market, refining margins more than tripled over last year’s quarter, from $12.45 to $37.54, an unprecedented level.

Marathon also enhanced its refinery utilization from 94% to 100% and thus its refining segment grew its EBITDA from $0.7 billion in last year’s quarter and $1.4 billion in the first quarter to a record $7.8 billion.

Source: Investor Presentation

As a result, earnings-per-share jumped from $0.67 to an all-time high of $10.61. Given the blowout refining margins, which have remained in place in the running quarter due to the war in Ukraine, Marathon is likely to post record earnings-per-share of $20.00 this year.

About a year ago, Marathon completed the sale of its Speedway business to 7–Eleven for after–tax proceeds of $16.5 billion in cash. The deal includes a 15–year fuel supply agreement for about 7.7 billion gallons of fuel per year. Marathon has used most of the proceeds to fund aggressive share repurchases and reduce its debt. The amount of share repurchases has been massive, as it has reduced the share count by 25% since last year.

As long as the war in Ukraine does not come to an end, Marathon will keep thriving thanks to the tight oil market. However, due to the abnormally high earnings this year and the sale of the Speedway business, we expect earnings-per-share to decline -22.0% per year on average over the next five years.

On the other hand, Marathon is now trading at a P/E of only 5.3, which is much lower than its historical average of 10.7. If the stock reverts to its average valuation level in five years, it will enjoy a 16.8% annualized P/E expansion.

Nevertheless, the stock is likely to offer a -5.8% average annual return over the next five years, as the 16.8% valuation tailwind and the 2.2% dividend are likely to be offset by the 22% expected annual EPS decline.

Click here to download our most recent Sure Analysis report on MPC (preview of page 1 of 3 shown below):

Final Thoughts

Thanks to the strong tailwind of the economic reopening and their strong business models, the Big 4 major U.S. refiners are likely to significantly grow their EPS in the next five years. Several refining stocks have outperformed the S&P 500 to start the year, which could make investors hesitant to buy. Fortunately, we still see them as undervalued, with strong total returns expected through their future EPS growth, rising P/E multiples, and dividends.

In the comparison of three of the major refiners, the dividend yield did not differentiate them significantly. The outlier was HollyFrontier, which suspended its dividend this year. Meanwhile, MPC has the lowest projected total return of the group, as it is the stock with the greatest expected P/E contraction (signaling it is the most overvalued).

On the contrary, Phillips 66 seems to have the most attractive mix of valuation, growth prospects, and dividend yield. As a result, PSX is the stock likely to offer the highest 5-year return. Investors should also note that it is the only refiner that is highly diversified and can keep thriving even in a downturn of the refining margins.

In fact, if the price of oil continues to rise in the upcoming years, it will probably exert pressure on refining margins due to its pressure on the demand for oil products. In such a scenario, the midstream segment of Phillips 66 will offset most of the damage of the refining segment. Therefore, in such a scenario, Phillips 66 is likely to outperform its peers by a wide margin.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Originally Posted on suredividend.com